Commodities for centuries have been one of the most popular trading assets in the world. Read this article to know how to invest in commodities.

Commodities for centuries have been one of the most popular trading assets in the world. Read this article to know how to invest in commodities.

As long as the economy has existed, commodities trading has continued and it is certain that their prices will continue to fluctuate. Depending on economic conditions, cycles, available supply, weather forecasts and investor sentiment. The trade in commodities has been going on for millennia, dating back to a time when money did not exist. Back then, entire communities used them as their main currency. Merchants had to travel thousands of kilometers to sell the goods they purchased. Trading fleets risked transport on seas full of pirates and enemy ships. Today, the commodity market looks very different but its role is invariably huge.

For example, oil prices affect transportation costs around the world, and problems with wheat supply can result in rising food prices. Commodity investing is also interesting to investors because commodities often behave inversely to stock market indices. Some investors may use commodities futures contracts and hedge or diversify their portfolios through commodity ETFs or stocks of selected companies in the commodities sector. Traders, on the other hand, most often choose commodities CFD trading. It is to this method of trading commodities that we will devote our attention. From oil and gas to precious metals, cocoa, coffee or wheat prices. Want to learn more about commodities trading? We encourage you to read the article.

Source: XTB

Types of Commodities

Commodities can be an interesting addition to an investment portfolio. When demand in the economy is still high and inflation is rising, it is commodities that can provide a kind of hedge against it. For example, gold can gain in times of market stress, uncertainty or the prospect of an economic downturn. For this reason, gold is referred to as a 'safe haven'. Industrial commodity prices rise when markets see global, economic development. As a rule, commodities can be divided into several different basic groups.

Energy commodities

Energy commodities include oil and gas. Crude oil is one of the most important commodities in the world, being the primary energy carrier. Its price is a product of the global demand for oil and the production levels of the world's largest producers. When the economy is booming, oil prices can stabilise at slightly higher levels, although the increase is usually offset by higher production. Higher volatility in the oil market often occurs when the supply-demand relationship is disrupted. Gas is used for both energy and industrial purposes. It is described by many as an intermediate energy source between fossil fuels and green energy.

Precious metals

Precious metals, such as gold, silver, platinum and palladium, have long attracted investors seeking stability and security of wealth. Gold is considered a safe haven in times of economic uncertainty. The limited amount of the commodity on Earth contributes to the persistently high price per ounce. Silver, on the other hand, has another use - industrial. Platinum and palladium, in addition to their aesthetic value, are often used in the automotive industry in the production of catalytic converters.

Agricultural commodities

Agricultural commodities include agricultural products such as grains (wheat, corn), vegetable oils, sugar, cocoa, cotton and many others. In addition to demand and supply on the world market, the prices of these commodities are often dependent on weather factors. Investors interested in trading agricultural commodities should keep track of the latest information on weather conditions, crop harvest forecasts and changes in global consumption. Limited supply can drive up prices. A good example of this is the May 2023 rally in cocoa prices - driven by falling exports from Nigeria and Côte d'Ivoire and still strong demand from importers.

Industrial commodities

Industrial commodities are a wide range of commodities used in industrial production. These include copper, aluminum, zinc, lead, nickel, iron, steel and many others. The prices of these commodities are often closely linked to the condition of the global economy and the overall demand for industrial products. In view of this, their prices often move in line with economic cycles - copper is a good example.

What influences prices?

Commodity prices are susceptible to many factors that can lead to price increases or decreases. Commodities markets are highly cyclical and understanding the cycles is key to successful commodity investing. Let's review the most important factors affecting prices.

Supply and demand

The primary factor affecting commodities is the relationship between supply and demand in the market. If the supply of commodities is limited and demand increases, prices tend to rise. In contrast, an excess of supply against demand leads to a decline in prices. A good example of this is the massive drop in crude oil prices during the crash caused by the Covid-19 pandemic. At that time, the world experienced a rapid economic collapse, which was immediately reflected in the price of oil, industrial commodities and gold. It is worth monitoring the supply and demand situation in the commodities market to identify potential investment opportunities.

