Zoom (ZM.US) stock managed to erase some of the premarket losses however is still trading 5.0% lower after the video-conferencing platform cut its annual sales outlook, expecting lower profits from its declining online business.

-

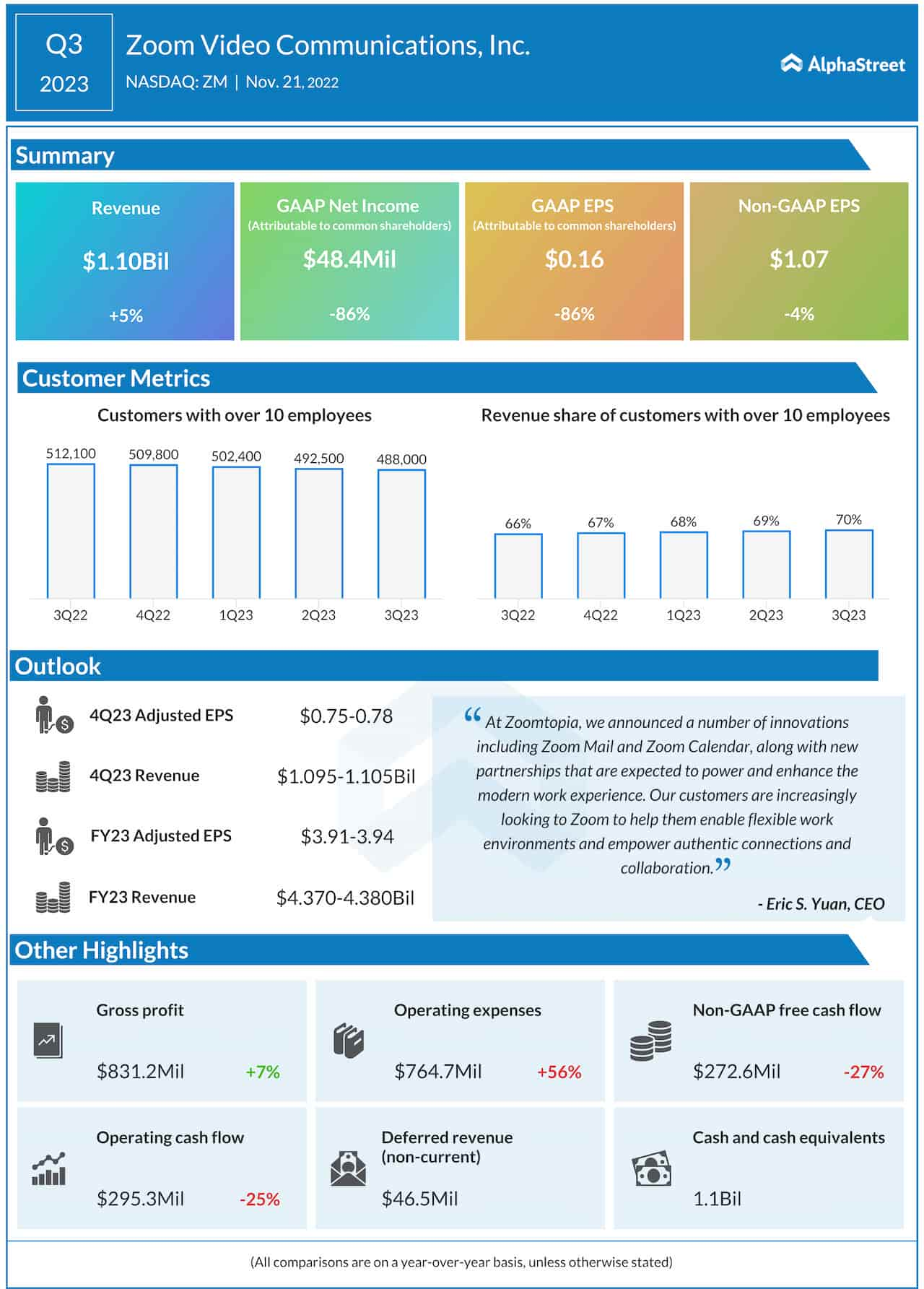

In Q3 earnings dropped 4% from a year earlier to an adjusted $1.07 per share, topping analysts estimates of $0.84 per share.

-

Revenue increased by 5% to $1.102 billion, below market estimates of $1.094 billion. Sales growth slowed for the seventh straight quarter as the company struggles to adjust to a post-COVID world.

Highlights of Zoom's earnings report. Source: alphastreet.com

-

"When the pandemic hit in (early 2020), Zoom’s super-easy-to-use solution saved the day, Zoom penetrated the video conferencing market with record speed and the company quickly ramped to a $4 billion revenue run rate," said JMP Securities analyst Patrick Walravens, who carries a 'market perform' rating on the stock.

-

"But today Zoom’s challenges include fending off competition from Microsoft Teams in the enterprise, identifying the right value proposition to stabilize its $2 billion Online business, and finding the next big growth driver to change the “commoditization” narrative and drive its second act," he added.

-

For the current quarter the company expects revenues in the region of $1.095 billion and $1.105 billion, slightly below Refinitiv projections, with a lower-than-expected tally of between $4.37 billion and $4.38 billion for the coming fiscal year.

Zoom (ZM.US) stock plunged nearly 90% from its pandemic high from October 2020, however downward move halted recently around $70.80 level, which managed to fend off bears also during today's session. As long as price sits above, upward impulse towards resistance at $82.60 may be launched. This level is marked with previous price reactions and 23.6% Fibonacci retracement of the last downward wave. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street