Wednesday's session on Wall Street is marked by increases. The US500 has broken above the 5000 points barrier, setting new all-time records. The rise in American indices might be surprising to some, as on one hand, we observe increasingly bold comments from Fed bankers signaling that the first rate cuts may not come as soon as expected, and on the other hand, we see declines in the banking sector today due to liquidity risk concerns related to New York Community Bancorp (NYCB.US). Tesla's shares (TSLA.US) gained even 3% today after reports that the company's U.S. managers were required to assess whether each team member's role is critical. However, these gains have already been completely erased.

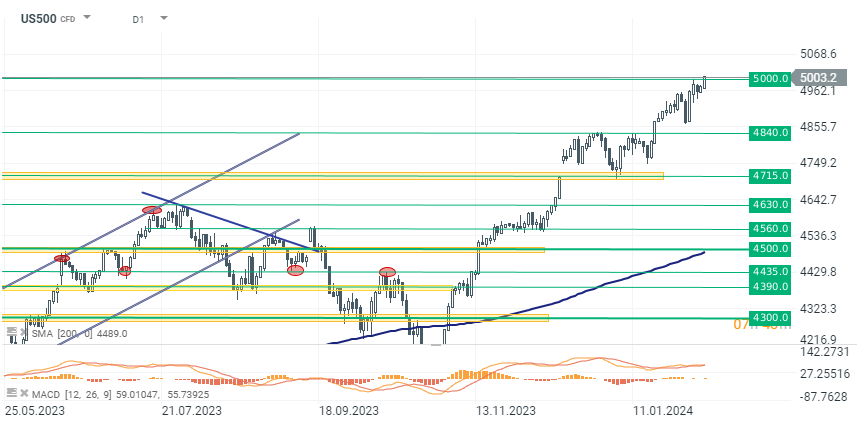

US500 Interval D1

The index gains nearly 0.70% today and breaks through the significant psychological barrier of 5,000 points. Investors' attention is now focused on the daily close. If bulls manage to maintain above 5,000 points, it will be a new record level. It is important to note that to close above the previous peak, bulls must maintain the level of 4982 points. In case of a pullback, it is worth monitoring the levels of 4840 and 4950 points, which are the nearest support zones.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers