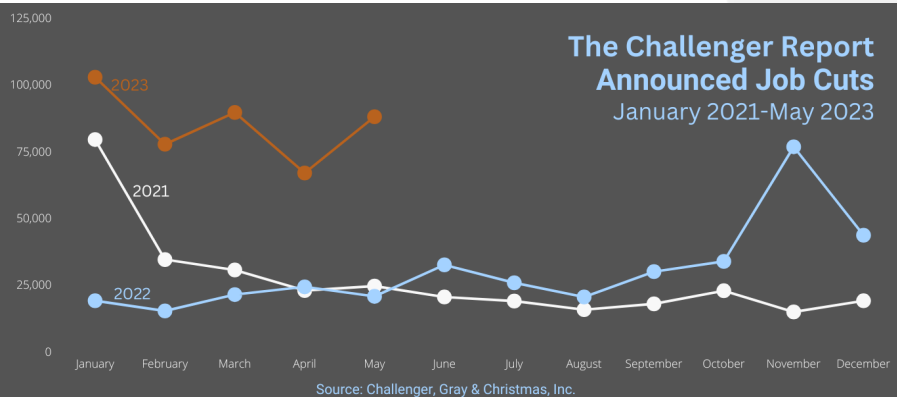

According to data compiled by Challenger, Gray & Christmas, Inc. planned layoffs in the US in May totaled 80.09 thousand, compared to 66.99 thousand recorded the month before. The increase in layoffs we have seen so far this year is particularly notable. For some context, Q1 layoffs were already the highest since 2020 and we are likely to see this trend continue into Q2. It is worth noting that on an annualized basis, it was the lowest level of hiring since 2016.

On the other hand, however, the overtone of this data seems to be negated by yesterday's JOLTS reading, which surprised sharply higher.

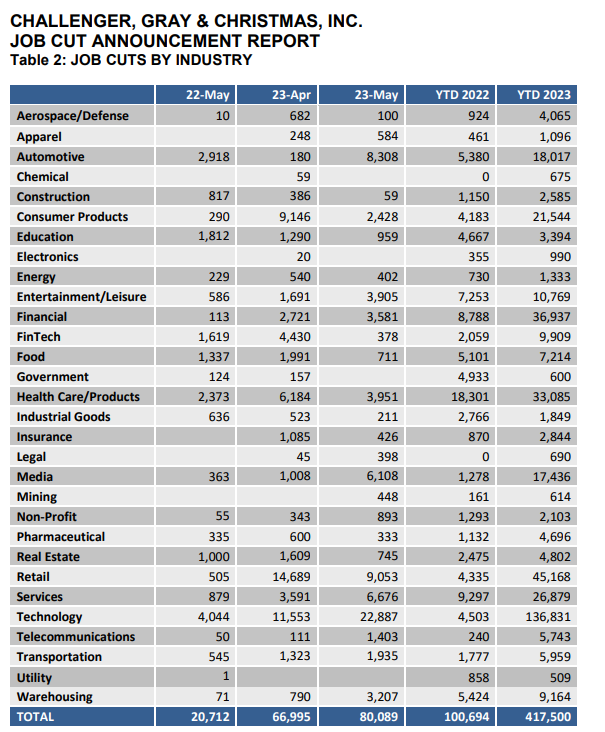

Layoffs are particularly affecting the technology, retail and automotive industries. So far in 2023, companies have announced plans to cut 417,500 jobs, an increase of 315% compared to 100,694 layoffs in the same period last year. Source: Challenger, Gray & Christmas, Inc.

Layoffs are particularly affecting the technology, retail and automotive industries. So far in 2023, companies have announced plans to cut 417,500 jobs, an increase of 315% compared to 100,694 layoffs in the same period last year. Source: Challenger, Gray & Christmas, Inc.

Detailed data by specific industry. Source: Challenger, Gray & Christmas, Inc.

A more pessimistic data reading and the reaction to the ECB Minutes drive EURUSD quotes. Source: xStation5 `

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Economic calendar: US CPI in the spotlight (13.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.