The US500 is struggling today for the highest close ever. On March 14, the contract opened higher than the current price, but this was due to a rollover. Gains of the index futures are motivated by the growth of technology companies valuations. Interestingly, the US500 initially lost in anticipation of tomorrow's Fed meeting and the large uncertainty about the tone of tomorrow's event. On the other hand, the lack of a large negative market reaction to the BoJ hike means that the Fed need not be overly hawkish tomorrow.

One of the driving forces, in addition to Apple and Microsoft, is Nvidia, which unveiled at its AI conference a new "superchip" called Blackwell, which is part of their series of artificial intelligence chips. The Blackwell B200 chip is an improved version of the previous H100 chip and offers better performance and lower power consumption. "Superchip" GB200 combines two B200 chips on a single board, along with a Grace CPU, providing even higher performance and energy efficiency for chatbot server farms. Nvidia also unveiled its entry-level model called GR00T, designed to control humanoid robots and enable them to understand natural language and mimic human movements. In addition, Nvidia is entering the cloud quantum computing market, offering a quantum computer simulation service using its artificial intelligence chips.

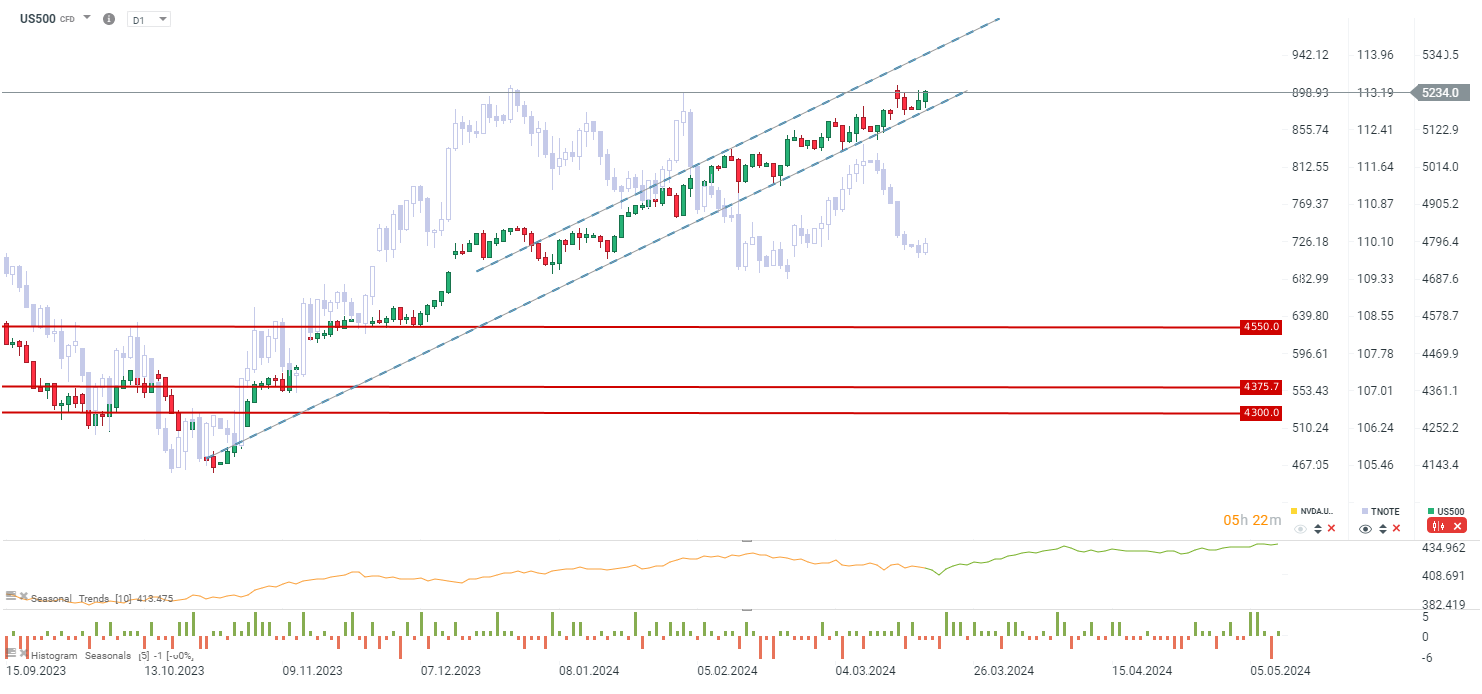

The US500 is vying for the highest close in history. Potentially, even today the highest daily level in history is also within reach, which is only 17 points from the current level. After recent strong declines in U.S. bond prices, which lasted continuously from May 11-18, today shows the first signs of recovery. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report