During the first session of the new year, 2026, Nasdaq 100 futures are up nearly 1.1%. S&P 500 (US500) and Dow Jones (US30) futures are also gaining, rising by 0.7% and 0.4%, respectively. The session in Asia – where trading was somewhat limited – was very strong. The benchmark for Asian equities excluding Japan (with Japan closed) climbed 1.7%, while Hong Kong’s Hang Seng surged nearly 2.8%, supported by gains in technology stocks. In the US, the focus at the start of the year is also shifting toward the tech sector, where AI is expected to remain the key investment theme in 2026.

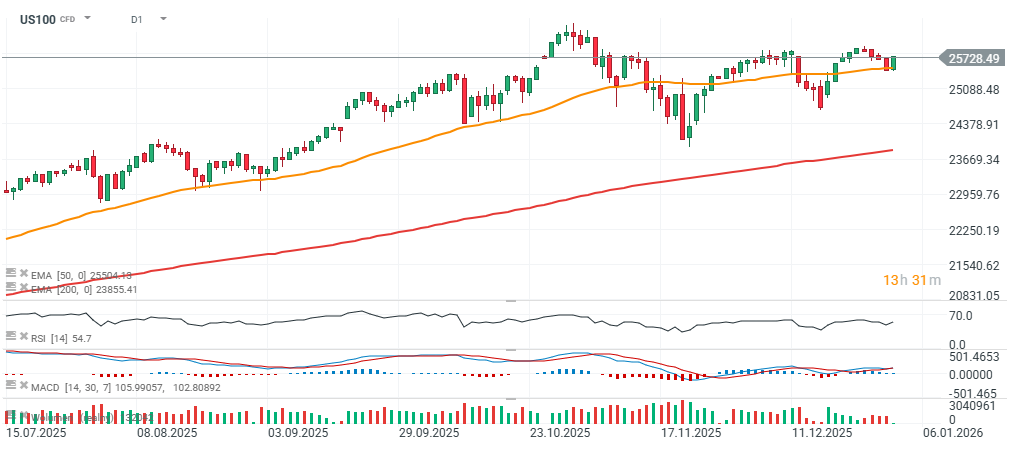

From a technical perspective, the index held support near 25,450 points, defined by the EMA50 (orange line), and is now approaching 25,750 points. The RSI remains in neutral territory; however, it is worth noting that buying volume remains relatively low ahead of the New York cash-session open. Markets appear encouraged by the resilience of the US economy, with recession risk still seen as very limited. At the same time, Donald Trump is expected to adopt a more dovish stance toward the Fed, where Kevin Hassett remains the leading candidate to replace Jerome Powell.

Source: xStation5

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge