In the early hours of June 13 the long-simmering tension between Israel and Iran escalated dramatically, triggering not only a military standoff but also a wave of volatility across global financial markets.

In the early hours of June 13 the long-simmering tension between Israel and Iran escalated dramatically, triggering not only a military standoff but also a wave of volatility across global financial markets.

Live market update:

20th June 2025: Technical signals are supportive of the oil price

- Threat of US attack on Iran to keep oil prices elevated

- Strait of Hormuz attack key risk for the oil price

- Oil majors: can BP play catch up?

Oil prices are higher by 12% so far this week and is outperforming stocks, gold and Bitcoin. The market is flooding into oil, as tensions rise in the Middle East. Zooming out, the oil price extended gains on Thursday, and Brent crude is now up 4% YTD, after underperforming for most of 2025.

Technical signals are supportive of the oil price

This could be a turning point for the oil price. The recent rally has sliced through the 200-day moving average, which is a medium-term bullish signal for the commodity. The recent range for Brent crude has been $70-$77 per barrel. The Brent price broke above the top of this range on Thursday as the market remains on alert for a potential US airstrike on Iran.

Threat of US attack on Iran to keep oil prices elevated

There is a growing geopolitical premium on the oil price right now, although the White House is keeping its cards close to its chest and providing no information about what US plans for Iran could be. Reports suggest that President Trump is still hoping for a diplomatic outcome to this conflict, which is why he has not given his final authority to a strike. However, as time passes without a non-violent solution, an air strike becomes more likely. This means that upside pressure on oil may not let up in the current environment.

Strait of Hormuz attack key risk for the oil price

In the short term, the risks are to the upside for oil. Some analysts argue that the geopolitical premium on the oil price is about $10, which could push the price of Brent crude to $80 per barrel. However, the market still expects the oil price to moderate, as long as the oil supply is not disrupted, and the Strait for Hormuz is not targeted in any attack. This is vital for the oil price, since around 20 million barrels of crude are estimated to flow through the waterway each day.

The CEO of Shell, the oil giant, has said that a blockade of the Strait of Hormuz would have a huge impact on the global energy market, but he also said that the company has some contingencies in place in case this happens, which could cushion some of the blow.

The situation is very volatile and fluid, and we expect traders to remain nervous as we wait to see what comes next in this conflict. However, the oil price may not surge to the highs from 2022, when Russia invaded Ukraine, because there is plenty of slack in the oil market right now, so the oil price has some capacity to absorb a supply shock. There is expected to be a significant oil supply surplus by 2030, to the tune of 8 million barrels per day, according to the IEA.

Chart 1: The Brent crude oil price has surged on the back of the Middle East conflict

Past performance is not a reliable indicator of future results. Source: XTB and Bloomberg.

Oil majors: can BP play catch up?

The upside for the oil price is also having a big impact on energy companies. However, in the last month, UK oil majors have outperformed their US counterparts like Exxon and Chevron. This is to be expected, since the US is less likely to be impacted by any disruption to oil supply in the Middle East. Instead, supply disruption for Shell and BP could have a positive impact on their bottom lines in the coming weeks. It may also give BP’s share price time to catch up with its global peers, as you can see in the chart below.

Chart 2: Global oil majors, normalized to show how they move together YTD.

Past performance is not a reliable indicator of future results. Source: XTB and Bloomberg.

17th June 2025: Geopolitical tensions weigh on sentiment as oil rises

Oil prices continue to climb, approaching $74.50 per barrel, while gold has seen only modest gains.

Investor nerves were rattled after U.S. President Donald Trump abruptly left the G7 summit to monitor Middle East developments from the White House. Conflicting reports over a possible ceasefire further unsettled markets, suggesting potential for escalation.

Oil Gains May Be Limited

Brent crude has risen by $6 since the Iran-Israel conflict began last week, a relatively muted response given the stakes. So far, oil exports remain unaffected, and the Strait of Hormuz through which 20% of global supply flows remains open. Rising inventories and stable Iranian output have helped cap prices near the $75 level.

Additionally, robust U.S. supply and OPEC+ production increases are tempering upward pressure. However, a major escalation or regime shift in Iran could trigger a sharper spike in prices.

UK Market Highlights

Despite broader declines, the UK’s FTSE 100 is outperforming its European counterparts, supported by gains in energy stocks such as BP and Shell, both up over 1%. The FTSE 250 is also showing resilience. In contrast, the British pound is underperforming and remains the weakest G10 currency on the day, despite positive sentiment from a recent trade deal. UK bond yields are rising in step with European counterparts.

Fed in Focus

Looking ahead, markets are eyeing Wednesday’s (18.06.2025) Federal Reserve meeting. While no rate cut is expected, investors will scrutinise the updated Dot Plot for clues on the Fed’s outlook. March’s median projection put 2025 rates at 3.88%, close to current market pricing at 3.84%. Unless the Fed signals a significant shift, major moves in stocks, bonds, or the dollar are unlikely.

Rising oil prices could reinforce the Fed’s cautious stance, underscoring its data-dependent approach and reducing the likelihood of imminent rate cuts.

A conflict years in the making

The roots of this latest conflict stretch back years if not decades to the deep ideological and geopolitical rivalry between Iran and Israel. But what began as a regional cold war, marked by cyber sabotage and covert operations, has now spilled into a more direct confrontation.

Israel's recent airstrikes reportedly targeted Iranian nuclear facilities and key military infrastructure, including a major base of the Islamic Revolutionary Guard Corps (IRGC) and nuclear research sites believed to be linked to weaponisation efforts. Among the casualties was a high-ranking IRGC commander, according to Israeli intelligence leaks.

In a strategic escalation, Israel also struck the South Pars gas field, a critical energy hub jointly operated by Iran and Qatar. Additional reports suggest that fuel depots across Iran were also targeted in the operation, further hampering the country's energy infrastructure and logistical capacity.

Perhaps most notably, Israel is now believed to have gained control over the airspace in western Iran, following the destruction of several key air defense installations. According to Associated Press sources, this has opened a corridor for potential airstrikes on high-value targets near Tehran with relatively low resistance.

Iran's response came swiftly. Within hours, the country launched a barrage of drones and missiles targeting Israeli cities and military assets. Air raid sirens blared in Tel Aviv and Haifa, and Israel's Iron Dome air defense system intercepted many but not all of the incoming threats.

This tit-for-tat exchange marks the most direct military engagement between the two nations in recent history and has raised fears of a broader regional conflict that could draw in the U.S., Saudi Arabia, and Hezbollah in Lebanon.

While the United States did not take part directly in the airstrikes, it played a critical supportive role in regional defense. U.S. forces intercepted a number of Iranian missiles aimed at Israeli and allied positions, demonstrating coordination in the broader air defense effort.

The Biden administration has publicly urged both sides to de-escalate and issued a stern warning to Iran against launching any retaliatory strikes on American bases or personnel in the region. President Trump, meanwhile, is applying pressure on Iran to return to nuclear negotiations and accept restrictions on its nuclear program. According to diplomatic sources, Trump also privately cautioned Israeli leadership against any moves to target Iran’s Supreme Leader directly, an act that could cross a dangerous threshold.

Planned U.S.-Iran nuclear talks scheduled for the weekend in Oman were canceled after Tehran declared them “pointless” in light of the Israeli offensive. The collapse of this diplomatic track underscores the heightened volatility of the moment.

Russia has offered to mediate and assist in de-escalation efforts. Countries including the United Kingdom, Saudi Arabia, and Egypt have also called for restraint, warning that further escalation could plunge the entire region into broader conflict.

How did the markets react? Shockwaves and volatility

The financial markets were quick to react. Oil prices surged on fears that the conflict could threaten shipping through the Strait of Hormuz, a key chokepoint through which 20% of the world’s oil flows. Brent crude climbed by as much as 13% in intraday trading, briefly touching $78 per barrel before stabilizing around $75.

Where could oil prices go from here?

Oil prices may still have room to climb if the conflict between Israel and Iran escalates further. A broader regional war, particularly one that draws in additional players beyond the two nations could significantly disrupt global energy markets. The most severe risk lies in a potential attack on critical oil infrastructure or export routes. If Iran seeks to retaliate by targeting the Strait of Hormuz, a vital chokepoint through which nearly 20% of the world’s oil flows, the implications for supply and pricing could be dramatic.

From a geopolitical standpoint, much hinges on how the United States responds. President Trump has indicated that the U.S. may take direct action against Iran, and the United Kingdom has already pledged to deploy fighter jets to the region. Meanwhile, the European Union is set to convene an emergency meeting on Tuesday to discuss the unfolding crisis. This week’s G7 summit is also expected to focus heavily on the situation, with energy security likely to top the agenda.

