Today's ECB decision is strongly awaited by the markets. Not only because there will be questions about whether the ECB actually accelerated the pace of asset purchases, as it was pointed out at the previous meeting. This time investors will be looking for clues on tapering, as was the case with the Bank of Canada, which decided to reduce the volume of weekly purchases, mainly due to high inflation and better economic prospects. Has the economic outlook in the euro area improved enough to take a step towards normalizing monetary policy? Rather not, although of course even the lack of any additional measures can be considered positive by investors as well as positive for the euro, which the ECB certainly does not want at the moment.

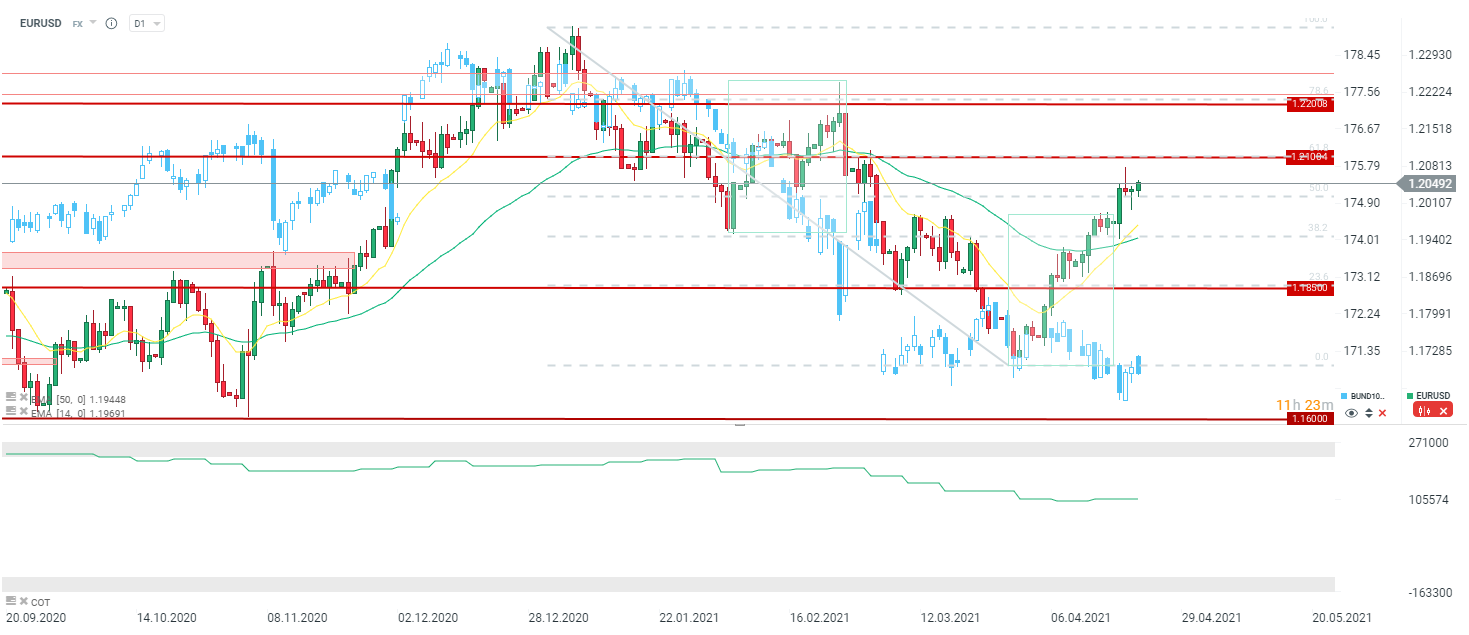

EURUSD rebounded yesterday, negating potential evening star formation. As one can see, however, after the last 3 sessions, the volatility can be quite high, especially in the case of a surprise at 12:45 or questions about the pace of asset purchases after 13:30. As one can see, bund prices are trying to rebound, although recent moves are certainly not as strong as in the case of US bonds. Source: xStation5

EURUSD rebounded yesterday, negating potential evening star formation. As one can see, however, after the last 3 sessions, the volatility can be quite high, especially in the case of a surprise at 12:45 or questions about the pace of asset purchases after 13:30. As one can see, bund prices are trying to rebound, although recent moves are certainly not as strong as in the case of US bonds. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Market Wrap: Capital Flees Europe 🇪🇺 📉