Summary:

-

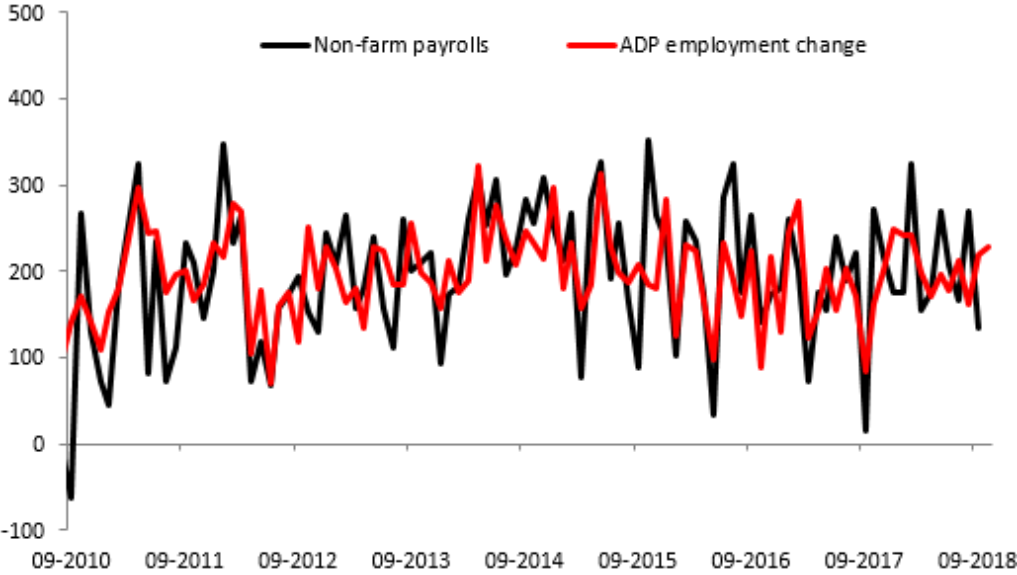

ADP employment change: 227k vs 189k exp (prior revised down by 12k to 218k)

-

Canadian GDP beats forecasts: M/M: +0.1% vs + 0.0% exp. Prior 0.2%

-

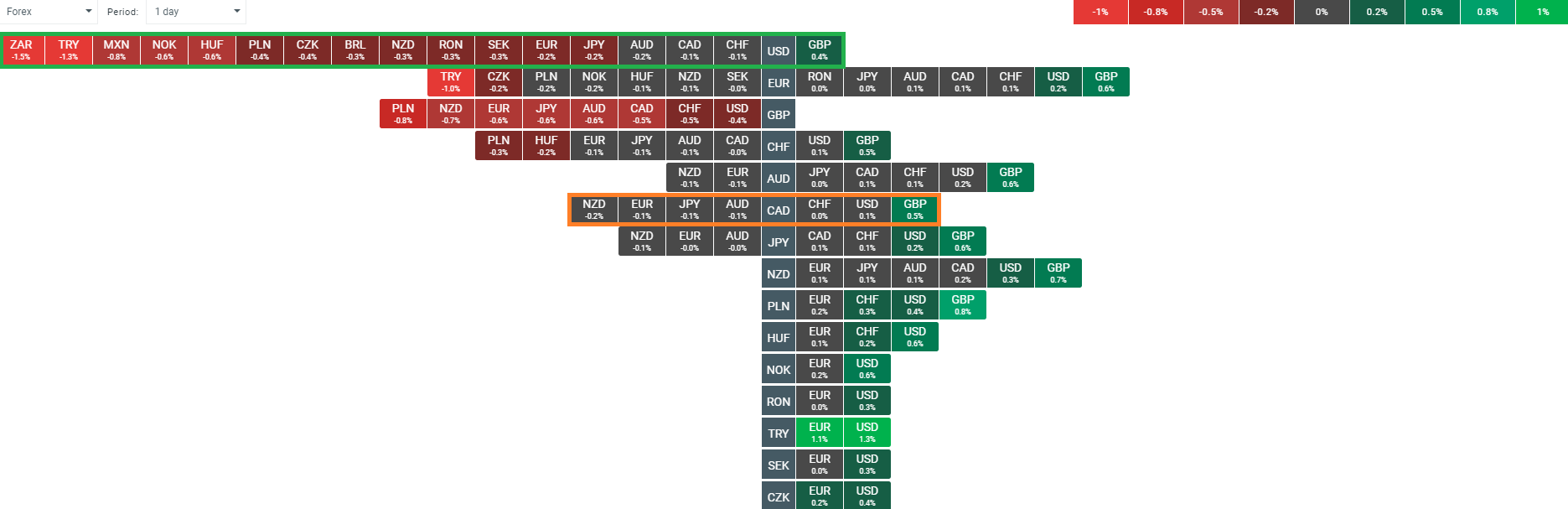

USD hits 2018 peak; CAD fairly mixed

The simultaneous release of North American data this afternoon has seen two positive readings both north and south of the border with the latest read on US employment and Canadian growth both beating expectations.

USD is gaining against all its peers other than GBP, while the Canadian dollar is fairly mixed on the day. Source: xStation

First off, the US. The ADP employment change for October came in at 227k compared to a consensus forecast of 189k. The figure is the highest since the data for March and also the 3rd time in the past 4 releases this has beaten forecasts. The prior was revised lower to 218k from 230k previously but even with the slight blot it still stands comfortably above the 200k mark.

The ADP is quite widely seen as a precursor for the monthly NFP. In light of this, today’s beat may have raised expectations for Friday’s release. Source: XTB Macrobond

At the same time as the ADP, the Canadian GDP for August was also released, with a month-on-month gain of 0.1%. This was fractionally above the flat reading expected but a little lower than the 0.2% seen last time out. In year-on-year terms the growth was 2.5% compared to 2.4% expected, but the prior reading for July was revised down by 10 basis points to 2.3%. There’s a clear strong correlation between industrial GDP and oil extraction in Canada, which is unsurprising given that crude is one of the nation’s largest exports. On this front there was a bit of a pickup in the data with mining, quarrying and oil and gas extraction rising by 0.9%.

An increase in oil extraction of late has seen a small tick up in industrial GDP but both these metrics remain well below the levels seen around a year ago. Source: XTB Macrobond

An increase in oil extraction of late has seen a small tick up in industrial GDP but both these metrics remain well below the levels seen around a year ago. Source: XTB Macrobond

USDCAD is edging a little higher on the day with the market still looking to rally after breaking above a falling channel on Monday. Despite a BOC rate hike and hawkish tone last Wednesday the market failed to drop, with a long wick on the D1 candle indicative of buying pressure. A move above 1.3158 would open up possible further gains to 1.3225 and maybe even 1.3290. Source: xStation

USDCAD is edging a little higher on the day with the market still looking to rally after breaking above a falling channel on Monday. Despite a BOC rate hike and hawkish tone last Wednesday the market failed to drop, with a long wick on the D1 candle indicative of buying pressure. A move above 1.3158 would open up possible further gains to 1.3225 and maybe even 1.3290. Source: xStation