-

Coronavirus threat is still serious in the US

-

US equities continue to surge

-

Gold gradually approaching $1,800.00 level

Global financial markets are still under pressure. Almost everyday investors are “bombarded” with new coronavirus updates. The situation looks particularly disturbing in the US where new Covid-19 cases are rising in at least 36 states. Therefore stocks in Europe seem to be cautious - FTSE 100 lost 0.90% while other indices finished the session near the flatline. DAX did relatively well and added 0.64%.

Ironically, stocks in the US (where coronavirus situation is getting uglier) tend to rise. After a mixed open, all major US indices started gaining momentum. Nasdaq and Russell 2000 are adding around 1.00% right now. Some market participants can surely think about the common phrase “don’t fight the Fed” under the circumstances.

One should certainly take a good look at precious metals today. Silver spot price is rising over 2% at press time while gold is up around 0.65%. As far as gold is concerned, its price is relentlessly approaching $1,800.00 mark. Breaking above this barrier would definitely bring even more attention as these levels were not seen since 2011.

In terms of economic data, today’s calendar was really busy. Industrial production in Japan declined in May 8.4% MoM (vs expected -5.6%). On the other hand, Chinese PMIs extended some gains as indices are still above 50 pts mark. British GDP data came in slightly below expectations (-2.2% QoQ in Q1 2020) while readings from the US turned out to be mixed. Chicago PMI unexpectedly amounted to 36.6 (vs expected 45.0), but CB Consumer Confidence managed to beat market expectations.

Tomorrow one should pay attention to PMIs from major economies. Germany will release a bunch of hard data including unemployment change and retail sales report. In the afternoon investors will get to know ADP employment report from the US as well as EIA’s crude oil inventories. Traders will have a day off in Canada and Russia.

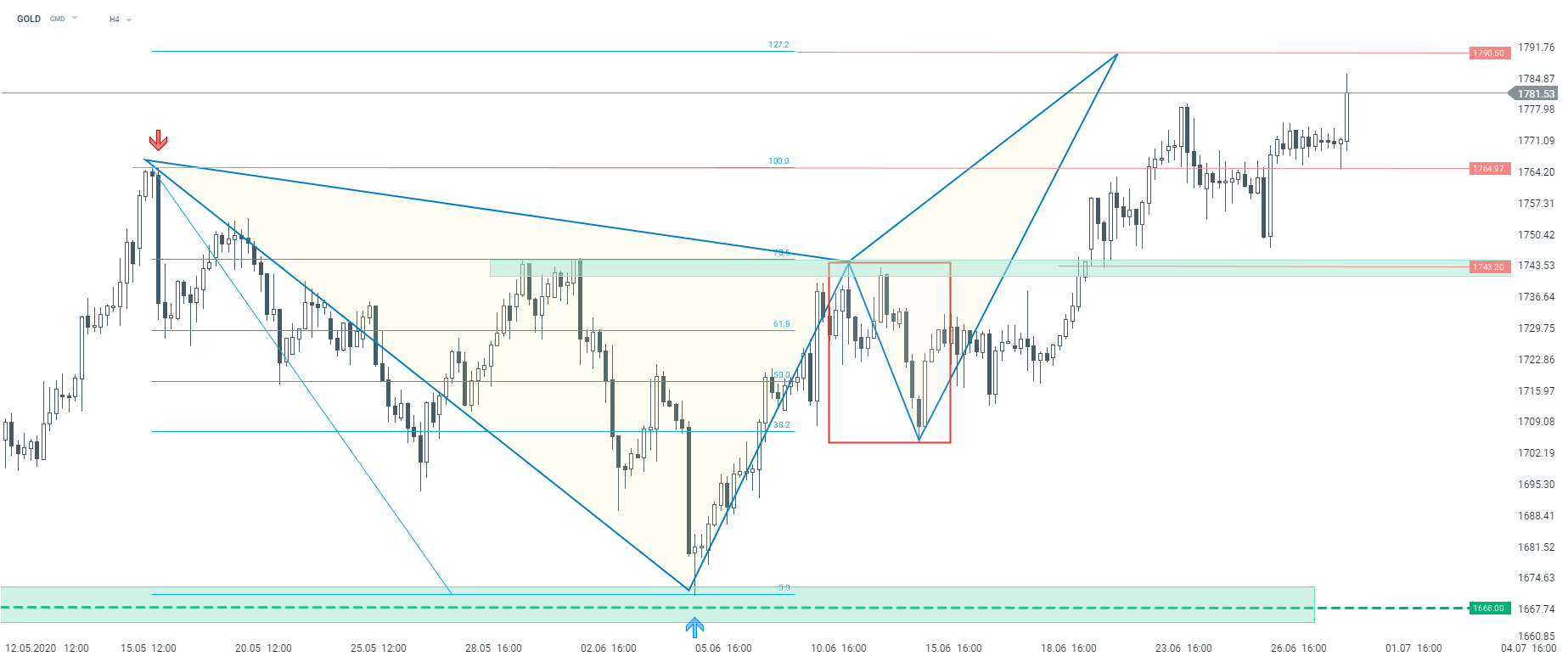

Gold price is relentlessly approaching $1,800.00 mark. Investors might expect a strong resistance there as these levels were not seen since 2011. Some market participants surely bet on the yellow metal amid the ongoing global uncertainty. $1,790.50 may be treated as a short-term resistance. Source: xStation5

Gold price is relentlessly approaching $1,800.00 mark. Investors might expect a strong resistance there as these levels were not seen since 2011. Some market participants surely bet on the yellow metal amid the ongoing global uncertainty. $1,790.50 may be treated as a short-term resistance. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.