Prices reversed some of the previous week's gains—which were driven by expectations of a Chinese recovery and supply uncertainty from Russia—as the new week began. Last week, prices peaked near $70 per barrel, reaching their highest level in nearly two months, although gains were significantly curtailed by the end of Friday's session.

OPEC+ Strategy and Supply Overhang Risk

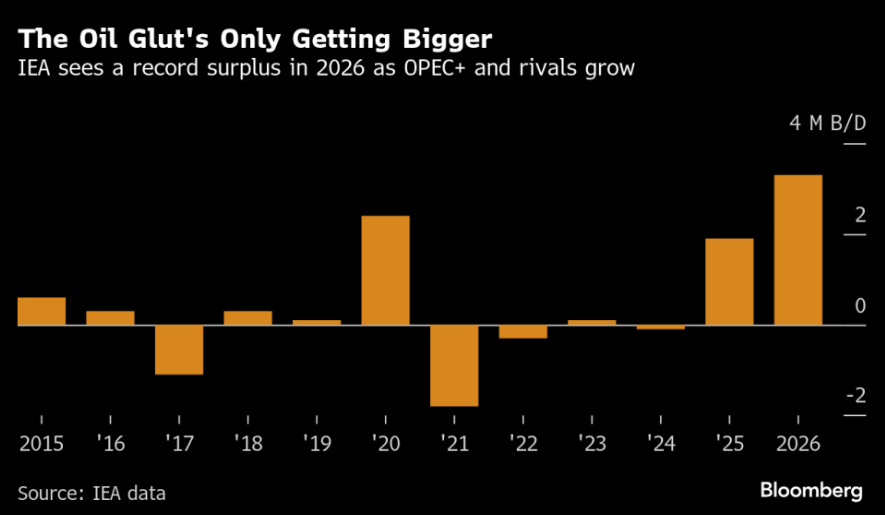

Unofficial reports over the weekend suggested that OPEC+ is considering another production increase from November, potentially exceeding the previously announced 137,000 barrels per day. Such a decision would continue the alliance's strategy to regain market share at the expense of its traditional role as a price regulator, raising concerns about a further surge in the global supply overhang. The IEA estimates that the surplus could reach as high as 3 million barrels per day next year. Under this scenario, Goldman Sachs estimates Brent and WTI could fall to the $50-$60 per barrel range.

IEA anticipates a massive supply overhang next year. Source: Bloomberg Finance LP

IEA anticipates a massive supply overhang next year. Source: Bloomberg Finance LPThis week, the statement from the Saudi Arabian Oil Minister on Wednesday will be crucial, as will the cartel's upcoming meeting scheduled for October 5. If plans to increase production limits are confirmed, a further decline in prices is possible, especially given the current period of seasonal inventory build-up.

Russian Risks Remain a Counterbalance

It is important not to overlook the persistent supply risks related to Russia. Over the weekend, Ukraine launched further attacks on Russian oil infrastructure, which could entrench domestic fuel shortages. However, reduced crude processing in Russia could also necessitate an increase in the export of crude oil itself—a negative factor for the market. Currently, up to 30% of Russia's refining capacity is offline, and storage capacity is limited. Therefore, to avoid shutting down production, Russia may be forced to increase its crude exports.

Furthermore, speculation suggests that Donald Trump has unofficially granted Ukraine permission to use US-supplied equipment for strikes deep inside Russia. This move implies potentially greater pressure on Russia. Trump is known to desire that countries like India and China cease purchasing Russian commodities.

Key Market Focus Points for Investors

-

Confirmation of the OPEC+ production increase decision at the meeting in the first week of October.

-

API and EIA data on inventory changes, which could reinforce or alleviate current supply pressure.

-

The pace of economic recovery in China and Europe as signaled by central banks.

Technical Outlook

Oil is currently testing the 50-period moving average near $64 per barrel. Should the price close today at current levels or lower, it would complete an Evening Star formation, indicating a continuation of the decline. However, if the price rebounds in the latter part of today's session, a retest of the $65-$66 per barrel range is possible. Source: xStation5

Oil is currently testing the 50-period moving average near $64 per barrel. Should the price close today at current levels or lower, it would complete an Evening Star formation, indicating a continuation of the decline. However, if the price rebounds in the latter part of today's session, a retest of the $65-$66 per barrel range is possible. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report