Release of the US jobs report for January 2023 is a key macro event of the day. Report will be released at 1:30 pm GMT and is expected to show non-farm payrolls growing by 185k. If those expectations are confirmed, it would be the first sub-200k NFP reading in 2 years! ADP estimates released earlier this week raised some concerns as they pointed to only 106k jobs added in the US economy in January. Nevertheless, ADP has been a rather poor predictor of NFP recently. A softer reading could see dovish Fed bets increase and it may support risk assets like equities while putting pressure on USD. Wage growth data will also be on watch - faster-than-expected declaration would be welcome for Wall Street.

US, NFP report for January

-

Non-farm payrolls. Expected: +185k (ADP: +106k). Previous: +223k

-

Unemployment rate. Expected: 3.6%. Previous: 3.5%

-

Wage growth. Expected: 4.3% YoY. Previous: 4.6% YoY

Markets are rather calm around an hour and a half ahead of data release. The US dollar is trading mixed against G10 currencies while US index futures trade flat on the day. Precious metals inch higher with GOLD and SILVER trading 0.1 and 0.3% higher, respectively.

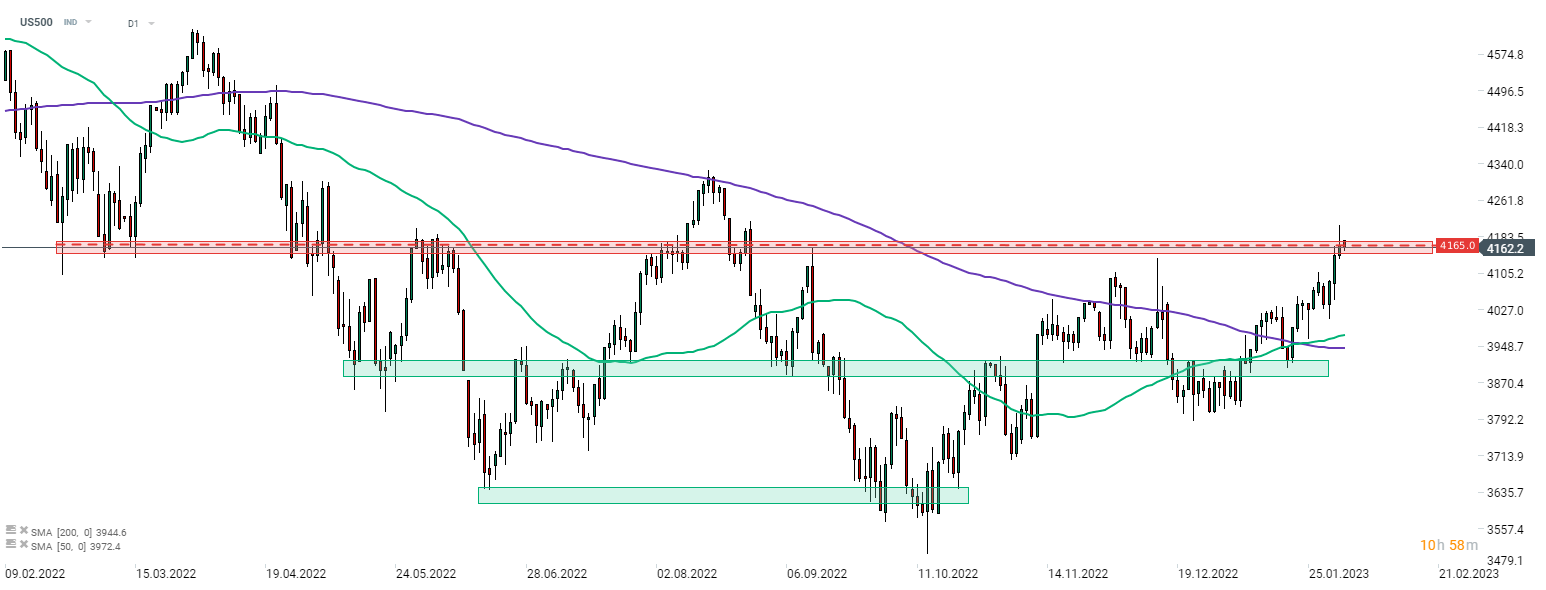

S&P 500 futures (US500) is trading more or less flat on the day. The index struggles to build onto yesterday's upward move and bulls seem to lack momentum to push the price above mid-term 4,165 pts resistance zone. Will NFP give them fuel for such a break? Source: xStation5

S&P 500 futures (US500) is trading more or less flat on the day. The index struggles to build onto yesterday's upward move and bulls seem to lack momentum to push the price above mid-term 4,165 pts resistance zone. Will NFP give them fuel for such a break? Source: xStation5

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop

Morning Wrap: Nvidia's brilliant results drag the market down (27.022026)