- The USA may seek changes in power in Venezuela, further escalation of tension between the USA and Venezuela becomes likely, and even military intervention.

- The presence of the USS General Ford aircraft carrier indicates a time window.

- Chevron prepares for expansion in Venezuela, with strategic agreements in the background.

- With US support, Venezuela may once again become a significant player in the oil market.

- The USA may seek changes in power in Venezuela, further escalation of tension between the USA and Venezuela becomes likely, and even military intervention.

- The presence of the USS General Ford aircraft carrier indicates a time window.

- Chevron prepares for expansion in Venezuela, with strategic agreements in the background.

- With US support, Venezuela may once again become a significant player in the oil market.

Signs in the Sky and on the Ground

In recent months, there has been an unprecedented increase in tensions between the USA and Venezuela, particularly between their leaders — Nicolás Maduro and Donald Trump. What is more concerning is that this increase in tensions is accompanied by the deployment of US troops to the Caribbean, unseen for decades. Questions arise as to what the outcome of these events will be and how they will impact the markets.

Venezuela is one of the few openly socialist countries right on the doorstep of the USA and has close relations with Russia, China, Iran, and Cuba. Maduro was potentially to be removed in 2020 through a US military operation, but ultimately this did not happen. Many indications suggest that Trump may try his hand again, this time opting for a military solution.

Two important facts point to this. Firstly, as reported by Reuters, among others, the Maduro government made a very generous proposal to the USA, offering a range of significant economic concessions. However, the USA rejected it without attempts at negotiation. Additionally, the USA has amassed an unprecedented amount of ships, aircraft, and missiles in bases and ports around Venezuela. Enough to break the armed forces of a medium-sized country. This grouping is many times larger than Trump's rhetoric focusing on drug cartels would suggest. At the same time, it is worth emphasizing that this may still be merely a show of strength and readiness rather than the ultimate use of force. On the other hand, Trump has already shown this year that he is ready to fight regimes, as demonstrated by the bombing attack on Iranian nuclear infrastructure.

Operational measures

Soon, the strike group of the USS General Ford aircraft carrier will join the current grouping. The presence of such a ship carries several important implications.

Due to the very complex system of rotation, operation, and maintenance of aircraft carriers — the USS General Ford will have a window of about 15-20 days to engage in action against Venezuela before it must return to port. Failure to meet these deadlines threatens long-term disruption of the aircraft carrier operation schedule.

Considering the current speed of the aircraft carrier — it will be in a position to conduct military operations on Venezuela between November 8 and 10. The aircraft carrier operation window can be extended to a maximum of November 22-30.

The goal of the operation may be to strike military infrastructure and troop groupings, allowing for the takeover of power by opponents of Maduro prepared for this, who will then form a new government oriented towards cooperation with the USA.

When the dust settles

If the USA ultimately decides to strike Venezuela, it would be a quick action leading to the end of the current regime. A prolonged operation with possible losses on the US side would be a disaster for the current presidential administration. The Venezuelan state has been in economic decay for years, and its armed forces are numerous but very poorly equipped, trained, and commanded. Also, the loyalty of officers and the military may prove shaky. Due to these facts, the base scenario is a quick US success, but long-term regional stability remains in question.

Therefore, it is necessary to consider the economic justification and market effects of such a drastic solution. It is common knowledge that Venezuela has the largest documented oil reserves in the world. What is less known is that Chevron, despite the embargo on Venezuela, continues to export Venezuelan oil to the USA and still maintains the capabilities and "know-how" to work with Venezuelan oil. Equally important in the context of recent events is that at the turn of August and September, Chevron and Valero signed agreements aimed at increasing the supply of Venezuelan oil. Valero is one of the refineries off the coast of the Gulf of Mexico, specializing in processing Venezuelan oil. Since Venezuelan oil is heavy oil, and adapting refineries to process the raw material is time-consuming, the USA still needs access to this type of raw material.

Oil is significant in the context of long-term geopolitical and trade rivalry. Russia and Iran depend on its export, and China on its import. Control over Venezuela's deposits would allow the USA to cut China off from part of a crucial resource that it has been intensively stockpiling in recent months, and increasing the currently meager production and pressure on the price of the raw material could push Russia's and Iran's budgets and economies into the abyss. At the same time, the Trump administration, focused on supporting conventional energy sources, must balance the desire to lower prices with supporting its own extraction sector, which needs prices above the range of 50-60 USD to continue developing.

A side thread worth mentioning regarding raw materials is that Venezuela also has deposits of Coltan. A mineral that combines Cobalt and Tantalum. Two rare elements very important in the space, defense, and automotive industries.

Black gold

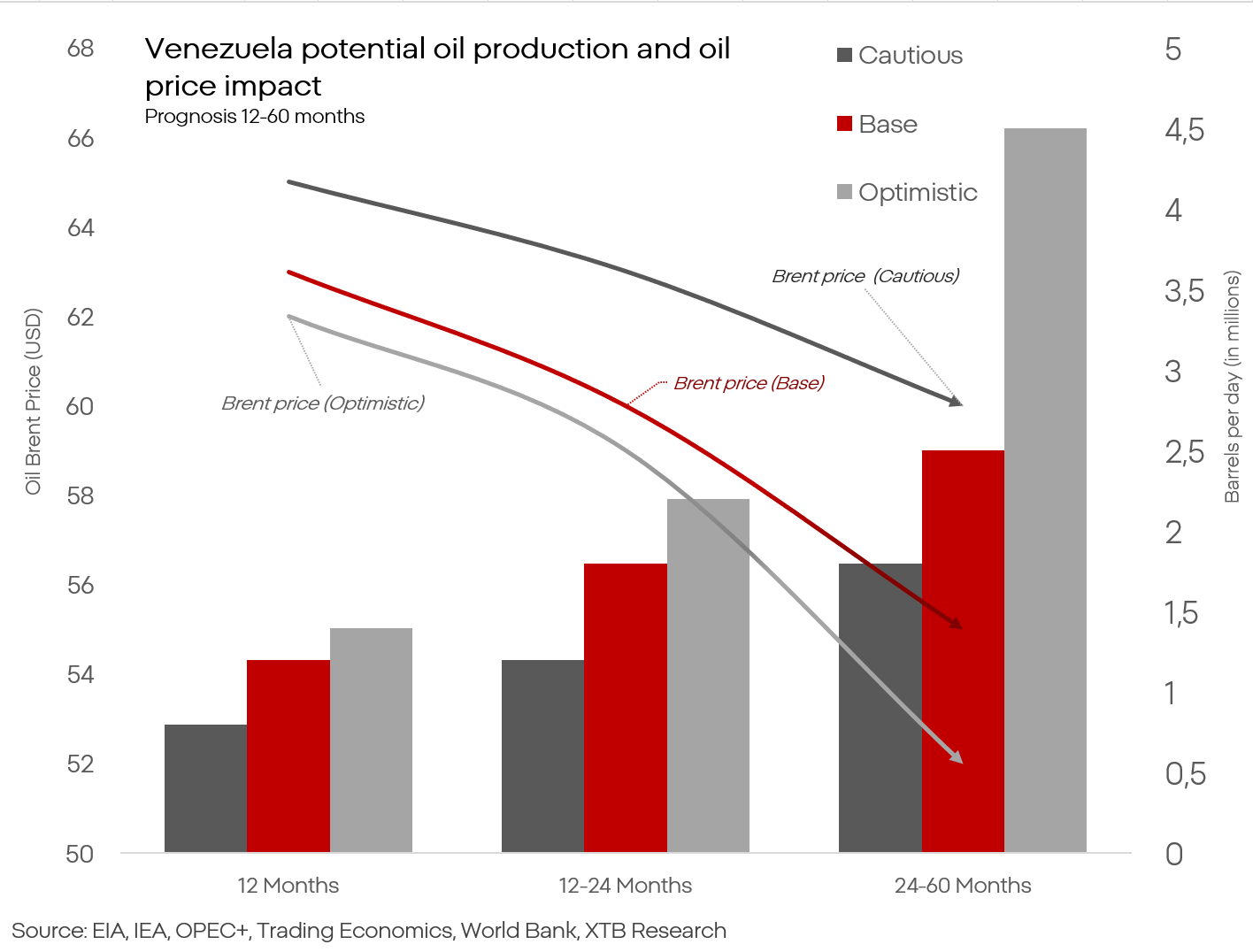

The state of oil production in Venezuela is about 0.9-1.0 million barrels per day, with a significant majority exported to China. This constitutes less than 1% of global production. In the event of a massive attack and coup in Venezuela, production in the short term may collapse by 25-50%, which will not cause a fundamental shortage in the market, but on the wave of concerns, the price of oil may increase by even 5-8%, however, this increase will be very short-lived due to the lack of fundamental basis. Much more important is what will happen in the long term.

In a cautious scenario, the rebuilding of Venezuela's oil production capacity is slow. It is still expected that production will increase by about half compared to today's levels over a 5-year perspective. Nevertheless, analytical centers and government organizations are already clearly communicating record oil surpluses in the coming years, so the price of oil will slide down, regardless of Venezuela's participation.

The base scenario is a highly probable variant in which oil production consistently increases, and cooperation with the USA allows for the rapid introduction of the raw material to the market. Such a scenario will inevitably bring the price of oil below 60 dollars.

The optimistic scenario assumes exemplary capital allocation and a leap in the expansion of the extraction industry in Venezuela. The maximum achievable production in Venezuela is about 4.5-5 million barrels per day, which is a fivefold increase compared to today's levels.

The above equations place Russia in the worst position. Russia needs Ural Oil (traded at a discount to Brent oil of about 10-12$) to cost a minimum of 50$, which means a Brent oil price of at least 60$. A drop in price below 60$, under current conditions, for 2-3 quarters will lead Russia to an economic catastrophe.

Iran's economy has been in this state for several years and serves as a sobering reminder of where Russia is heading. Hyperinflation, extreme fiscalism, and the collapse of most public services and infrastructure. The government struggles to maintain control. Further oil price reductions could lead to the collapse of the state and/or the dismantling of its "axis of resistance."

This situation leaves China in a relatively good position; they will benefit from cheap oil, which they are an importer of, but it will leave China isolated against the USA, and in the event of intensified rivalry, the USA will have more ways to cut China off from an indispensable resource. In short, Venezuela is a risky, almost poker-like move, but if the above scenario can be realized, the USA can tilt the balance of power extremely in its favor with one move. However, this remains only one of many possible scenarios, and the number of unknowns and risks is still significant.

CVX.US (D1)

Source: xStation5

Kamil Szczepański

XTB Financial Markets Analyst

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing