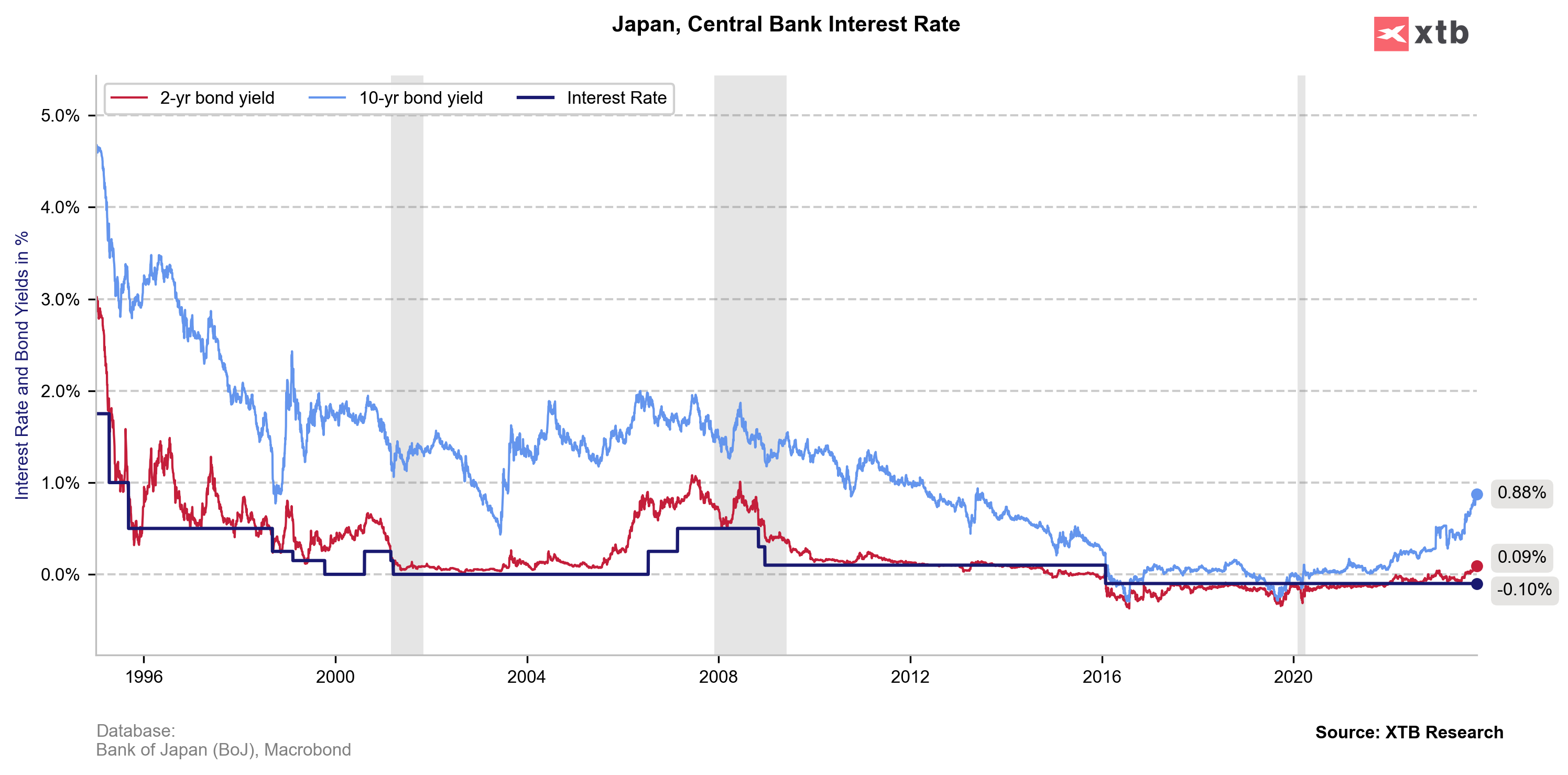

Today's session brings slightly increased volatility of the Japanese yen, due to the Bank of Japan's monetary policy decision scheduled for tomorrow. With the start of the session on Wall Street, the USDJPY pair fell below the psychological barrier of 150.00, which previously served as a checkpoint for the Bank of Japan's presumed currency interventions. The reason for this appreciation of the yen was a report by the Nikkei agency, stating that the Bank of Japan is considering allowing the yields of 10-year government bonds to exceed the level of 1%, while the current upper range of possible deviation is exactly 100 basis points.

Currently, yields are slightly below the 0.9% zone. Maintaining such a range (a 0% target with a possible deviation of 100 basis points) in an environment of rising yields is costly, and it cannot be ruled out that it will actually be raised. Source: XTB

The USDJPY pair dips after the announcement of a possible relaxation of the band around the target yield. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)