Senator Mark Warner has conveyed that a cross-party group of 12 U.S. senators will introduce legislation today giving the U.S. Secretary of Commerce new authority to impose a complete ban on TikTok, owned by privately held Chinese conglomerate ByteDance.

- In recent years, TikTok's policies have repeatedly attracted the attention of U.S. regulators, citing privacy and data processing issues. The discussion of a viable ban on the platform comes as relations between Washington and Beijing have cooled again following incidents involving a Chinese balloon and an American visit and sale of hundreds of millions of dollars worth of F-16 munitions to Taiwan;

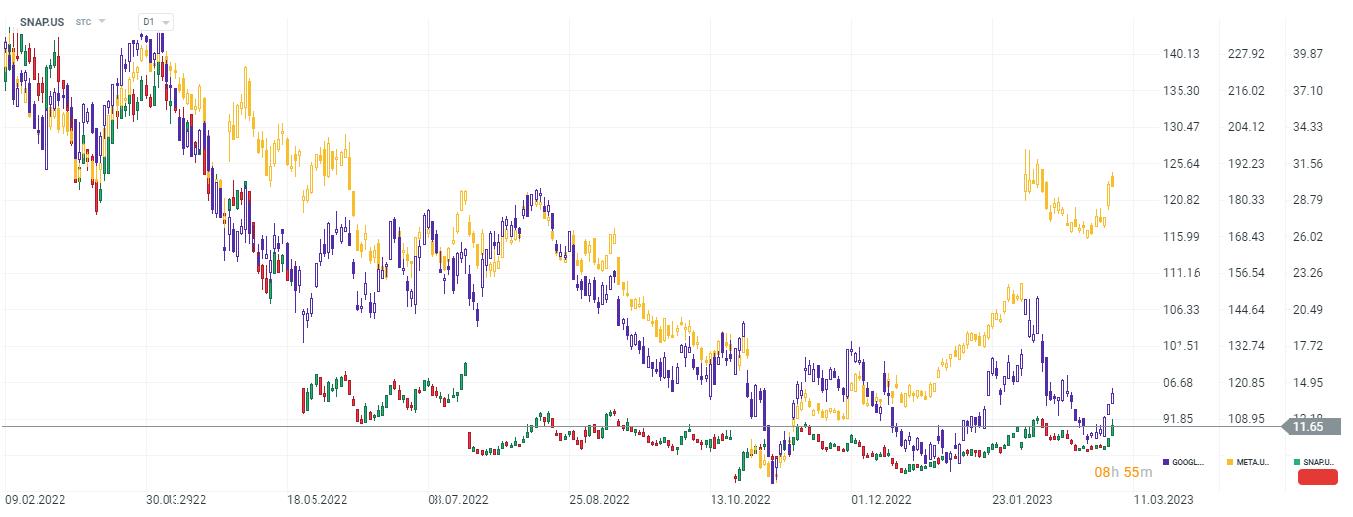

- Potentially, the TikTok ban will increase U.S. market share for rival platforms especially Snap (SNAP.US), Meta Platforms (META.US) and Alphabet (GOOGL.US), which could benefit the stocks of these companies.

Snapchat (SNAP.US), Meta Platforms (yellow color) and Alpahbet (purple color) stocks, D1 interval. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street