Zoom Video (ZM.US) stock rose sharply before the US open as the video conferencing specialists posted better than expected financial results for the fourth quarter. Additionally the company forecasts solid annual profit this year as it plans to integrate more artificial intelligence into its products.

-

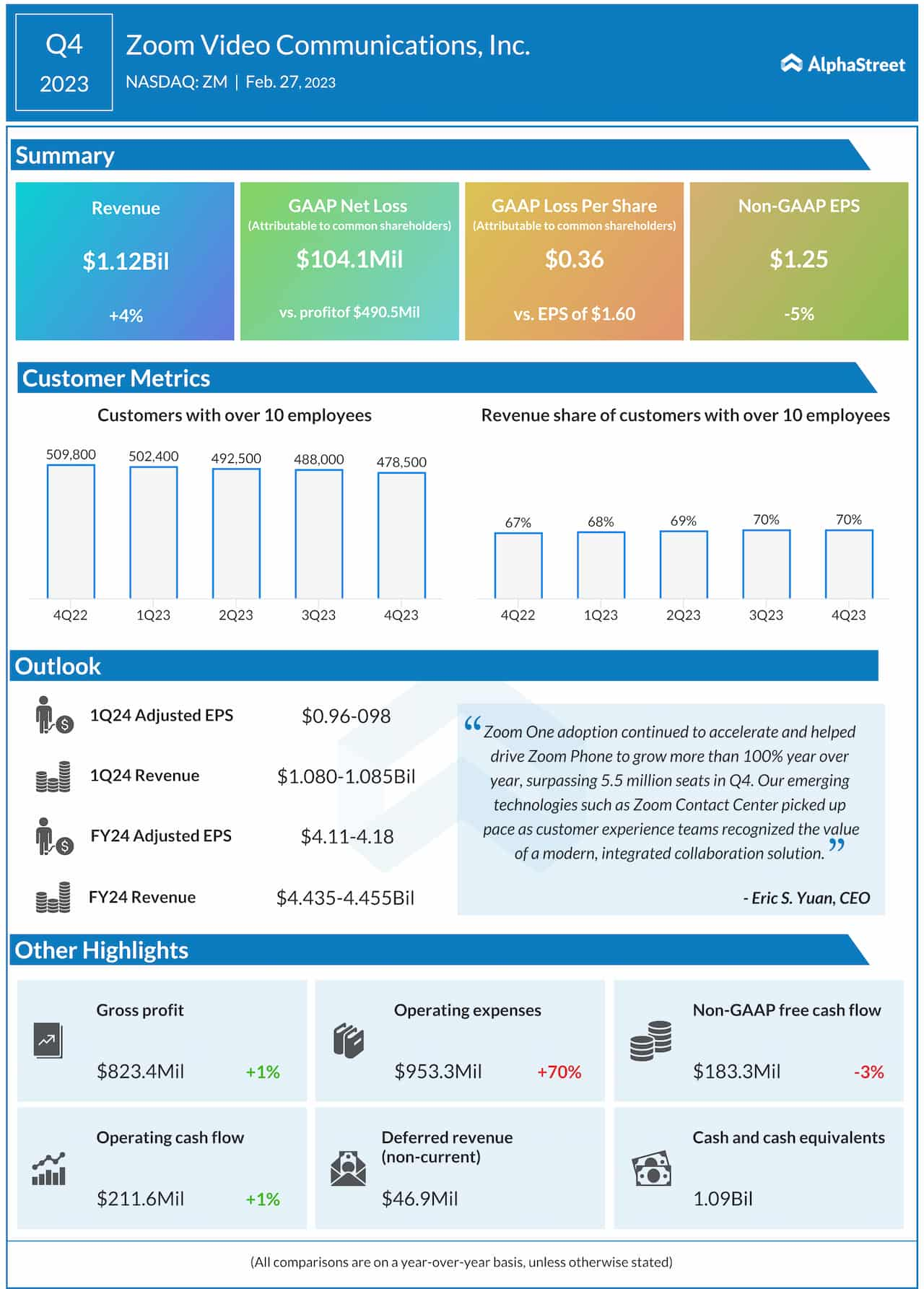

Earnings fell 5.0% YoY to $1.22 per share, adjusted, vs. 81 cents as expected by analysts, according to Refinitiv.

-

Revenue rose 4% to $1.12 billion, vs. $1.10 billion as expected by analysts, according to Refinitiv.

-

For the current quarter, the company expects revenues between $1.08 and $1.085 billion, with an estimate of between $4.435 billion and $4.455 billion for the year, and forecast earnings in the region of $4.11 to $4.18 per share.

Highlights of Zoom latest financial results. Company had nearly 213,000 Enterprise customers at the end of Q4, which represents a 12% increase YoY. Source: Alpha Street

-

“Zoom One adoption continued to accelerate and helped drive Zoom Phone to grow more than 100% year over year, surpassing 5.5 million seats in Q4. Our emerging technologies such as Zoom Contact Center picked up pace as customer experience teams recognized the value of a modern, integrated collaboration solution,” said Zoom’s CEO Eric Yuan.

-

"The age of AI and large language models has arrived, and we want to empower smarter experiences and workflows that enable our customers to benefit from these transformational tools," Yuan added.

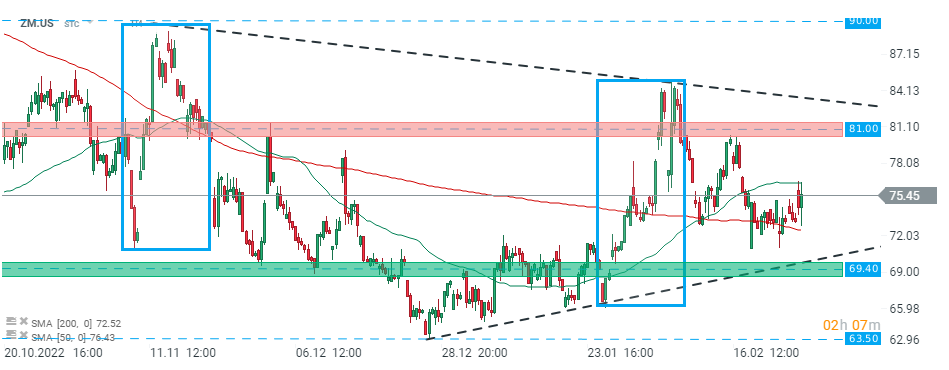

Zoom Video (ZM.US) stock rose sharply in premarket however buyers failed to uphold momentum after the start of the US session. Currently price continues to trade in between 50- and 200-hour moving averages, awaiting a catalyst for a break. Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