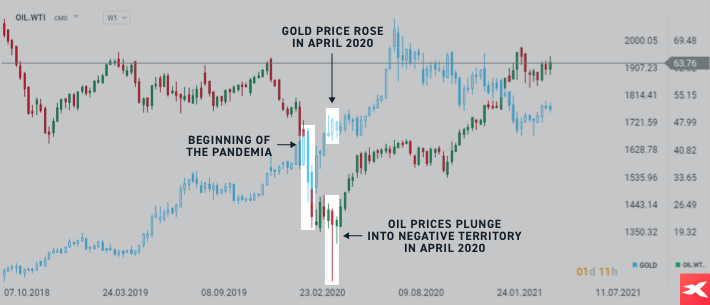

Oil demand fell sharply back in March 2020, when the pandemic started. Declines deepened in April 2020, when an oversupply of crude oil led to an unprecedented collapse in oil prices, forcing the contract futures contract price for West Texas Intermediate (WTI) to plummet from $18 a barrel to around -$37 a barrel. For comparison, gold (blue chart) also fell sharply in March 2020, along with other commodities. However it managed to regain ground in April 2020. This shows how the commodity market can be volatile at times. Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. Source: xStation5

Oil demand fell sharply back in March 2020, when the pandemic started. Declines deepened in April 2020, when an oversupply of crude oil led to an unprecedented collapse in oil prices, forcing the contract futures contract price for West Texas Intermediate (WTI) to plummet from $18 a barrel to around -$37 a barrel. For comparison, gold (blue chart) also fell sharply in March 2020, along with other commodities. However it managed to regain ground in April 2020. This shows how the commodity market can be volatile at times. Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. Source: xStation5

Weather conditions and mining costs

Natural gas and agricultural commodities in particular are susceptible to weather conditions. For example, forecasts of cold temperatures or harsh winters may support higher gas prices because the market will expect higher heating demand. Mild weather, on the other hand, may support the selling side and lower demand.

Adverse weather events, such as droughts, floods, hurricanes or hailstorms, could negatively affect crops and push up agricultural commodities. Above all, traders watching the market in the short term should regularly follow weather forecasts and monitor the situation in the agricultural market. The cost of extraction, transportation, storage and the limit of profitable production can also be important indicators for the commodity market.

Central banks policies and geopolitics

Monetary decisions at the central bank level can have a significant impact on prices. However, they usually act with a time lag. The most important central bank whose decisions affect the global economy is the US Federal Reserve.

For example, when inflation is too high, the Fed raises interest rates to lower consumer demand. Investors then assess the chances of an economic slowdown. An increase in the chances of a recession, as a rule, does not favour oil and industrial commodities. But it can be favourable for gold prices.

Changes in interest rates, central bank policies, economic stimulus packages or the introduction of new regulations. All these indirectly affect commodities. In addition, political conflicts, trade wars and other geopolitical events can also have a significant impact. The trade embargoes against Russia are a great example. Following the outbreak of war in Ukraine, Russian gas stopped flowing to Europe in 2022. The prospect of limited supply drove crude prices at the time.

Currencies power

Currency values have a direct impact on commodity prices. If the value of the currency of a country that exports commodities falls against other currencies, the commodities prices from that country may rise as they become cheaper for foreign buyers. Investors need to monitor currency exchange rates, especially the U.S. dollar (USD). Often, a strengthening dollar promotes the imposition of downward pressure on commodity prices. Currencies associated with countries relying heavily on commodity exports and extraction like the Norwegian krone (NOK) or the Australian dollar (AUD) can also be important indicators. Remember, these are just a few of the many factors affecting commodity prices.

Global economic growth

The prices of most commodities are highly dependent on the health of the global economy. When markets perceive circumstances favourable to improving global trade, commodity prices may also rise. On the other hand, the prospect of a crisis or economic slowdown puts downward pressure on them. The reason, of course, is the projected lower demand. For example, copper prices may be strongly correlated with economic cycles because of its industrial applications.

