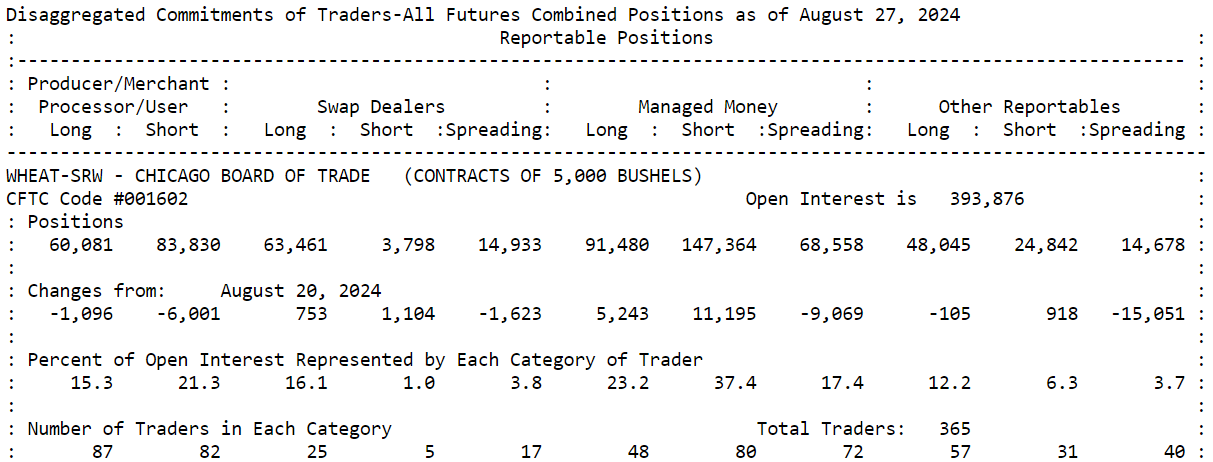

Weaker than expected harvests across the Europe lifted December Chicago Wheat futures on CBOT (WHEAT). Prices are higher more than 1% on a daily basis, extending 'trend-reversal' pattern amid improving technicals and fundamentals. The new market structure has potential to put further pressure on commodity short-sellers. The Commitment of Traders (CoT) report from 27 August signals short covering across bearish-headed speculators.

Managed Money held large bearish bets during risky summer months, but now are partially forced to short coverage. Source: Commitment of Traders

Managed Money held large bearish bets during risky summer months, but now are partially forced to short coverage. Source: Commitment of Traders

