The US500 is retreating today amid continued uncertainty over the US debt limit. We are also seeing fairly mixed data from the US - a fairly strong PMI index for services, but for manufacturing back below 50 points, which could be a sign of a breathless economy. At the same time, in the face of heightened risk and increasing chances of a hike in June, yields are rising quite sharply.

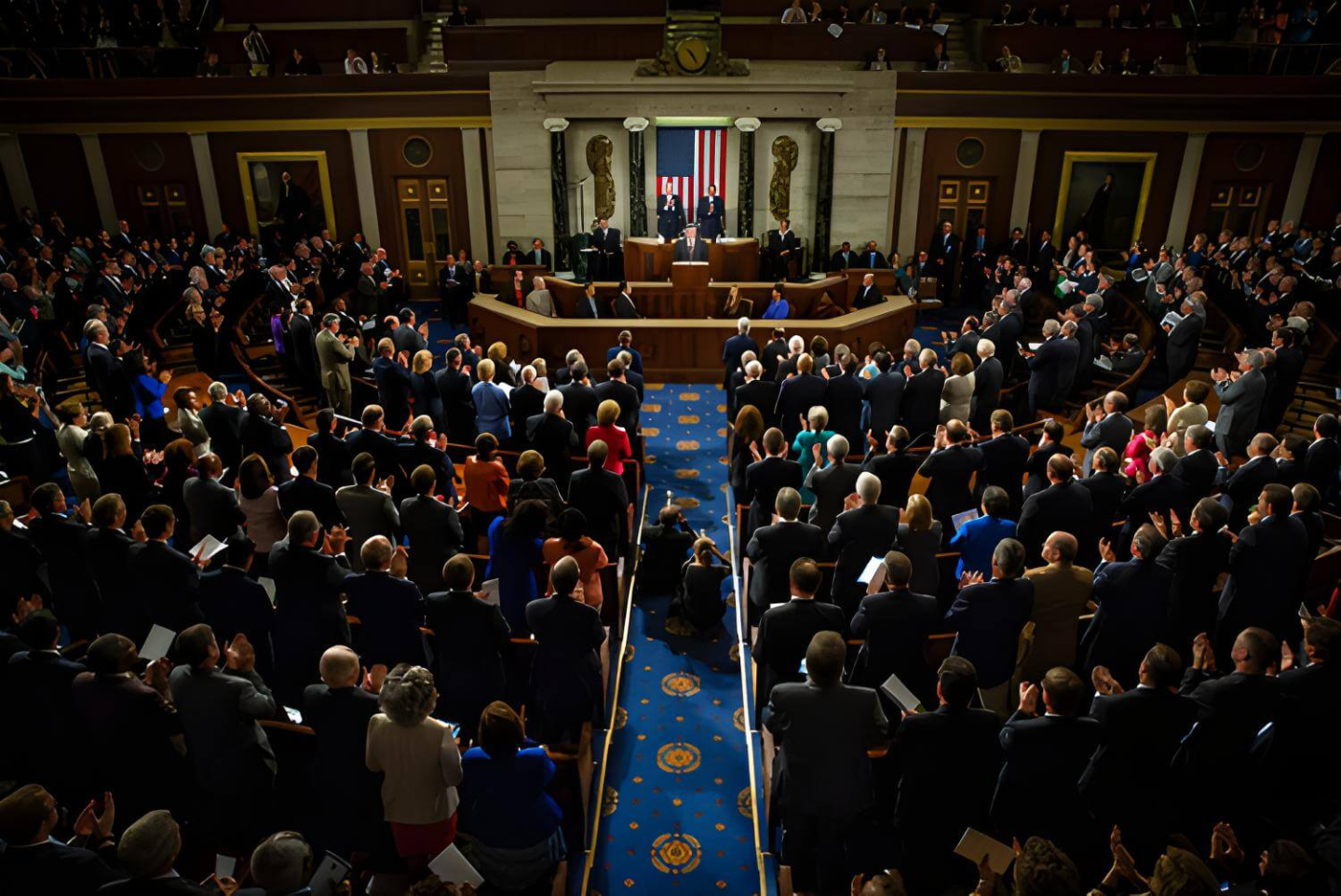

It is worth noting that a similar situation happened recently, when the US500 was trading relatively high, close to 4200 points, and yields started a rally. The US500 only started an actual pullback 2 weeks later, which only ended when divergence closed. The strong rise in yields started on 12 May and given the same period when the indices reacted, we have to look at the date of 26 May, the coming Friday. It seems that stronger declines could start on Friday if indeed the Democrats do not get along with the Republicans by the end of this week. Then the talks will be moved to literally days before the X-date.

Source: xStation5

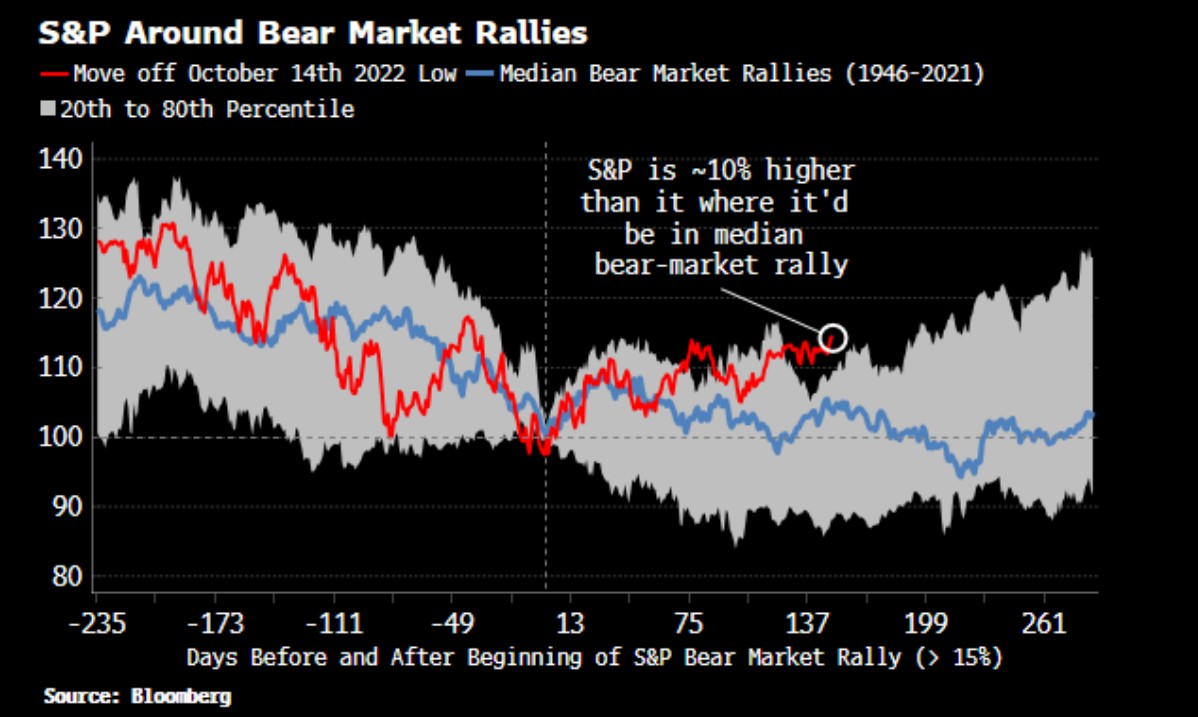

It is also worth noting the so-called "bear market rally". This is related to the upward correction in the downtrend. The US500 is currently behaving much better than in previous upward corrections in a downtrend. If the situation were to repeat itself, i.e. we are further in a downtrend, the potential for a downward correction from the current level is enormous. On the other hand, it seems that at least temporarily the US500 should react positively to a potential debt limit agreement. After that, the US500 may react to reduced liquidity if the financial sector throws itself into buying newly released bonds. Source: Bloomberg

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street