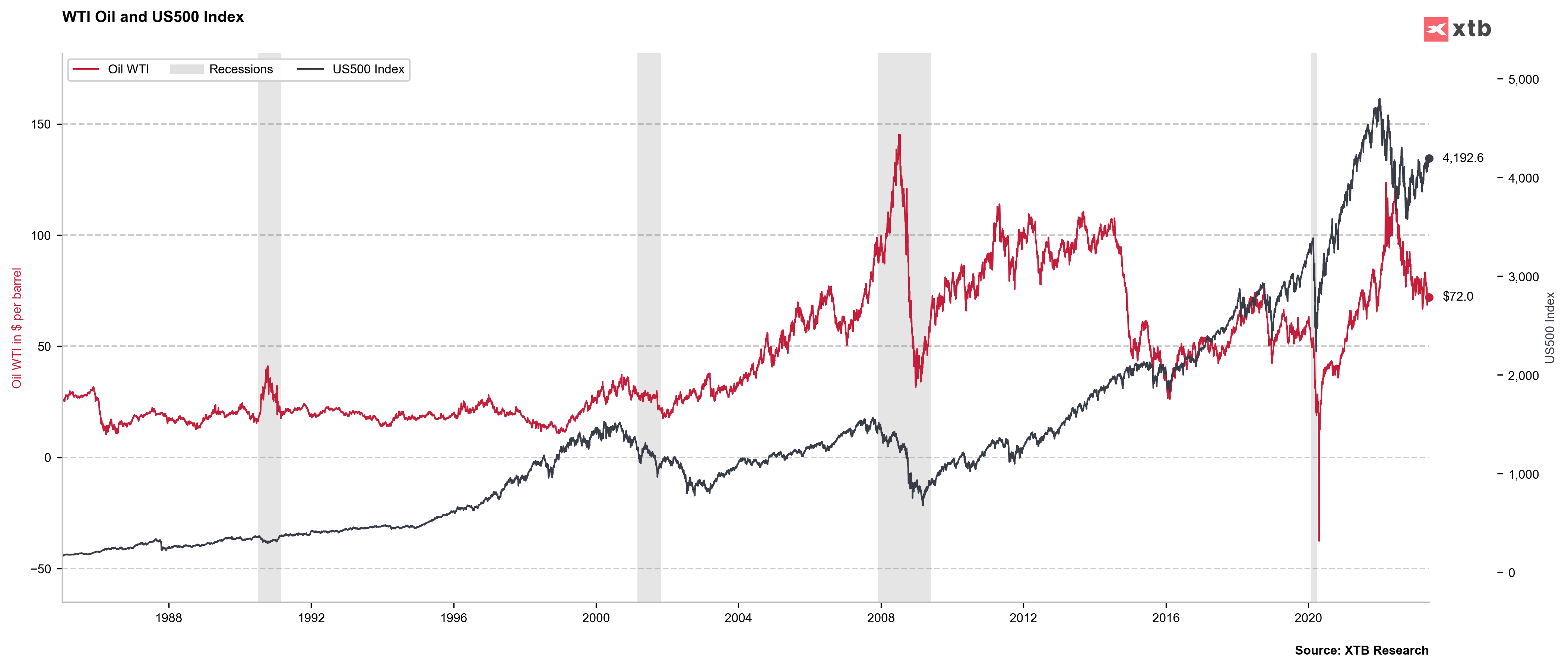

By juxtaposing the historical price movements of the S&P500 index and U.S. WTI crude oil, we can see that crude prices are significantly dependent on economic prosperity. A strong economy also favours the stock market. During recessions (gray bars), oil prices tended to fall along with stock prices. Source: XTB Research

By juxtaposing the historical price movements of the S&P500 index and U.S. WTI crude oil, we can see that crude prices are significantly dependent on economic prosperity. A strong economy also favours the stock market. During recessions (gray bars), oil prices tended to fall along with stock prices. Source: XTB Research

Commodity trading strategies

Commodities traders use a variety of strategies specific to both short-term traders and long-term investors. Consistently executing the intended strategy can help optimise performance and manage risk. It is worth remembering that each commodity trading strategy has its own unique characteristics and requires proper analysis. It is also no guarantee of investment profit. Investors should monitor current events and information related to the commodities market.

Trend swing strategy

This strategy involves identifying and taking advantage of long-term trends in the commodities market. Investors who want to move according to the trend try to identify commodities that are in ongoing upward or downward trends and make investment decisions according to them. The use of technical analysis, such as trend lines, trend indicators or characteristic price formations, can help identify trends and make appropriate decisions.