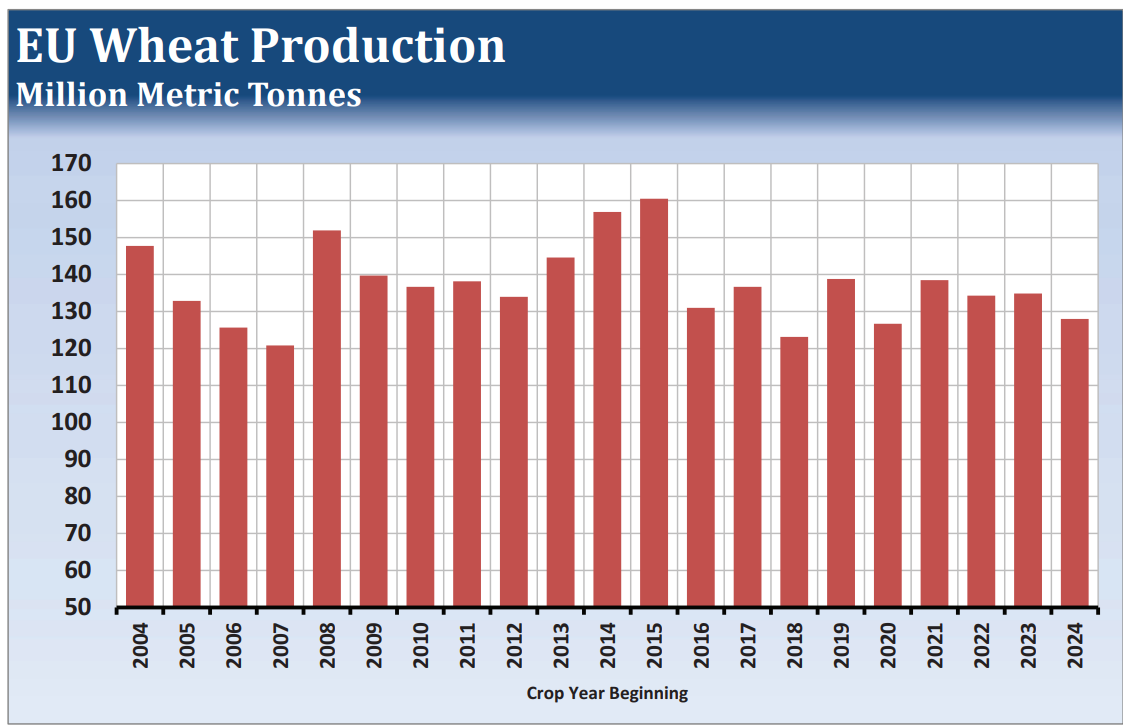

EU, Russia and Black-Sea region will report lower wheat production this year. EU Commission usable wheat production dropped from 121k tons to 116 k tons, expected now. Argus research also lowered France crops to 25.17 million tons this year (23% lower on a yearly basis). Also, Ukraine commented that production can drop 15% from current levels. Probably, US exports will be solid, amid lower supply across the major exporters.

European wheat production will be probably lower this year. Source: Hightower Report

European wheat production will be probably lower this year. Source: Hightower Report

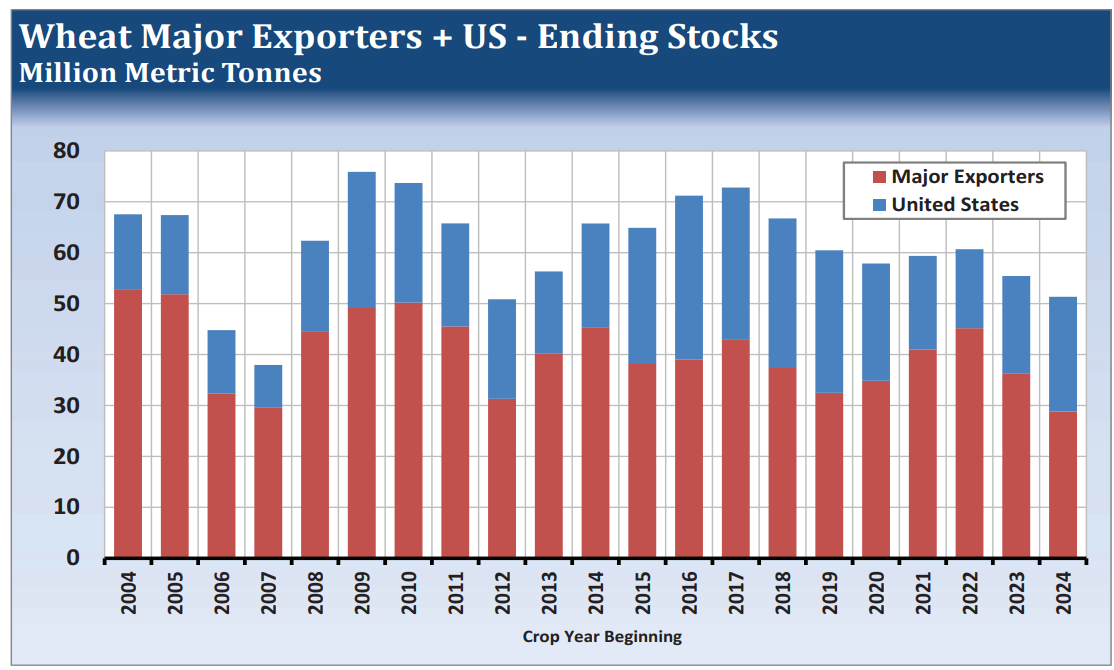

Major exporters ending stocks are down 3 years in a row, while US inventories are still solid. Source: Hightower Report

Major exporters ending stocks are down 3 years in a row, while US inventories are still solid. Source: Hightower Report

WHEAT (H1 interval)

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