Summary:

-

Core US PCE price index Y/Y: 2.0% vs 2.0% exp. 2.0% prior

-

Canadian GDP M/M: +0.2% vs +0.1% exp. 0.0% prior.

-

USDCAD drops back below 1.30. Trades near daily lows

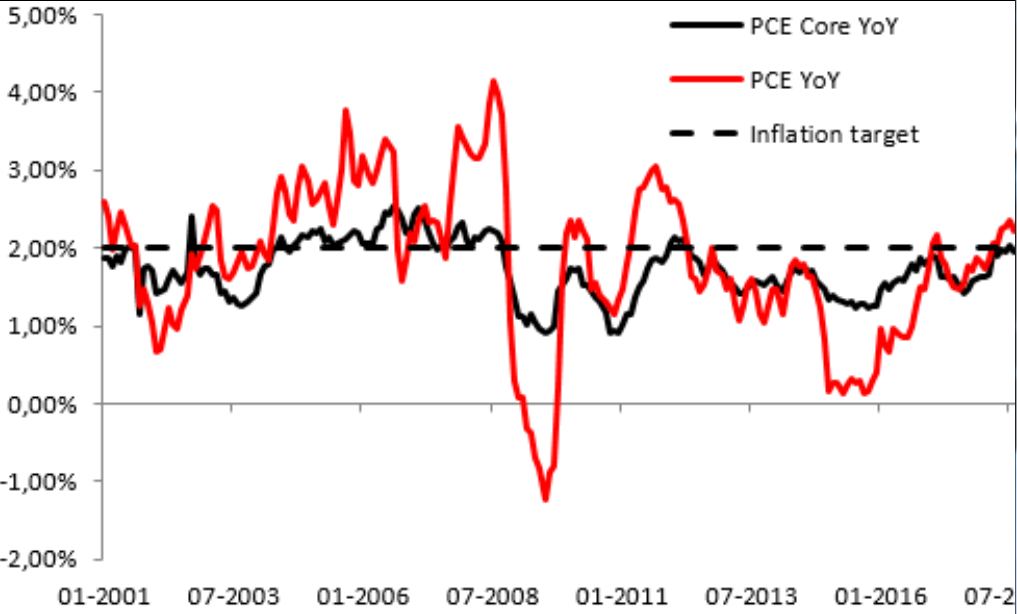

Two data points from North America this afternoon have done little for the prospects of USDCAD bulls with the pair remaining near its lowest level of the day below the 1.30 handle after their release. First off the US core PCE price index gathers a fair bit of attention as the Fed’s preferred gauge of inflation. This metric for August came in at 2.0% Y/Y as expected, showing no change from the previous month. In M/M terms however there was a small miss here with a print of 0.0% below both the consensus forecast (+0.1%) and the prior (+0.2%). The headline figure also pulled back a little in coming in at 2.2% Y/Y from 2.3% beforehand, but this dip was widely expected. The core reading remains at the Fed’s inflation target of 2% while the stand along PCE is above it even after the recent decline.

The PCE core remains at the Fed’s inflation target while the PCE is still close to its highest level since 2011 despite the recent dip. Source: XTB Macrobond

At the same time that we got the latest inflation figures from the US we also received the most recent growth numbers from Canada. There was an upside beat here with the GDP M/M for July rising more than the 0.1% expected, with an increase of 0.2%. This comes after a flat reading of 0.0% last time out. In Y/Y terms this means a rise of 2.4% compared to 2.2% expected. The manufacturing component was particularly pleasing with a rise of 1.2% M/M marking the fastest pace of growth since November 2017 with non-durable manufacturing of 2.4% the highest in four years and led by chemicals and petroleum products. The Oil industry remains a key facet of the Canadian economy and this can be shown by the strong correlation between oil extraction and GDP growth for the country’s overall industry. Given that Oil hit a 4-week high just this week it is not hard to imagine extraction rising going forward and this could boost growth further.

There’s historically been a close correlation between Canadian oil extraction and industrial GDP growth. The recent pick up in GDP hasn’t been matched by a rise in oil extraction but given that crude hit a 4-year high this week it could well pick-up going forward. Source: XTB Macrobond

There’s historically been a close correlation between Canadian oil extraction and industrial GDP growth. The recent pick up in GDP hasn’t been matched by a rise in oil extraction but given that crude hit a 4-year high this week it could well pick-up going forward. Source: XTB Macrobond

USDCAD has dropped back below the 1.30 handle today and the market is now around the middle of it’s longer term channel which dates back to early summer. Source: xStation

USDCAD has dropped back below the 1.30 handle today and the market is now around the middle of it’s longer term channel which dates back to early summer. Source: xStation