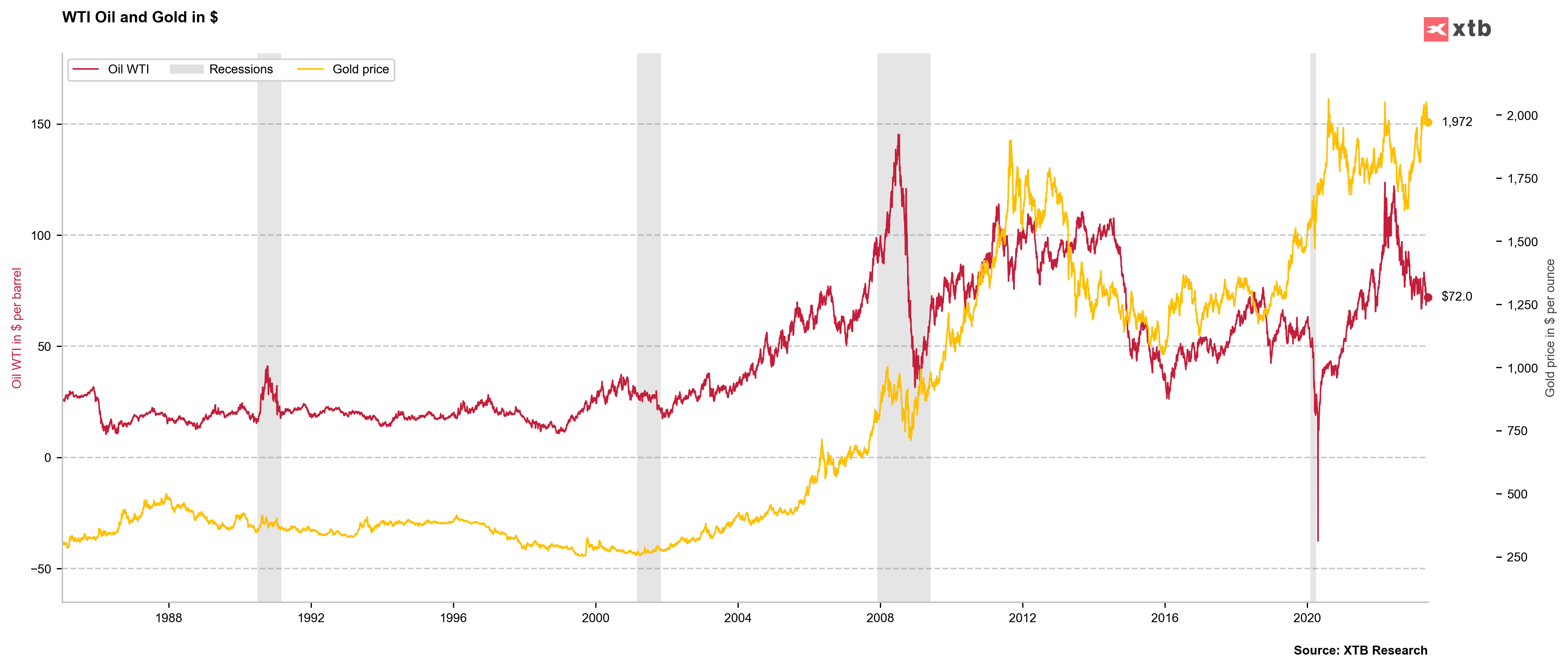

If we look at WTI oil prices and gold prices, we see that the precious metal has fared more steadily than oil during several U.S. recessions (gray bars), since 1980. Always remember that trading futures contracts is risky and any past results may not occur in the future. Source: XTB Research

If we look at WTI oil prices and gold prices, we see that the precious metal has fared more steadily than oil during several U.S. recessions (gray bars), since 1980. Always remember that trading futures contracts is risky and any past results may not occur in the future. Source: XTB Research

Contrarianism

As a rule, this means opening positions and trading commodities in counter-trend. Contrarianism characterises investors and traders who base their strategy on playing 'against the crowd'. Although it is almost impossible to predict a price bottom or peak, a risky counter-cyclical strategy can give an advantage to patient investors and aggressive traders. For example, when the entire market is talking about a recession, investors acting contrarian can buy stocks of commodity companies and open buy positions on futures contracts. On the other hand, when the market is in a phase of euphoria - contrarians can sell off the stocks they own. And use short selling - the ability to open positions on price declines. Contrarian strategy is definitely not for every commodities investor and may be extremely risky because in fact no one knows when the market will reverse the trend.

Seasonality

Commodities are often subject to seasonal price increases or decreases. Not only because of economic cycles, but also because of other factors. These can be issues related to the crop season, energy demand or the consumption period. For example, natural gas prices may rise during periods of increased energy demand. Such a period is the winter period. Declines may begin seasonally with the forecast of lower heating demand. Agricultural prices often rise before the harvest season. Investors can take advantage of these seasonal patterns by analysing historical price data and looking for recurring patterns.

Spread strategy

Spreads are differences in prices between different commodity contracts. Traders can analyse and compare the prices of different commodity contracts and make decisions based on price differences. For example, an investor may decide to buy one contract of a commodity with a lower price and simultaneously short sell a contract of another commodity with a higher price. In the expectation that the price difference between the raw materials will narrow or or increase.

Future trends

Analysing the potential for future trends in the market is extremely important for commodity investors. Understanding upcoming trends allows you to make sound investment decisions and can help you achieve long-term investment success. An important aspect of analysing future trends in the commodities market is to take into account the changing environment and adaptability. These days, economic, geopolitical and environmental volatility have a huge impact on commodity prices and supply.

By trading futures contracts investors can express their views on price prospects not only through buying transactions. But also through short selling, betting on commodities prices declines. Several key factors are worth considering when analysing future trends in the commodities market.

Technology development

Technological developments can affect the efficiency of raw material extraction, processing and utilisation. Investments in new technologies, such as robotics, artificial intelligence or the Internet of Things (IoT), can project how raw materials are used in various industries. And on the scale of their use.

Geography and geopolitics

Certain regions of the world are rich in specific raw materials, which can affect their price and availability. Also, changing international relations and trade policies can affect the raw materials market.

Ecology

Another important factor is sustainability and concern for the environment. Growing environmental awareness and increasing environmental regulations have an impact on how raw materials are extracted and selected. Companies need to incorporate these factors into their strategies and invest in greener solutions.

Upcoming trends in the raw materials market will also be shaped by changing consumer preferences. In the long term, awareness of green, ethical and socially responsible products may lead to increased demand for renewable energy or raw materials with a low carbon footprint.

Risk Management

Risk is inherent in commodity trading especially in leveraged futures contracts. The prices of commodities are fluctuating every day for a variety of reasons, such as changes in supply and demand, weather conditions, monetary policy, sentiment and many other external factors. Raw material prices can also be affected by armed conflicts or trade embargoes, which disrupt the supply and demand relationship.

A key element in commodity trading is an understanding of risk and proper capital management. Unpredictable random events have a significant impact on global financial markets. Often the most likely scenarios turn out not to be the ones that ultimately come true. Therefore, it is important to use defensive orders and stick to some basic rules.

Investment budget and position size

The first step in capital management is to establish an appropriate investment budget. The investor should determine how much money he is willing to invest in commodity trading and how much of his portfolio to allocate to these transactions. It is important that this budget is realistic and adapted to individual financial capabilities. You should not invest more than you are capable of losing. Also consciously manage the size of the positions in your portfolio.

Defensive orders

XTB understands how important open position management is for traders and investors. Not all investors and traders follow charts and information for hours, every day. Commodities can react violently to data, world news or any random events that can affect prices. Defensive orders come to the rescue, which can protect profit and limit potential losses.

Defensive orders such as stop loss, take profit or trailing stop loss not only help to apply the established strategy. They can be an important risk management tool in commodity CFD trading.

Diversification

Diversification means skillfully looking for assets that are not correlated with each other and spreading investments across different commodities and financial instruments. Its main purpose is to reduce risk and volatility in a portfolio. For example, a potential decline in copper price contracts can reduce exposure to an ETF that gives exposure to gold. Diversification also aims to reduce the risk associated with fluctuations in the value of individual commodities. If the value of one commodity falls, an investor can have other profitable investments to offset the losses. One advantage may also be the potential for outperformance when different commodities perform well, at different times.

- Investing in different commodities and markets reduces the risk associated with one particular commodity. If the price of oil falls, for example, an investor can hold other commodities that continue to generate returns.

- Diversifying a portfolio can bring new opportunities to an investor. With different investments, an investor can take advantage of the benefits of different market trends and cycles.

- Diversification can help reduce the volatility of the overall portfolio and, as a result, act as a hedge against the occurrence of Margin Calls. If one commodity loses value, other investments can offset the losses. Ultimately, proper diversification leads to a more stable portfolio.

Not everyone diversifies their portfolio arguing that diversification can significantly reduce the impact from 'winning positions'. Diversification also has specific risks and may not always produce the expected results. An investor may encounter a situation in which the majority of investments do not yield satisfactory returns.

Increased complexity of management

Having many different investments requires more attention and monitoring. The investor needs to be aware of current trends and events in different markets. This can be time-consuming and require more commitment.

Commodities CFD trading at XTB

Storing physical commodities is difficult, and most often impossible. For retail investors, it is virtually impossible. XTB clients can consider exposure to commodities in a variety of ways, including through CFDs.

Long / Short

CFDs allow investors to trade on both price declines and price increases. This makes trading commodity contracts more flexible. If an investor expects the price of a particular commodity, such as oil, to rise, he can open a BUY (long) position. The position will then make a profit when the price rises. On the other hand, if the investor expects the price to fall, he can open a SELL (short) position. In such a situation, he will record a profit when the price falls, according to his prediction. Betting on price declines is called short selling.

Commodities on XTB Platform (CFD futures trading)

- Agricultural: SUGAR, COFFEE, CORN, COCOA, SOYBEAN, SOYOIL, COTTON, WHEAT

- Energy: OIL, OIL.WTI, NATGAS, GASOLINE, LSGASOIL

- Industrial: COPPER, ALUMINIUM, ZINC, NICKEL

- Precious metals: GOLD, SILVER, PLATINUM, PALLADIUM

- Livestock: CATTLE, LEANHOGS

One of the alternatives to the 'difficult' physical exposure to the commodities market are contracts for difference (CFDs - 'contracts for difference'). When trading CFDs, the trader's performance depends on the direction of the trade (BUY, SELL) and the price difference between the opening price and the closing price of the position. Such instruments can help diversify an investment portfolio. They are characterised by:

- The ability to trade on both price increases and decreases

- Defensive orders (stop loss and take profit, as well as trailing stop loss)

- Low trading costs

- Leverage

- High volatility of position values

- High investment risk

- High liquidity

- Settled in real time (T+0)

- The investor does not become the owner of the raw material, only the contract

- No costs associated with storage of raw materials

CFD trading

When trading CFD instruments, traders do not purchase actual commodities. They are trading a derivative instrument - a contract for price difference. Trading commodities CFDs does not look quite the same as trading unleveraged stocks or ETFs. First of all, because of leverage.

Leverage allows you to open larger positions with a small percentage of their value through a so-called margin, so called 'Margin'. On the other hand, leverage is associated with high investment risk and volatility. This can lead to the automatic closing of the position through the defensive mechanism 'Stop Out' if the loss in the account grows. Before an investor decides to trade CFDs, it is very important that he or she has a good understanding of how derivatives work.

Depending on the commodity chosen, the value of 1 lot, i.e. the basic volume unit of the position, varies. Thus, for GOLD 1 lot is the price of 100 ounces, for OIL it is the price of 1000 barrels, for SILVER 5000 ounces, and so on. Traders will find information about the value of 1 lot directly in the XTB investment platform. Thanks to the minimum order of 0.01 lot, each investor is able to adjust the size of the position to his own investment opportunities.

- For example - if the leverage is 1:20, the margin is equivalent to 5% of the contract value

- Thus, to open a position with a contract value of $2,000 an investor can use only $100

- The size of the position is measured in lots

- The minimum order size is 0.01 lot (so called 'micro lot')

- Leverage increases both potential profits and losses

- Defensive orders can hedge a position and help manage risk

You can read more about CFD trading here.

