Summary:

- The US dollar had a great second quarter, but will the data justify this strength?

- The NFP report should show decent employment growth

- Only a surge in wages could trigger a major USD appreciation

The NFP report is typically heavily anticipated by traders around the globe and this month is no exception. In this analysis, we crunch the NFP numbers and take a look at the two markets that could respond: EURUSD and US500.

The NFP report - is there a case for a stronger dollar?

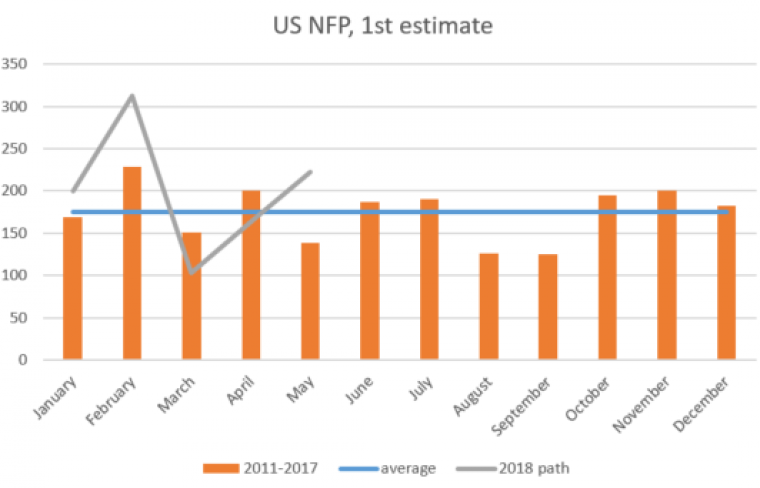

The US labour market has been really strong - this is not questioned at all. Average employment growth in the past 12 months through May was at 197k, just a notch below a 200k figure for a previous such period. If anything, this suggests a great appetite for workers as you’d normally assume some employment growth deceleration as the unemployment rate goes down to 4%. This shows economic strength - however, this is nothing new for the markets and certainly not a reason to cheer another 200k growth. For that matter, June looks to be an average month both when compared to 2011-2017 and 2001-2017 period.

Employment growth is volatile but has been very solid and June’s been traditionally a good month. Source: Macrobond, XTB Research

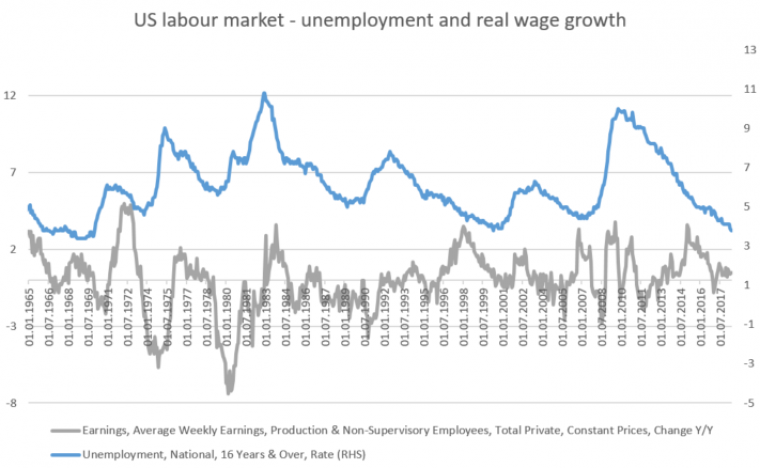

What is important for the Fed - and thus for the markets - is wage growth. At this stage of the economic cycle, wages used to grow at least at a 4% pace, not a sub-3% that is the case right now. What’s more, real wage growth has been nearly non-existent during this decade except for a 2014-16 period where it’s been caused not by nominal wage growth but declining petrol prices. So from that point there’s little inflationary pressure and amid Trade War risks the Fed could choose to stay cautious unless it sees an acceleration in (nominal) wage growth above 3% y/y.

US unemployment rate is at its lowest point in decades but it does not correspond with wage growth. Source: Macrobond, XTB Research

EURUSD

The pair will await the NFP reading with anxiousness. Even though we argue that a major surprise in the report is unlikely, the pair still needs to cement fundamentals of a recovery after it managed to defend the 1.15 support twice - first after the Italian bond mini-crisis and again after a dovish ECB. Some ECB members actually helped the euro on Wednesday by saying that waiting too long for a hike could be risky and now the pair needs a confirmation that US wage growth does not accelerate. The nearest support can be spotted at 1.1860.

EURUSD rebounded off the key support zone but we cannot be sure of a rally yet. Source: xStation5

US500

Wall Street has been remarkably resilient to the Trade Wars risks and the US500 has so far managed to stay within the upwards channel and above the 2700 support zone. We can actually see some lower shades on a D1 candle and at this point it looks as the support has been defended. The US equity market traditionally reacts in a positive way to solid employment growth accompanied by a modest wage growth.

US500 managed to defend the key support line and stays in the channel. Source: xStation5

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Three markets to watch next week (06.03.2026)