Investors' attention today turns to inflation readings from the world's largest economies. The publication with the greatest market significance is, of course, US CPI inflation, which will be an important factor in shaping the Fed's future monetary policy and may prove to be a valuable reference for other central banks' decisions. Today's 1:30 p.m. BST release will create a lot of volatility in the broad market, so let's take a look at the most important data on the report.

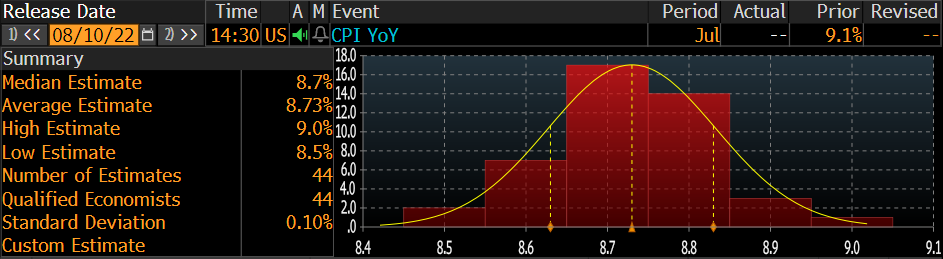

The consensus of analysts surveyed by Bloomberg assumes that the July inflation reading will reach 8.7% y/y, compared to an earlier reading of 9.1% y/y. However, we mark special attention to the small standard deviation of forecasts, which increases the chance of a plus/minus surprise. Source: Bloomberg

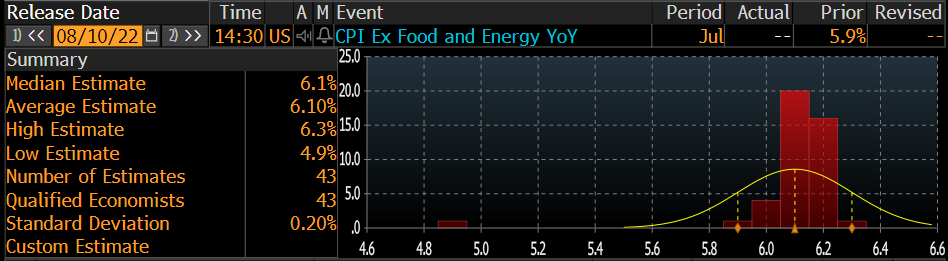

The forecasts for inflation readings excluding food and energy prices are slightly different. Here, analysts assembled by Bloomberg forecast an acceleration of inflation to 6.1% y/y, compared to an earlier reading of 5.9% y/y. This highlights the importance of especially oil and gasoline prices in the US as a factor creating inflation (average prices fell in July). Source: Bloomberg

Money market rates currently point to a 76% probability of a 75 basis point rate hike at the September FOMC meeting. Today's reading will certainly bring an update in market valuations. Source: Bloomberg

At the moment, stock markets are trading at mixed levels, the U.S. dollar is weakening against other currencies, and 10-year yields are rising slightly.

EURUSD pair rose slightly during today's session and is currently testing the upper limit of the triangle formation. Nevertheless, traders restrain themselves from taking larger transactions ahead of CPI release. Markets forecast that the annual inflation rate in the US will slow to 8.7% in July, however a significant downward surprise could reduce some pressure on the Fed and push USD even lower. On the other hand, a hotter-than-expected reading will reinforce the central bank's aggressive stance against surging inflation (especially given last week's strong NFP reading) and likely trigger another dollar rally. Source: xStation 5

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)