Summary:

-

US November retail sales: +0.2% vs +0.1% exp

-

Control group beat particularly strong (+0.9% vs +0.4% exp)

-

USD extends earlier gains to trade higher across the board

This afternoon there’s several pieces of second tier data released from the US with arguably the most important the latest figures on consumer spending. On this front there’s been some pretty positive news with the November advance retail sales month-on-month rising by 0.2% against a consensus forecast of 0.1%. Furthermore the past reading of 0.8% has been revised higher to now stand at 1.1% which makes the rise seem a fair bit more impressive.

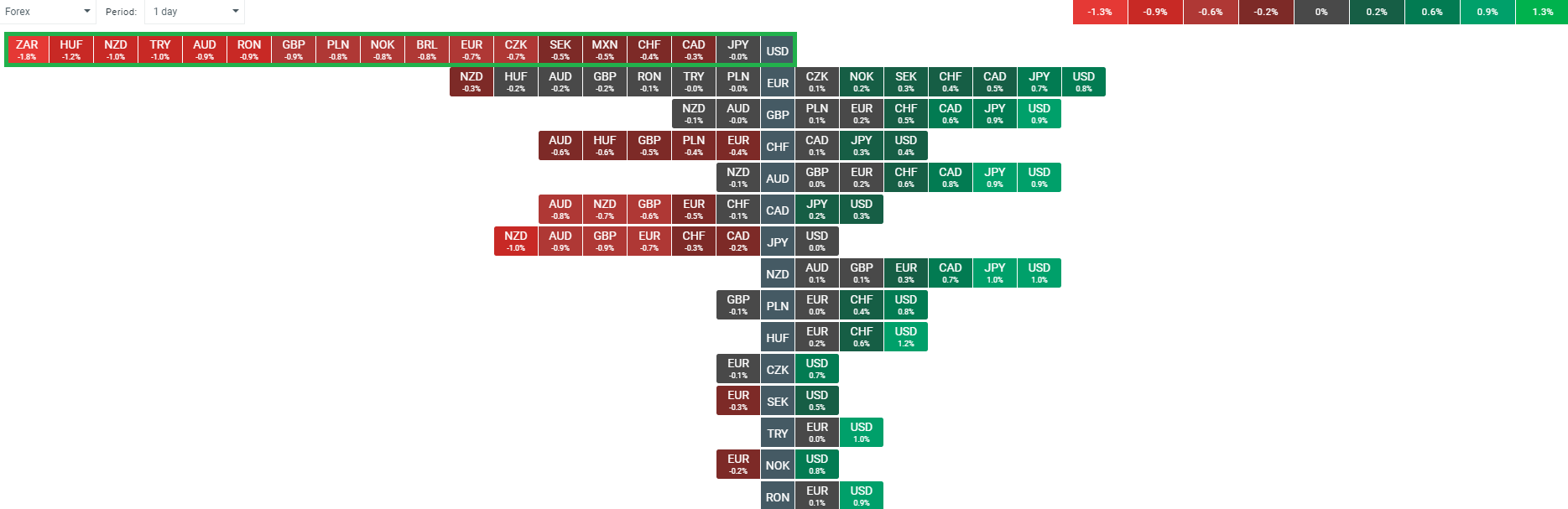

The US dollar is rising across the board after the release, with the buck building on earlier gains after the release. The biggest rise is seen against the ZAR while the JPY is barely lower. Source: xStation

Looking closer at the data, the core reading after stripping out auto sales came in at 0.2% m/m as expected. The prior reading here was also revised higher from 0.7% beforehand to 1.1% now. More importantly though, the control group in particular has shown a strong rise with a M/M gain of 0.9% compared to median expectations for +0.4%. Again there was a positive revision here with the prior reading being moved markedly higher to now read 0.7% after previously showing 0.3%.

The USD has built on earlier gains after the release and is looking set to end a good week on the front foot. Yesterday we identified a triangle consolidation that has been in place for the EURUSD in recent weeks and there may have been a decisive break lower today. The pir has fallen below the 1.13 handle and is now not far from its lowest level in over a month. The region from 1.1220-1.1280 remains a possible obstacle to further declines but if price can move beneath these then a larger decline to 1.1110 is possible.

The EURUSD has made an attempted break lower today after moving out to the downside of a consolidatory triangle that has confined price in recent weeks. Source: xStation

The EURUSD has made an attempted break lower today after moving out to the downside of a consolidatory triangle that has confined price in recent weeks. Source: xStation