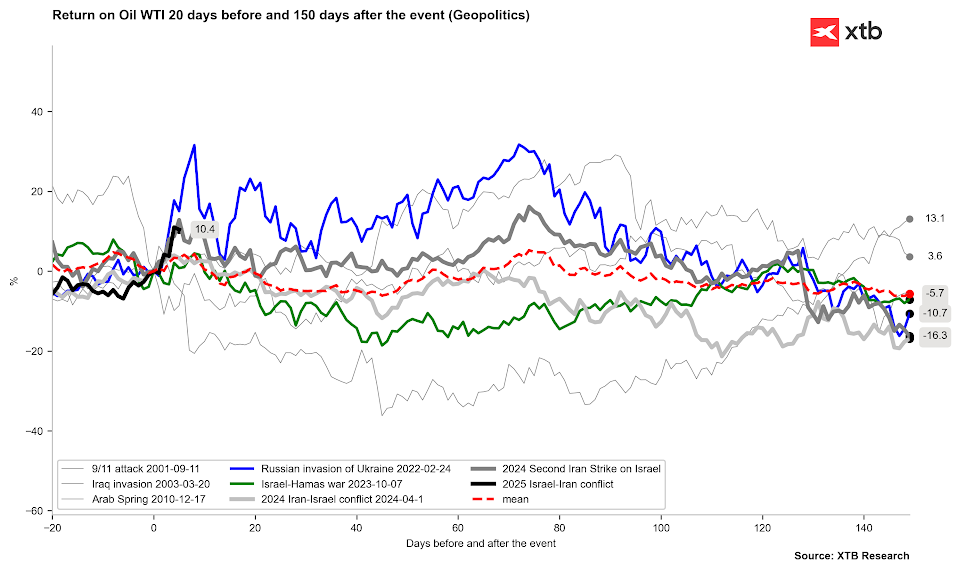

The behaviour of oil prices aligns with previous geopolitical events related to the oil market. In the past, the initial wave of increases typically subsided after 5 -10 days. Past performance is not a reliable indicator of future results.

Source: Bloomberg Finance LP, XTB

Equity markets were not immune. The S&P 500 fell 1% on the news, while the Dow Jones Industrial Average dropped nearly 1.8%. European and Asian markets followed suit, reflecting global investor anxiety. However, by June 16, signs of stabilisation emerged. U.S. futures pointed to a modest recovery as markets began to price in the likelihood of a contained conflict rather than a full-blown regional war.

Safe-haven assets rallied in the immediate aftermath. Gold rose by more than 1.5% as investors sought shelter, while the U.S. dollar gained strength against major currencies. Treasury yields, which move inversely to bond prices, initially dipped as money flowed into government debt but later rebounded amid shifting inflation expectations.

The broader economic implications

While the initial market reaction was sharp, analysts are closely watching for longer-term consequences. Chief among them is the potential impact on inflation. Rising oil prices feed directly into higher transportation and energy costs, which could delay expected interest rate cuts from major central banks such as the Federal Reserve and the European Central Bank.

Economists have warned that maintaining oil prices between $90 and $100 for an extended period would significantly drive inflation higher and potentially disrupt the current path of monetary easing. The bank also warned that a sustained conflict could shave as much as 20% off U.S. equity markets from their highs if energy prices remain elevated and geopolitical risks grow.

Moreover, certain sectors are beginning to see rotation. Defense contractors and energy companies are outperforming, while airline, tourism, and consumer discretionary stocks are under pressure. “We’re entering a risk-off environment,” said one portfolio strategist, noting increased demand for liquidity and quality assets.

A measured response - for now?

Despite the intense headlines, many experts believe the current conflict is likely to remain contained. Both Israel and Iran have powerful regional and international incentives to avoid a prolonged war. Israel is wary of overstretching militarily while maintaining its focus on domestic security. Iran, meanwhile, is grappling with internal economic turmoil and may not be in a position to sustain a lengthy confrontation.

Financial markets, for now, appear to share that view. The volatility index (VIX), sometimes called Wall Street’s “fear gauge,” spiked briefly to 22 before easing back to around 20. Investors are on edge but not panicked.

When did the conflict begin?

History offers some useful context. Previous Middle East conflicts including the 1973 Yom Kippur War, the Gulf War in 1991, and the 2006 Lebanon conflict often caused short-term market dips, followed by relatively quick recoveries once fears of supply disruptions or escalation eased. In many cases, geopolitical shocks have presented long-term buying opportunities for disciplined investors. Still, analysts caution against complacency. The situation remains fluid, and a single miscalculation could upend markets all over again.

Lets dive into the history of the two countries a bit more.

