Summary:

-

US retail sales for September miss forecasts

-

Core figures also come in lower than expected

-

Data does little for USD. Remains lower on the day

The main economic data from North America today has shown an unexpected slowdown in consumer spending in the US and done little to help the US dollar which remains lower on the day against all of its peers. US advance retail sales for September showed a month-on-month increase of 0.1%, far smaller than the 0.6% expected and in line with the previous reading. The core figure was even worse, in falling for the first time in over a year at -0.1%. This was a bit of a negative shock against a consensus forecast of +0.4% and a prior of +0.3%.

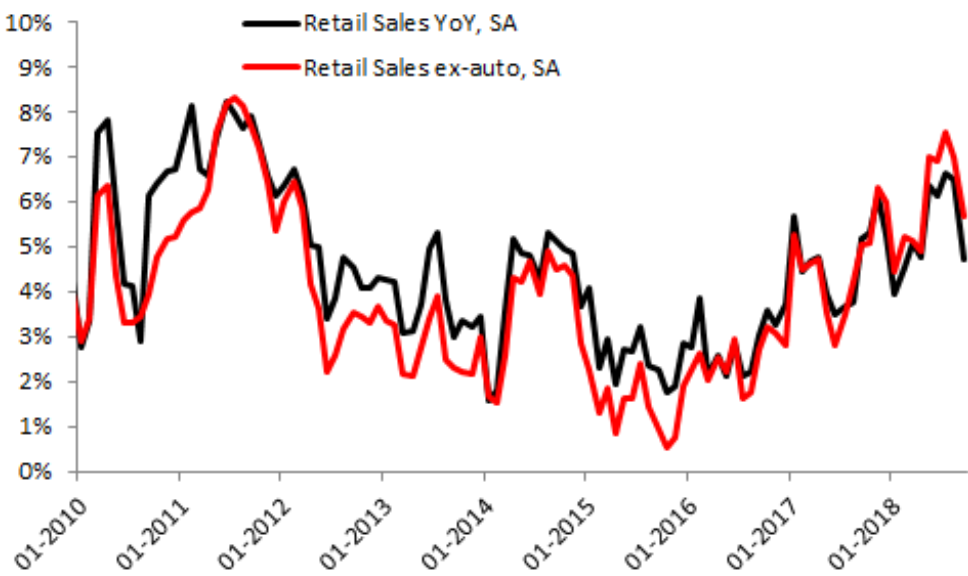

The latest US retail sales figures have disappointed with both the headline (4.7%) and core (ex-auto. 5.7%) falling back. Source: XTB Macrobond

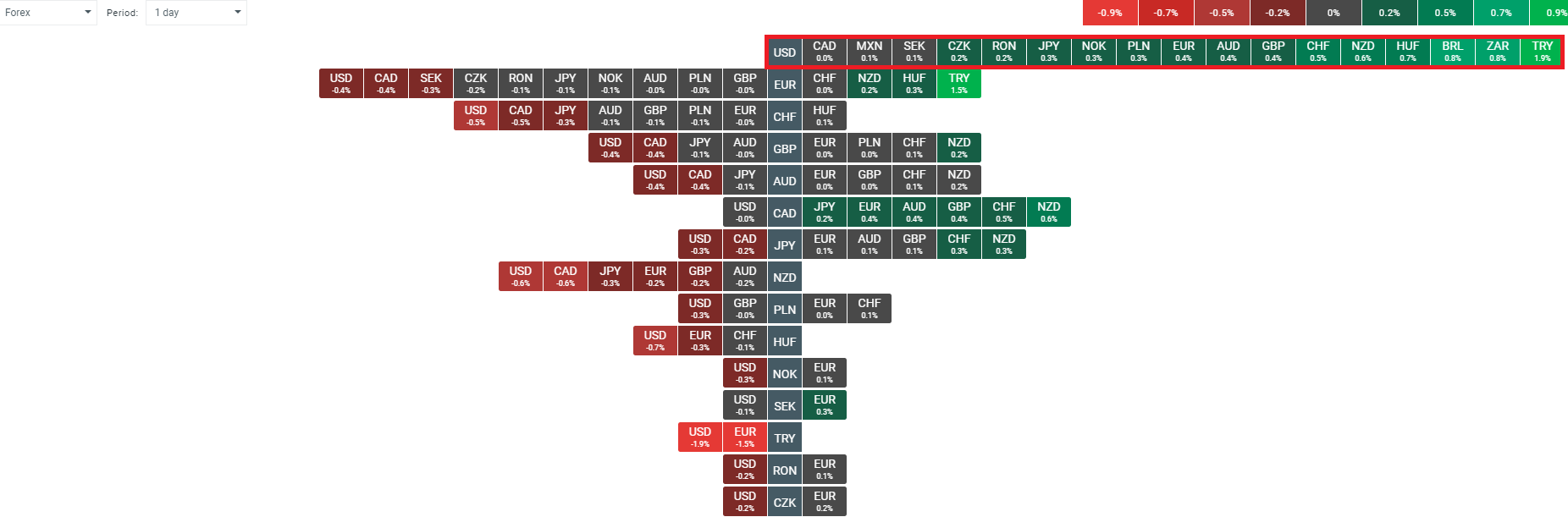

The US dollar has been coming back under a bit of pressure of late and it’s gotten off on the wrong foot this week in sliding lower across the board. The biggest gainer against the buck is the Turkish Lira which is higher by almost 2% as it looks to continue its recovery following the release of the US pastor on Friday. EM gains are a common theme with the Real, Rand and Forint also making steady steps higher.

The USD is drifting lower today, trading in the red against all of its peers. EM currencies in particular are rising against the buck. Source: xStation

It’s a pretty quiet week ahead on the data front from the US, and as such the moves in the USD could well be driven by the overall risk sentiment and also the other side of the pair. On this front the GBPUSD could be of particular interest given the recent developments relating to Brexit. In the last hour Brussels has reported given Britain a day to settle its position on Brexit before deciding how to respond to PM Theresa May’s dramatic move to “disengage” from talks on an EU exit agreement. This move from may came after talks yesterday between negotiators failed to yield any progress and leaves the self-imposed deadline of this week’s EU summit looking unlikely to be met.

GBPUSD gapped lower over the weekend on negative Brexit news but the market has promptly closed the gap and despite the seemingly increasing probability of a no-deal Brexit dips continue to be bought. The 50 SMA has done a pretty good job of identifying the trend the past 12 months and price is above here at present. A break above 1.33 could trigger a possible inverse S-H-S setup, while support may be found at 1.3080 and 1.2920. Source: xStation

GBPUSD gapped lower over the weekend on negative Brexit news but the market has promptly closed the gap and despite the seemingly increasing probability of a no-deal Brexit dips continue to be bought. The 50 SMA has done a pretty good job of identifying the trend the past 12 months and price is above here at present. A break above 1.33 could trigger a possible inverse S-H-S setup, while support may be found at 1.3080 and 1.2920. Source: xStation