US dollar is trading under pressure today, although it should be said that scale of the move is rather small compared to yesterday's strong pullback. A number of key macro releases has been scheduled for today with ADP jobs data being the most important one for USD in short-term.

What markets expect from the ADP report for August(1:15 pm BST)?

- Market expects employment gain to reach 195k in August, much lower than 324k report for July

- NFP report for July came in at 187k

- The past 4 ADP reports have beat market expectations noticeably

- Should ADP meet market expectations it would be the lowest reading in 5 months

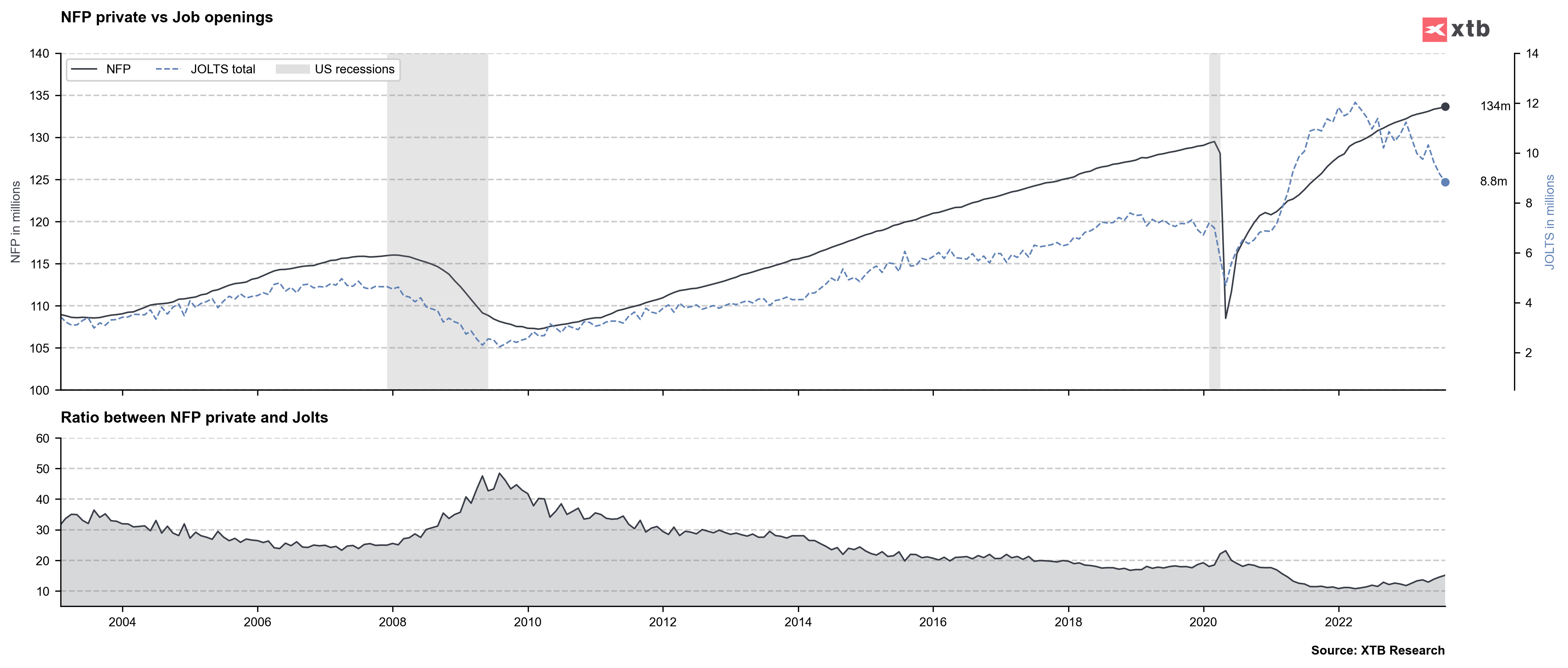

- Weekly jobless claims remain slightly above 200k but there has been a significant drop in JOLTS job openings, which now sit below 9 million

JOLTS data showed further drop in job openings in July, suggesting that employment gains in the United States may be over soon. Will ADP data confirm this thesis? Source: Bloomberg Finance LP, XTB

Powell said during his speech at Jackson Hole that jobs market is having more and more impact on inflation therefore a slowdown on labour market would be desirable by the Fed when assessing inflation dynamics. Should ADP report show weakness in the US economy, there is a big chance that US dollar will continue to weaken. Moreover, US dollar index (USDIDX) is pulling back from a key resistance zone, marked with peaks from May. Back then we have also observed significant gains in bond prices (drop in yields). We can also see that USD looks to be strongly oversold by institutional investors (blue line).

US dollar index may have painted a potential local high already and strong rebound in TNOTE prices support this view (inverted axis). Should data continue to show weakening in the US economy, USD may continue to underperform in the short-term. Source: xStation5

- Apart from US data, traders should also pay attention to release of German CPI data for August at 1:00 pm BST. Majority of German states that have already released CPI figures for August experienced higher-than-expected growth with Brandenburg CPI (the biggest surprise) accelerating from 6.7 to 7.1% YoY in August. Expectations for the reading for the whole Germany point to a drop from 6.2 to 6.0% YoY. However, state-level data suggests that there is a risk of an upside surprise, what may cement ECB rate hike in September

- US GDP report for Q2 2023 will be released today at 1:30 pm BST. However, it will be a revision therefore no major market reaction is expected. First release of the report back in July turned out to be a positive surprise with annualized growth reaching 2.4%

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

Daily summary: Markets capitulate under the influence of the Persian Gulf

Economic calendar: Eurozone CPI and central bankers speeches in focus