In the vast landscape of the internet, few platforms have left as indelible a mark on online culture as Reddit. What began as a humble experiment in 2005, has since blossomed into a global powerhouse of discourse, entertainment, and community engagement. Reddit's journey from a simple link-sharing forum to a dynamic network of diverse communities — each with its own distinct identity and fervent following — mirrors the evolution of internet culture itself.

Considering Investing in Reddit's IPO? In this article, we delve into its history, pivotal moments, and enduring impact of Reddit, exploring how it has shaped internet culture and influenced the way we connect, share, and interact online. Reddit's recent IPO has sparked investor interest. To help you decide if it's a good fit for your portfolio, let's explore some key details about the company.

In the vast landscape of the internet, few platforms have left as indelible a mark on online culture as Reddit. What began as a humble experiment in 2005, has since blossomed into a global powerhouse of discourse, entertainment, and community engagement. Reddit's journey from a simple link-sharing forum to a dynamic network of diverse communities — each with its own distinct identity and fervent following — mirrors the evolution of internet culture itself.

Considering Investing in Reddit's IPO? In this article, we delve into its history, pivotal moments, and enduring impact of Reddit, exploring how it has shaped internet culture and influenced the way we connect, share, and interact online. Reddit's recent IPO has sparked investor interest. To help you decide if it's a good fit for your portfolio, let's explore some key details about the company.

Live Update:

26 March 2024 - Reddit soars after successful IPO

The price of Reddit, the social forum network, has doubled since it listed on the US stock market in mid-March. The stock caused a stir with investors and it had the fourth largest IPO in the US so far in 2024.

Its warm reception is a sign of demand for tech stocks more generally so far this year. Meta, the Facebook parent and the original social network, is the fourth best performer on the S&P 500 so far this year, and is higher by 43%. Investor appetite for Meta this year is helping to drive demand for Reddit shares.

Chart: Reddit price doubles with a market share of $68.50

Source: xStation5

Reddit is also riding the wave of interest in artificial intelligence. It is selling its user data for AI training, and executives at the company say that this could generate $200mn in the coming years from Google and other tech giants that are using Reddit to train their large language models.

Added to this, Open AI’s chief executive Sam Altman is one of Reddit’s biggest shareholders, which has also aroused investor interest as they wonder what this relationship could hold for the future.

But, after a stunning debut, the road could be bumpy for Reddit. It will need to deliver its earnings reports in the coming quarters, and there is extra regulatory scrutiny that comes with being listed on a stock exchange.

Even Reddit’s tie-up with Google to train AI models is attracting attention from the US antitrust regulator, the FTC. The plan to licence user-generated content for AI models has drawn questions from the regulators as they probe privacy risks, copyright infringement and other questions of fairness that could arise from this deal.

We have seen other tech giants humbled by regulators, think of the recent decline in Apple’s share price after it was fined EUR 1.8bn by EU authorities for unfair practices in its streaming business. Also, Google, Apple and Meta are under investigation in the US and the EU for digital marketing violations. Thus, Reddit could find that life under regulatory scrutiny can cause share price volatility.

However, the warm reception to Reddit’s IPO is also a sign that demand for new tech stocks is strong, and it may unleash a wave of further tech IPOs, after a quiet couple of years. Reddit had to wait patiently before it listed on the stock market, but that patience seems to have paid off.

What is Reddit?

Although you may have heard of Reddit, are you actually aware of what the platform entails? Reddit describes itself as a global digital city. It is essentially a social media platform and online community where users can share news, content, and engage in discussions on various topics. It operates on a system of user-generated content, where registered members can submit text posts, links, images, and videos to themed communities known as "subreddits." These subreddits function like forums where Redditors can discuss their shared interests. There are subreddits for everything from sports and news to niche hobbies and local communities.

Reddit's voting system is what makes it unique. Users can upvote content they find interesting or downvote content they disagree with. This system determines what content reaches the top of subreddits and the overall Reddit front page. It also allows users to comment on posts, fostering discussions and interactions among its user base. Additionally, the platform offers features such as messaging, private messaging, and the ability to create custom feeds based on specific interests.

