WTI crude oil has dropped to $72.5 per barrel, slightly breaching the lows from June this year, marking the lowest price level since February. The declines from Friday and today have broken the upward trend line. Maintaining current levels might indicate the formation of a double low pattern, with a neckline around $84 per barrel. However, taking into account current fundamentals, the full formation of the pattern is practically impossible. Nevertheless, a technical rebound to around $78 per barrel cannot be ruled out.

Source: xStation5

Recession Fears? What Does This Mean for Oil?

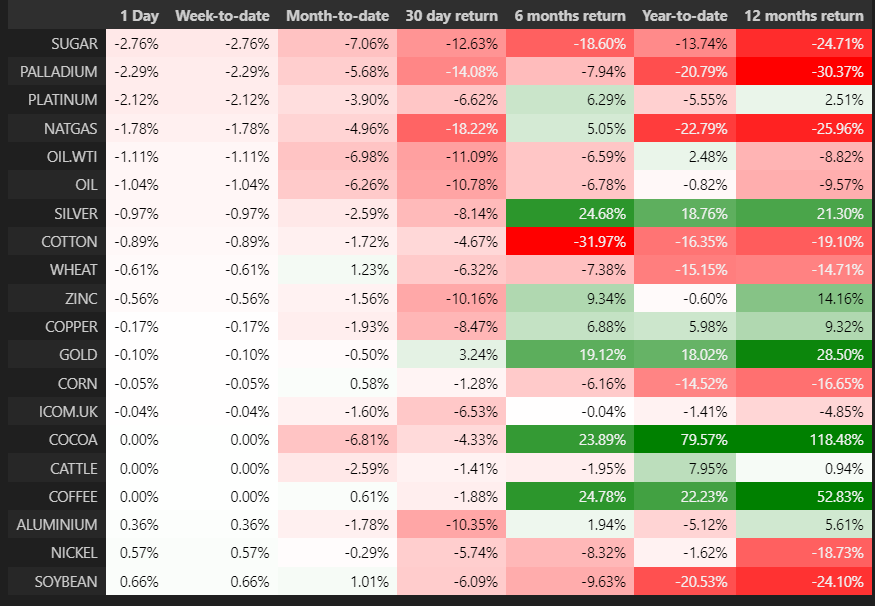

The magnitude of movements in the stock market can provide insights into the actual risk of a recession. On the other hand, if we look at the commodities market, significant movements are not observed today. However, some markets, such as oil and industrial metals, have long indicated a persistent recession risk, primarily related to the situation in China. Meanwhile, the market is now concerned about recession risks due to significant weakening in the US labor market and the unwinding of yen-financed carry trades.

The unemployment rate in the US has risen to 4.3%. During previous recessions, we observed a similar rebound in the unemployment rate. The Fed might already be late with rate cuts, which is why the market has started to price in a high probability of a 50% cut. To calm the market, clear communication from the Fed is needed, indicating that data is in line with expectations and the economy remains strong.

Source: Bloomberg Finance LP, XTB

As seen, oil is losing about 1.5% today, which is not unusual considering the movements in the stock market, particularly in Asia. However, it is worth noting that oil has dropped by about 8% since Thursday, following a previous rebound driven by increased geopolitical risk. Currently, geopolitical risk has less impact on oil prices, although a significant reaction from Iran to recent events could change the situation. Additionally, it is important to note that the US is currently in hurricane season. This could lead to reduced production in the Gulf, but the greater risk now appears to be reduced fuel production and decreased exports, which is already seen as negative for prices.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