- Pfizer(PFE.US) and BioNTech (BNTX.US) requested regulatory clearance for their vaccine in Europe

- OECD sees brighter economic outlook

- Stocks in the US Hit All-time High

Meanwhile S&P 500 and the Nasdaq hit record highs as hopes that a COVID-19 vaccine will be available soon. Investors’ attention focus on a handful of vaccine candidates as well as the start of global shipments as drugmakers submit paperwork for regulatory approvals. Dollar weakened after Fed Chair Powell pointed, during his testimony in Congress, that more fiscal action is needed and FED will expand both its bond-buying programme and ultra-cheap loans to banks. On the economic data, recent figures showed a rise in construction spending but a decrease in the manufacturing index. Yesterday US reported 157,901 new Covid-19 cases compared to 138,903 the day before. Death toll reached 1,172, compared to Sunday’s two week low of 826. Hospitalizations hit another record, with at least 96,039 people hospitalized for Covid-19.

US crude futures are trading 1.3% lower at $44.71 a barrel, while the international benchmark Brent contract fell 0.9% to $47.48. OPEC+ delayed output talks until tomorrow, as group members were unable to reach an agreement regarding crude production cuts. Investors will also keep an eye on the API report which will be published later in the day, with forecasts of 2.272 million barrels drop .

Elsewhere, gold futures rose more than 2.0% to $1,813.00/oz, after dropping almost 6% in November, its worst month in four years, while silver surged more than 5% to $23.90. EUR/USD is trading 0.95% higher at 1.2048 amid weaker dollar.

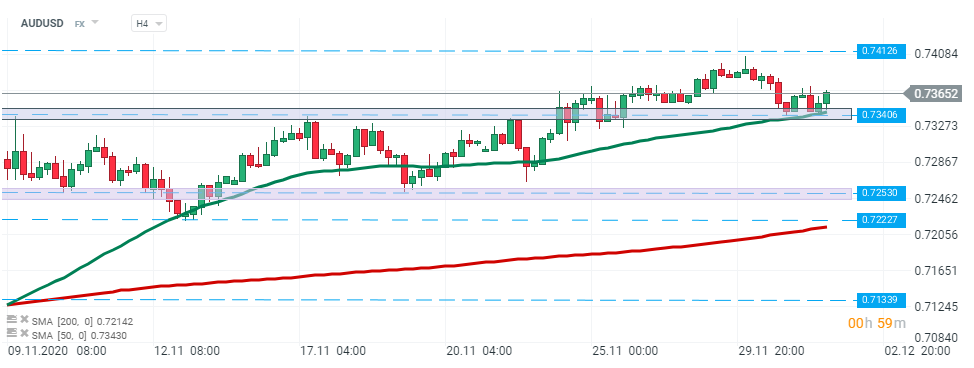

AUDUSD – pair bounced of the upper limit of the consolidation range at 0.7340 which is additionally strengthened by 50 SMA (green line). Should upbeat moods prevail, resistance at 0.7412 may come into play. Source: xStation5

AUDUSD – pair bounced of the upper limit of the consolidation range at 0.7340 which is additionally strengthened by 50 SMA (green line). Should upbeat moods prevail, resistance at 0.7412 may come into play. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.