When is Reddit’s IPO date?

Reddit is scheduled to launch its IPO on the New York Stock Exchange on Thursday, March 21, with the ticker symbol RDDT. The initial share price is anticipated to fall within the range of $31 to $34.

The company is targeting a valuation of approximately $6.4 billion, which is notably lower than the $10 billion valuation it had assigned itself during a private funding round in 2021.

Reddit intends to offer 22 million shares during its initial public offering, out of a total of 160 million outstanding shares, excluding stock units and stock options.

One interesting aspect of the IPO is that Reddit has not yet turned a profit, reporting losses of up to $90 million in 2023 meaning that investors will likely be considering Reddit's engaged user base alongside its financial performance when making investment decisions.

How to buy into Reddit’s IPO?

Reddit has not been listed on the stock market yet, however, you will be able to trade it the same way as any other stock on the market once it goes live.

If you have thoroughly researched and understand the company and its prospects and are interested in purchasing shares in the Reddit IPO, here is what you should do:

- Open a brokerage account. You will need a brokerage account to buy shares in the Reddit IPO. At XTB we request clients to fill out an online application form either through the website or the mobile app.Upon successful completion of the application and your KYC documents your trading account will be established.

Your capital is at risk. The value of your investments may go up or down.

- Fund your brokerage account. You will need to fund your brokerage account with enough money to buy the number of shares of Reddit you want.

- Set a stop loss order. A Stop-Loss Order is a type of closing order, allowing the trader to specify a specific level in the market where if prices were to hit, the trade would be closed out by our systems automatically, typically for a loss.

- Open a demo-account. If you aren’t ready to trade yet why don’t you start your trading journey by creating a demo account? XTB offers a demo account for 30 days where you can trade with fake money and explore your trading skills and platform.

The price of the shares in the IPO is anticipated to fall within the range of $31 to $34. You can use your limit order to ensure that you do not pay more than you are willing to pay for shares in the company.

It is important to remember that investing in IPOs is a risky proposition. The price of shares in an IPO can be volatile, and there is no guarantee that you will make money. You should only invest in an IPO if you are comfortable with the risk involved. Don’t invest more than you can afford to lose.

How does Reddit make money?

Reddit primarily generates revenue through advertising, premium memberships, and awards also known as Reddit Coins. Here's a breakdown of how the platform makes money.

Starting off strongly, Reddit offers various advertising options for businesses to promote their products or services on the platform. This is their main source of income, accounting for roughly 90% of their total revenue.These include sponsored posts, display ads,video ads, and promoted trends. Advertisers can target specific subreddits or demographics to reach their desired audience.

Reddit also offers a premium membership program called Reddit Premium (formerly known as Reddit Gold). Subscribers pay a monthly fee for features such as ad-free browsing, access to a premium-only subreddit, and a monthly allowance of Reddit Coins. While it contributes a smaller portion, around 10% of their revenue, Reddit Premium offers a recurring income stream and caters to users who prefer an ad-free experience.

Users have the ability to purchase Reddit Coins, a virtual currency used to award other users' posts or comments. These awards serve as a form of recognition or appreciation and come with various benefits, such as highlighting the awarded content and providing the recipient with Reddit Premium membership for a limited time. Reddit takes a portion of the revenue generated from the sale of Reddit Coins.

It has explored other revenue-generating initiatives, such as partnerships with third-party companies, sponsored content collaborations, and merchandise sales. Additionally, Reddit has introduced features like "Powerups," which offer enhanced features and customisation options for certain communities, potentially serving as an additional revenue stream.

Can Reddit expand its revenue streams?

Reddit is looking to expand its revenue streams beyond traditional advertising. They believe their massive collection of real-world conversations holds immense value for training AI models and other applications.

In their own words, Reddit considers their data a "goldmine" for tasks like search engine development, AI training, and research. They even see it as a crucial element for building large language models like ChatGPT.

