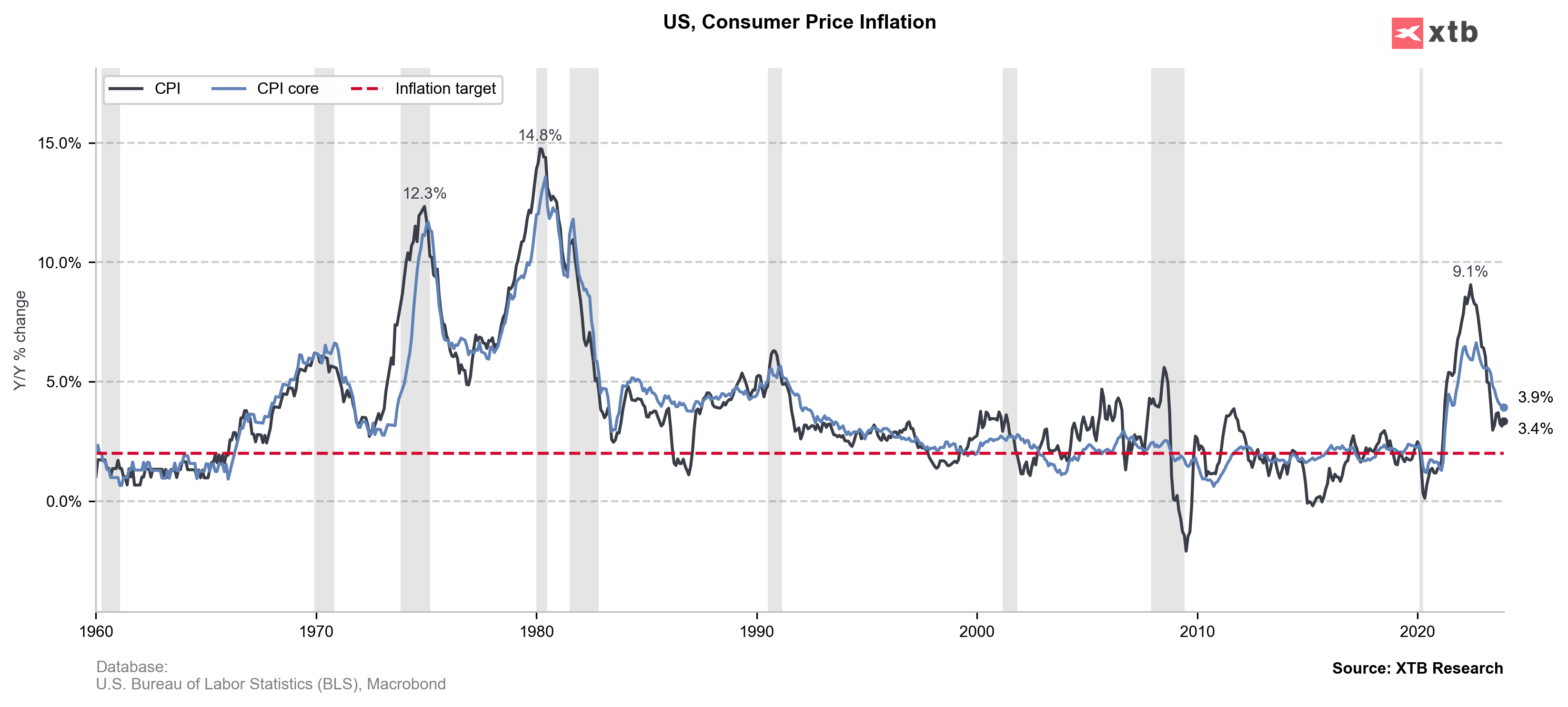

Release of the US CPI inflation report for January is a key macro event of the day. Report will be released at 1:30 pm GMT today and is expected to show a further slowdown in headline and core price growth measures. January's CPI print will be one of the releases that may help determine whether the first Fed rate cut will be delivered at May meeting or later.

What are markets expecting?

- Headline (annual). Expected: 2.9% YoY. Previous: 3.4% YoY

- Headline (monthly). Expected: 0.2% MoM. Previous: 0.2% MoM

- Core (annual). Expected: 3.7% YoY. Previous: 3.9% YoY

- Core (monthly). Expected: 0.3% MoM. Previous: 0.3% MoM

Source: Macrobond, XTB Research

Source: Macrobond, XTB Research

Median expectations among economists surveyed by Bloomberg and Reuters suggest further deceleration in US inflation, with headline CPI expected to slow below 3.0% YoY for the first time since March 2021. Core gauge is also expected to drop from 3.9% to 3.7% YoY, what would be the lowest reading since April 2021. Oil and, especially, US natural gas prices in January 2024 were much lower than in 2023, and it is contributing to a drop in annual price growth measures. Also, the continuing downtrend in car prices is supporting disinflation expectations.

However, prices subindices from ISM readings for January suggest upward inflationary pressure. Services ISM Prices Paid subindex surged from 56.7 to 64.0 in January (exp. 56.7) while manufacturing ISM Prices Paid subindex moved from 45.2 to 52.9 (exp. 46.9)

Source: Bloomberg Finance LP, XTB Research

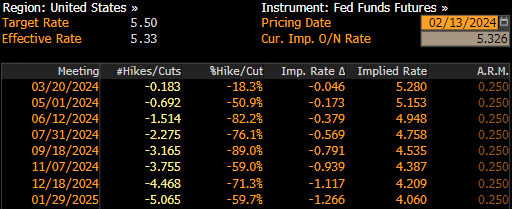

March rate cut seems to be off the table, following recent comments from Fed members that suggested the central bank may not have enough confidence in inflation by March meeting to cut rates. Money market price in an around-18% chance of Fed delivering 25 bp rate cut next month. However, May still looks probable with markets pricing in over 17 basis points of easing by then - or almost 70% chance. A dovish CPI print (lower than expected) would likely see those expectations rise further, and may potentially harm US dollar while supporting equities.

A look at the markets

EURUSD retested early-December 2023 lows in the 1.0730 area last week but bears failed to push the pair below. Pair has recovered slightly but the rebound started to lose momentum. A lower than expected CPI print today, could provide fuel and help resume the recovery move. In such a scenario, traders will focus on 200-session moving average (purple line, 1.0830 area) and 1.0865 resistance zone. On the other hand, a 3% or higher headline reading could lead to another test of the 1.0730 support. Source: xStation5

EURUSD retested early-December 2023 lows in the 1.0730 area last week but bears failed to push the pair below. Pair has recovered slightly but the rebound started to lose momentum. A lower than expected CPI print today, could provide fuel and help resume the recovery move. In such a scenario, traders will focus on 200-session moving average (purple line, 1.0830 area) and 1.0865 resistance zone. On the other hand, a 3% or higher headline reading could lead to another test of the 1.0730 support. Source: xStation5

S&P 500 futures (US500) climbed above the 5,000 pts mark last week for the first time in history. Index continued to gain but the advance was halted in the 5,066 pts area and a correction was launched. The index is trading 23.6% retracement of the recent upward impulse at press time. Should inflation data turn hawkish (surprise to the upside), index may be set to deepen drop. In such a scenario, the lower limit of local market geometry at 5,007 pts will be on watch. On the other hand, a dovish print could help the index recover towards recent highs. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales