S&P 500 futures are up approximately 0.1% ahead of the financial results from Nvidia, a pivotal company for the entire US stock market. Although the move in the US500 is minor, the index is trading near record highs, with the potential for its highest-ever close. Currently, Nvidia's market capitalization is around $4.4 trillion, giving it an 8.1% weighting in the S&P 500 index. Market expectations are high, yet also moderate due to obstacles related to export restrictions to China. Nevertheless, the company's results will influence not only its own share price but also the performance of global indexes, as Nvidia is the largest and arguably the most significant company in the world right now. Options pricing suggests a potential 6% move in either direction for the stock during the next trading session. This volatility will also be reflected in US500 and US100 futures contracts immediately after the earnings release, following the close of the cash session on Wall Street.

According to market participants, the increase in Nvidia's valuation is the result of relentless demand for artificial intelligence hardware. The company's sales are projected to grow by over 50% year-on-year. The market is positioned for solid results, and the accompanying rise in futures contracts reflects expectations for continued dynamic growth from the chip industry leader. Additionally, investors will be closely watching CEO Jensen Huang's comments regarding China, as a series of export limitations could impact future demand prospects in that region.

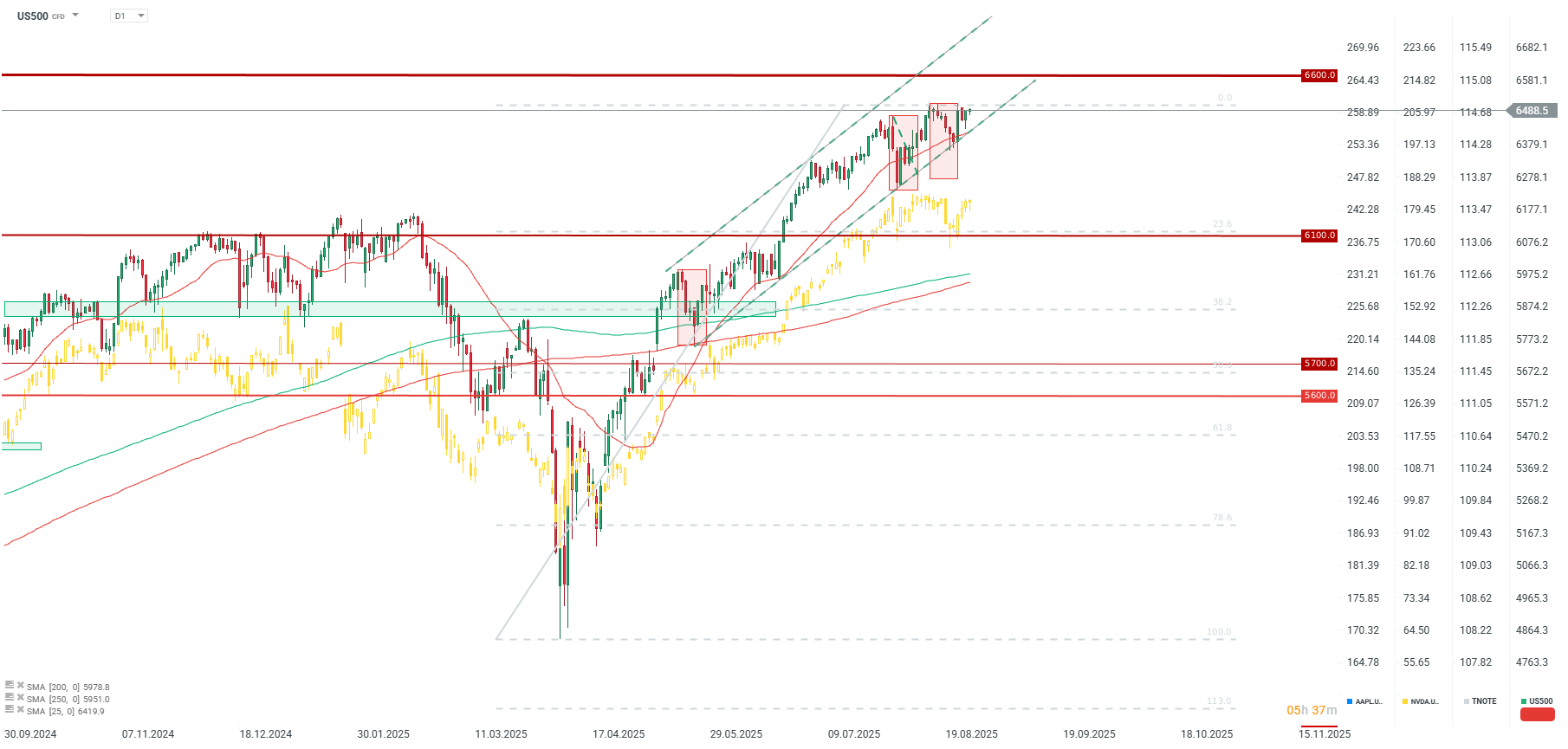

Nvidia is up just under 0.2% today and, similar to the US500, is trading near all-time highs. The US500 is trading slightly below the 6,500-point level. The nearest support is around the lower boundary of the upward trend channel along with the 25 SMA line. Many financial institutions forecast the US500 will reach 6,600 points this year, which would imply a move of just 1.6% from the current level.

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