This focus on data licensing isn't surprising considering Reddit's board includes Sam Altman, CEO of OpenAI (a leading AI research company). This connection suggests a natural fit for OpenAI to utilise Reddit's data for training its models

While the exact pricing for Reddit's data is unknown, they recently secured data licensing deals worth over $200 million, with an expected revenue of at least $66 million this year. As the AI market continues to grow, the value of Reddit's ever-expanding content pool is likely to increase as well.

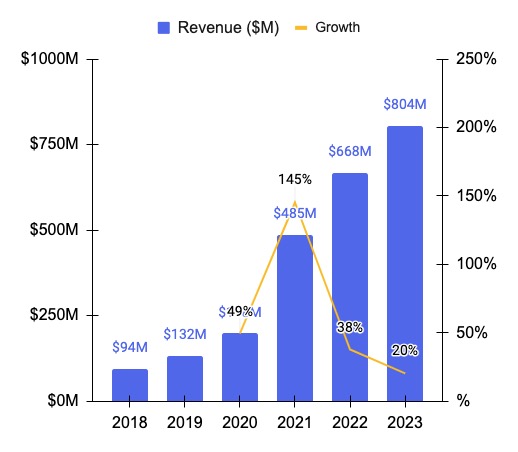

Source: Sacra

Source: Sacra

According to Sacra, Reddit's revenue jumped to $804 million in 2023, a significant 20% increase from $668 million in 2022. As we mentioned above, this growth is primarily driven by two factors:

- Large advertisers are increasingly recognising Reddit's value, with spending rising by 31% in 2022. Notably, this positive trend continued even as overall advertising spending dipped in the latter half of the year.

- The company's subscription service, offering ad-free browsing and other perks for $6 per month, has also seen steady growth.

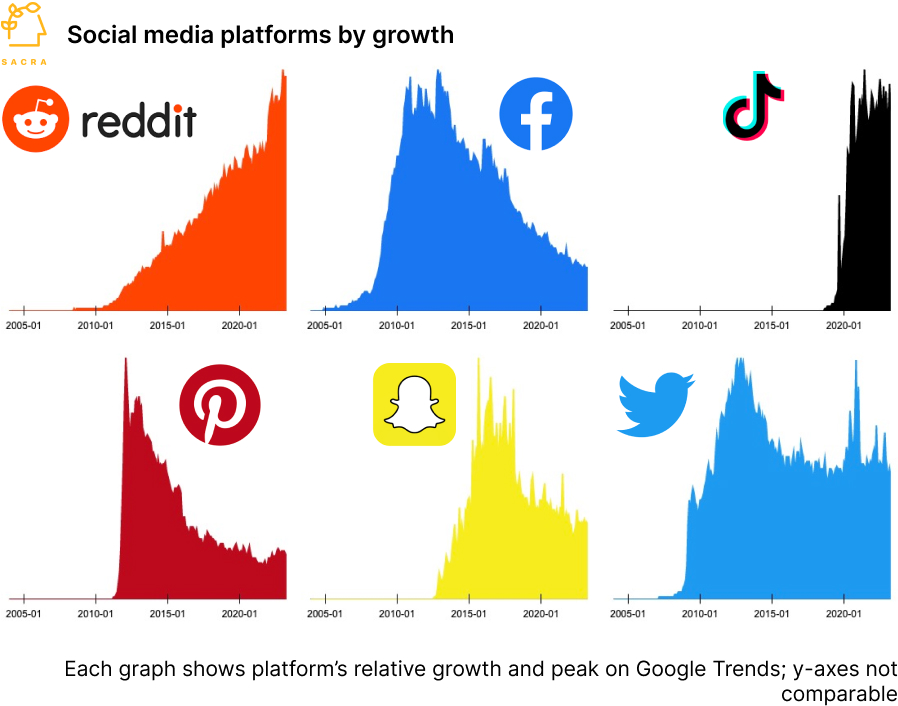

Source: Sacra

Source: Sacra

As seen above, in the world of social media advertising, Reddit saw impressive growth in 2022. Their ad revenue surged past established platforms like Meta (Facebook, Instagram) which grew 22%, Snap (Snapchat) at 16%, and Pinterest at 7%. Notably, Twitter even saw a decline of 13% in ad spending. Only the newcomer, TikTok, surpassed Reddit's ad revenue growth with a staggering 89% increase.

