Summary:

-

Bitcoin keeps on trading within the triangle pattern which could be broken out this week

-

China’s oldest tech media publication starts accepting Bitcoin for the magazine’s 2019 subscriptions

-

Chinese Bitcoin billionaire leaves the cryptocurrency industry

The beginning of the new week is bringing quite calm moves across major virtual currencies. The cryptocurrency market saw no hectic moves over the weekend as well. It means that Bitcoin is continuing to move within the triangle pattern which could be left as soon as this week. If so, it would see the Bitcoin price rising or falling at a quicker pace, though, there is also a risk the price continue consolidating after the medium-term triangle pattern is ultimately ended. What are the pivotal levels to watch when the cryptocurrency leaves the technical pattern? Assuming that the price will break above the upper limit of the triangle the first level for bulls may be $6800 followed by $7360. In turn, a move through the lower boundary of the pattern could see the price falling to $6170 and then to $5930. However, do notice that over the recent days the Bitcoin price has narrowed its range trading signalling that it could leave the triangle without any break (neither upward nor downward).

Bitcoin is approaching the end of the triangle formation which could spark a livelier move. Source: xStation5

Today’s newsflow concerning cryptocurrencies focuses on China. First of all, the country’s oldest tech media publication, Beijing Sci-Tech Report (aka Technology Life) announced that it was starting to accept Bitcoin for the magazine’s 2019 subscriptions. The subscription cost will be 0.01 BTC (roughly 450 CNY or $65). It does not seem to be something shocking given that the firm has repeatedly written reports concerning cryptocurrencies as well as the use cases of blockchain technology. Undoubtedly it is another sign of spreading popularity of Bitcoin as a means of payment. The firm wrote in a note that its desire is to promote blockchain technology in a real-world setting for practical actions. Let’s remind that earlier this year the Chicago Sun-Times also informed it would accept Bitcoin payments albeit it undid this option later.

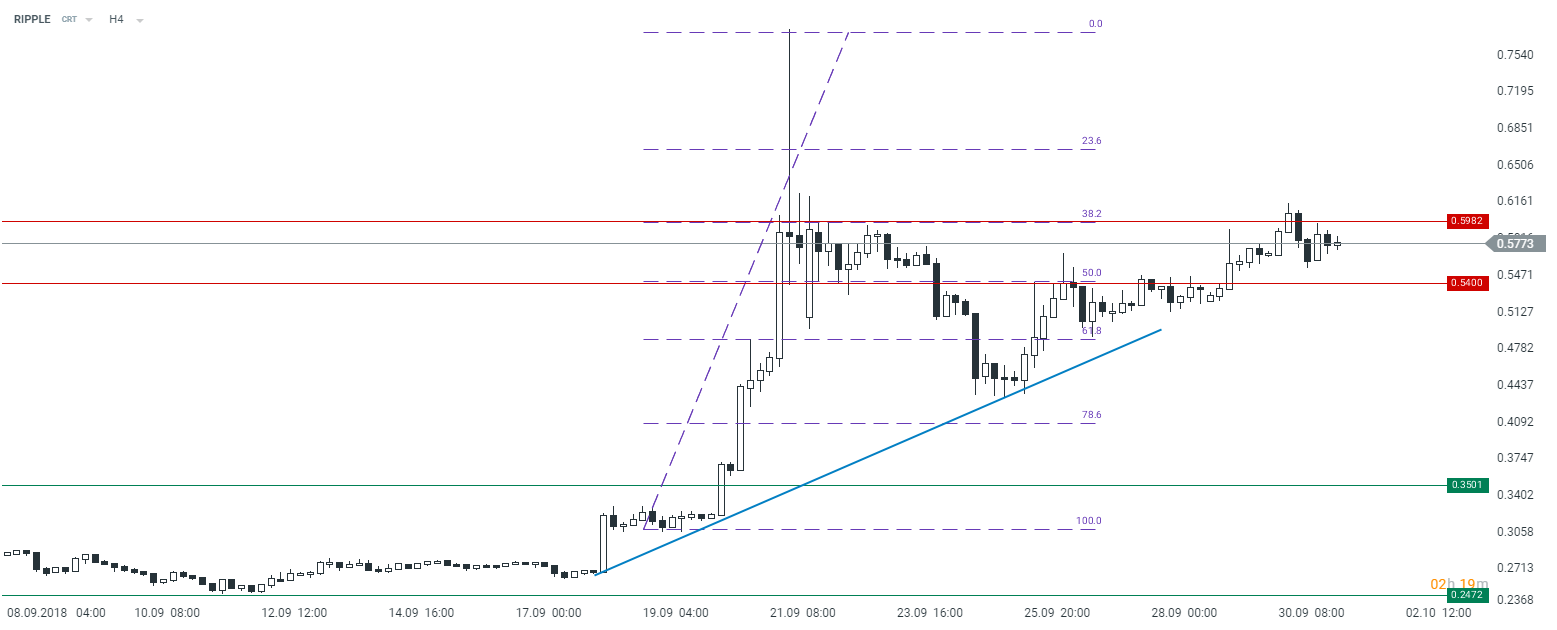

Ripple drew the bearish engulfing when it was trying to break above $0.60 and as a result one may expect that the price could struggle. Should buyers want to continue higher, they need to move through this level. Source: xStation5

Ripple drew the bearish engulfing when it was trying to break above $0.60 and as a result one may expect that the price could struggle. Should buyers want to continue higher, they need to move through this level. Source: xStation5

While the Bitcoin price has been consolidating over the recent three weeks (after a sudden drop it saw at the beginning of September), it has not convinced a Chinese Bitcoin billionaire to stay in the industry. Li Xiaoli, China’s in-house Bitcoin billionaire and blockchain investor, has unexpectedly announced lately that he intends to stop investing actively in the cryptocurrency market. He wrote a short note on Weibo, one of the most popular social media platforms in China: “From this day on, I, Li Xiaolai, will personally not invest in any projects (whether it is blockchain or early stage). So, if you see ‘Li Xiaolai’ associated with any project (I have been associated with countless projects without my knowledge, 99% is not an exaggeration), just ignore it.” Note that Li is also the founder of BitFund, a Beijing-based venture capital fund focusing on promising cryptocurrency and blockchain projects.