Try investing in XTB and open a demo account. The XTB Platform is available on desktop, web and app versions (iOS, Android).

Other options for investing in commodities

When investing at XTB, investors have more than just CFD instruments at their disposal. XTB offers several hundred stocks and dozens of ETFs commodity funds that offer direct or indirect exposure to the commodities market.

Stocks: Exxon Mobil (XOM.US), Chevron (CVX.US), BP (BP.UK), Shell (SHELL.NL), Occidental Petroleum (OXY.US), Rio Tinto (RIO.UK), BHP Billiton (BHP.US), Vale (VALE.US), Freeport McMoran (FCX.US), Glencore, Newmont (NEM.US), Anglogold Ashanti (AU.US), Barrick Gold (GOLD.US).

ETF: iShares Physical Gold (IGLN.UK), iShares Physical Silver (ISLN.UK), Deutsche Boerse Commodities Gmbh ETC (4GLD.DE), iShares Commodity Diversified Swap (ICOM.UK), ETF WTI Crude Oil (OD7F.DE), iShares Oil & Gas Exploration & Production (IOGP.UK), iShares Stoxx 600 Oil & Gas (SXEPEX.UK), ETFS Natural Gas (NGAS.UK), SPDR S&P Oil & Gas Exploration (XOP.US), ETF Industrial Metals (AIGI.UK), ETF Dow Jones Industrial Average UCITS ETF (CIND.UK), SPDR Industrial Average Trust (DIA.US).

Some of the stocks and ETFs are at the same time also available as contracts for difference (CFDs).

PLEASE NOTE! CFDs are not suitable for investors who have a low risk appetite and wish to invest over the long term.

FAQ

There is no single commodity that is universally recognised as the best investment over others. Forecasting future prices is a complex process. Also, the element of randomness has a big impact on the market and trader behavior. For traders in the commodities market, regular, in-depth analysis of the current market situation including the likelihood of a recession or potential supply factors can be crucial. The commodities market is huge, making it almost impossible to analyse information on each of them. Some investors specialise in trading only a selected commodity. This could be oil, gas or wheat, for example. Investors are more likely to choose commodity stocks and ETFs.

To start trading in commodities at XTB, one must first open a free real account and undergo a verification process. Once it is successfully completed, the investor has the opportunity to trade CFDs and invest in commodities through stocks and ETFs.

Beginning investors should familiarise themselves not only with the opportunities but, more importantly, with the risks associated with investing in financial markets. CFD instruments are particularly risky and require familiarity with how they work. Basic information about CFD trading and financial markets, You can find on XTB educational platform: https://www.xtb.com/en/education

The biggest risk for the commodities market is a period when the economy is weakening; this can be a recession, stagflation or economic depression. At such times, prices fall, especially for energy commodities such as oil or natural gas, and industrial commodities such as copper, aluminum or zinc. In a recessionary environment, on the other hand, precious metals - primarily gold - may gain. It is worth considering, however, that the future is unknown, and although investors base their analysis on the future, certain situations will not necessarily repeat themselves. The key to prices ultimately is the relationship between supply and demand.

Traders of CFD instruments can take a so-called short position on the prices of selected commodities like oil, copper, gold, silver and many others.Then they record profits when prices fall and lose when prices rise. Remember, however, that trading CFD instruments is very risky and can lead to serious losses.

Commodities can be a good investment and bring investors returns. Stocks and ETFs can help diversify a portfolio. At the same time, analyzing the commodities market requires knowledge and awareness of the risks. Remember the seasonality and cyclicality of the commodities market and the key factors that affect prices.

Yes, of course it is possible, but always remember the investment risks. Trading is addressed to investors who are aware not only of the opportunities but also of the risks that are inherent in price forecasting. In XTB's educational platform you can find articles that will dispel a lot of your doubts and answer some of your questions e.g. https://www.xtb.com/en/education/cfd-definition

Uranium Trading - How to Invest in Uranium?

Emissions Trading - How to Invest in Carbon CO2?

Is Gold Becoming the World's New Reserve Currency? | Gold Investing

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.