While Reddit boasts a growing user base, there's room for even more revenue potential. Their average revenue per user (ARPU) has been steadily climbing, reaching $1.19, which is a significant improvement from $0.81 in 2021. However, it's important to note that this number still lags behind competitors. For instance, Twitter generates roughly $10 per user, and Facebook and Instagram pull in a much higher $45 and $35 per user, respectively. This suggests Reddit has an opportunity to further monetise its engaged user base.

Reddit’s History?

Reddit was founded in June 2005, by University of Virginia roommates Steve Huffman, Alexis Ohanian, and Aaron Swartz though credited primarily to Huffman and Ohanian. The idea stemmed from their desire to create an online community where users could share links and discuss topics of interest.

In October 2006, the company was acquired by Condé Nast Publications, a major media company, for a reported $10-20 million. This acquisition provided Reddit with resources for growth and expansion. During this period, Reddit experienced significant growth in its user base and community engagement. The platform became known for its diverse range of communities (subreddits) covering various topics and interests.

In September 2011, the company was spun off from Condé Nast as an independent entity. This move allowed Reddit to operate more autonomously and pursue its own strategic direction. Reddit underwent a significant shift towards user-generated content, with original posts and discussions becoming more prominent than shared links. This change contributed to Reddit's identity as a social news platform.

Reddit Gold, a premium membership program offering enhanced features, was introduced in 2010. In 2018, Reddit Premium replaced Reddit Gold, offering similar benefits along with ad-free browsing. Throughout its history, Reddit has faced challenges related to community management, moderation, and content moderation. Controversial subreddits, such as those promoting hate speech or illegal activities, have sparked debates about free speech versus community guidelines. The company implemented various policies and tools to address these issues while striving to maintain free speech principles.

That’s why the platform popularised the "Ask Me Anything" (AMA) format, where individuals, including celebrities, politicians, and experts, answer questions from the community. AMAs have become a significant cultural phenomenon, attracting widespread attention and participation.

Over the years, there have been changes in Reddit's leadership and ownership. Notably, co-founder Alexis Ohanian stepped down from his position on the board in 2020, urging the company to fill his seat with a Black candidate to address racial inequality.

In recent years, Reddit has focused on enhancing its platform's features, improving content moderation, and expanding its advertising and revenue-generating strategies. The platform continues to evolve, with updates, redesigns, and new features being introduced regularly. It is rereported that today, more than 50 million people use Reddit every day.

Final Thoughts

Overall, Reddit's history reflects its evolution from a small startup to one of the largest and most influential online communities in the world. Its impact on internet culture, news dissemination, and social interaction is undeniable, shaping the way millions of users engage with content and each other online.

FAQ

Reddit is scheduled to launch its IPO on the New York Stock Exchange on Thursday, March 21, with the ticker symbol RDDT. The initial share price is anticipated to fall within the range of $31 to $34.

There are a few potential reasons:

- Raising Capital: Going public allows Reddit to raise additional funds for future endeavours like expanding its infrastructure or acquiring new companies.

- Liquidity for Investors and Employees: An IPO provides liquidity for current investors and employees who hold shares in the company.

- Transparency: Public companies have stricter disclosure requirements, which can increase transparency and trust with users.

Like any IPO, there are inherent risks involved:

- Volatility: Newly public companies often experience significant stock price fluctuations.

- Growth Sustainability: Investors need to evaluate whether Reddit's user base and revenue streams can maintain their growth trajectory.

- Market Sentiment: Public perception and online discussions, especially those on communities like WallStreetBets, can significantly impact the stock price.

This remains to be seen. Ideally, Reddit can balance the need for growth with maintaining the unique community-driven atmosphere that makes it so popular.

What’s Next for Global Stock Markets?

What is Next for the AI Trade?

Investing during a crisis: Strategies and Tips

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.