Wheat futures, on the Chicago exchange, are holding near $550 per bushel, despite the unfavorable for bull's, yesterday highlights from USDA report. The geopolitical landscape appears to be indirectly influencing wheat, as markets are pricing in the chance of an Iranian attack on Israel and an anticipated potential Russian offensive on the Ukrainian front. Wheat has historically been likely to react with increases in response to various types of geopolitical tensions.

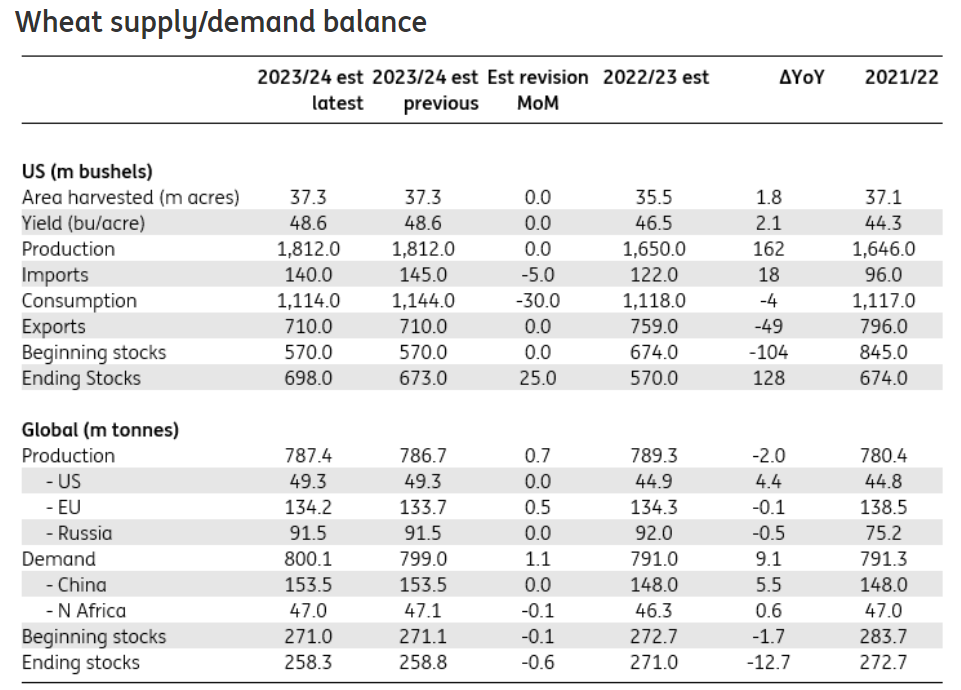

- The USDA report indicated a higher-than-expected increase in U.S. stocks versus a slight downward revision for global stocks. At the same time, demand forecasts were not raised. US inventories indicated 698 million bushels, and were 25 million higher than last time and 22% higher y/y. The average farm gate price for the season was reduced by $0.05 per bushel ($7.05 vs. $8.83 a year earlier)

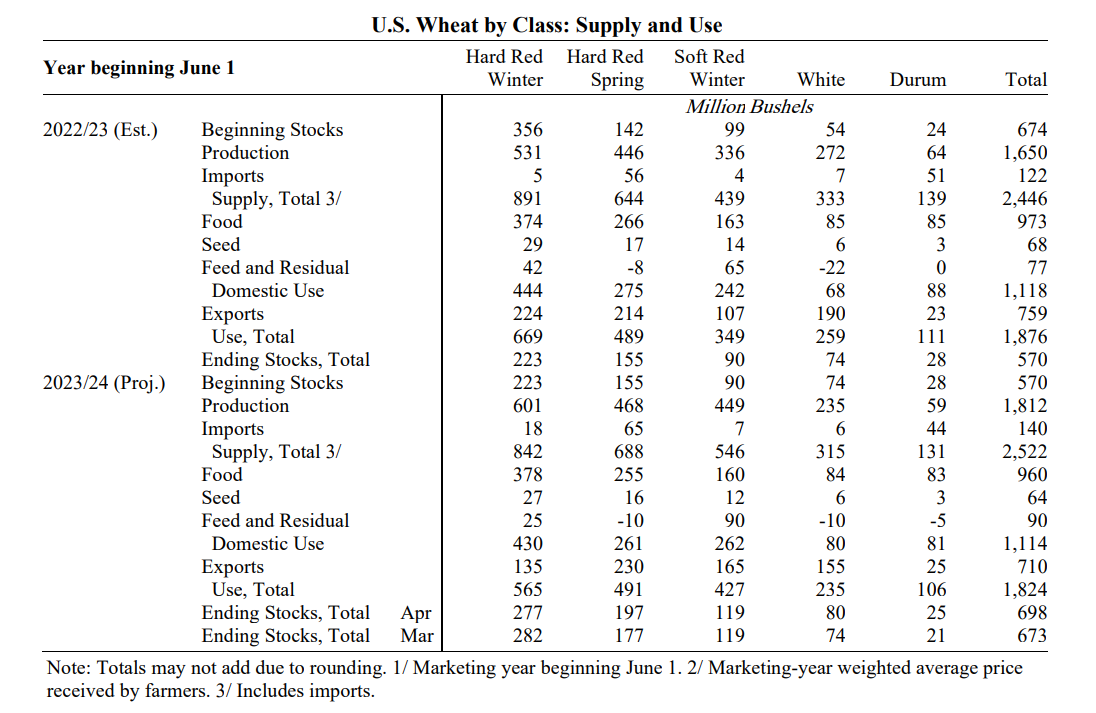

- U.S. wheat supply and demand forecasts for the 2023/24 season predict lower supplies, reduced domestic use, unchanged exports and higher stocks. The USDA, based on the latest NASS Grain Stocks report, forecasts a decline in domestic consumption due to lower-than-expected feed use and high stocks in the second and third quarters. Annual use of wheat in feed and residue was lowered by 30 million bushels, to 90 million.

- The USDA cut estimated US wheat imports by 5 million bushels to 140 million, bringing total supply to 2.522 billion bushels, and reduced feed and residual consumption by 30 million bushels to 90 million, with domestic consumption of 1.114 billion bushels and total consumption of 1.824 billion.

WHEAT (H1 interval)

WHEAT contracts did not lose much after the report and are defending the trend line and key resistance is still the SMA200 (red line), at $555 per bushel. The roll was scheduled for April 16/17.

Source: xStation5

US wheat stocks and production season 2022/2023 vs 2023/2024. Source: USDA

Wheat supply and demand balance. Estimated ending stocks, in global terms, were marginally lowered from 258.8 mt to 258.3 mt. Source: USDA, ING

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?