1948 – 1979: From cooperation to cold distance

When Israel declared its independence in 1948, Iran under the rule of Shah Mohammad Reza Pahlavi was among the first majority-Muslim countries to recognize the Jewish state de facto, though not officially de jure. Throughout the 1950s to the 1970s, relations between Israel and Iran were largely cooperative, even if discreet.

Key points during this period:

- Economic and intelligence collaboration: Iran exported oil to Israel, and the Mossad (Israel’s intelligence agency) worked closely with SAVAK, the Shah’s secret police.

- The “Periphery Doctrine”: Israel viewed Iran as a strategic ally on the “periphery” of hostile Arab states and sought to build strong ties with non-Arab regimes like Iran and Turkey.

- Military ties: Iran purchased Israeli arms and technology, and the two countries shared intelligence on Arab adversaries, particularly Egypt and Iraq.

But this relatively warm relationship was shattered in 1979, when the Islamic Revolution overthrew the Shah and installed Ayatollah Ruhollah Khomeini as Iran’s Supreme Leader.

1979 – 2000: Revolution and hostility

The new Islamic Republic under Khomeini adopted a vehemently anti-Israel stance. Israel became publicly vilified as a “Zionist regime,” and Iranian leaders called for its destruction.

Defining elements of this era:

- Ideological enmity: Iran’s clerical regime viewed Israel as a Western colonial implant and occupier of Muslim lands, aligning itself with the Palestinian cause.

- Support for Hezbollah: In the 1980s, Iran helped form Hezbollah, the Shiite militant group in Lebanon, which has since fought multiple wars with Israel and continues to threaten Israeli territory.

- Covert complexity: Despite public hostility, some quiet and unofficial contacts remained, especially during the Iran-Iraq War (1980–1988), when Israel reportedly supplied Iran with arms as part of the U.S.-led "Iran-Contra" affair.

However, any remaining behind-the-scenes cooperation ended by the 1990s as Iran’s anti-Israel rhetoric became more deeply embedded in its foreign policy and military strategy.

2000 – 2020: Nuclear tensions and the rise of the "Shadow War"

As Iran's nuclear ambitions grew more visible, so did Israeli fears of a direct existential threat. Israel vowed to prevent Iran from developing a nuclear weapon, seeing it as a red line.

Key developments:

- 2005–2015: Iran’s nuclear program progressed rapidly, triggering global concern. Israel repeatedly warned of Iran's nuclear "breakout capacity."

- Targeted assassinations: Between 2010 and 2012, several Iranian nuclear scientists were assassinated in operations widely attributed to Mossad.

- Stuxnet cyberattack: In 2010, a sophisticated cyberattack believed to be jointly carried out by the U.S. and Israel damaged Iran's Natanz nuclear facility.

- 2015 Nuclear Deal (JCPOA): Iran agreed to limit its nuclear program in exchange for sanctions relief. Israel, under Prime Minister Netanyahu, opposed the deal, arguing it merely delayed Iran’s path to a bomb.

2020 – Present: Maximum pressure, maximum risk

The U.S. withdrawal from the Iran nuclear deal in 2018 under President Trump, along with a "maximum pressure" sanctions campaign, intensified Iran-Israel hostilities.

Recent escalations:

- Covert strikes and sabotage: Israel has been linked to sabotage operations against Iranian nuclear and military facilities, including another major strike on Natanz in 2021 and the assassination of Mohsen Fakhrizadeh, a top nuclear scientist.

- Drone warfare and naval clashes: Iran and Israel have engaged in tit-for-tat attacks on oil tankers and cyber systems.

- Syria as a battleground: Iran’s presence in Syria supporting Assad and attempting to establish a military foothold near Israel’s border has led to hundreds of Israeli airstrikes against Iranian positions.

Why the conflict persists

The Iran-Israel conflict isn’t just about territory or politics it’s deeply ideological and strategic:

- Iran sees Israel as a threat to Muslim unity and a symbol of U.S. hegemony.

- Israel sees Iran as its most serious security threat, particularly due to its nuclear ambitions and support for groups like Hezbollah, Hamas, and Islamic Jihad.

Efforts to reduce tensions have failed largely due to these irreconcilable positions and mutual distrust. With diplomacy stagnant and military confrontations increasing in frequency and intensity, both countries now operate in what many analysts call a “shadow war,” occasionally erupting into open conflict as we are witnessing now in 2025.

Investing during geopoticial tensions?

For investors, the message is clear: maintain a diversified portfolio, increase allocations to defensive sectors if needed, and remain flexible. Those with higher exposure to energy and defense may benefit in the near term, while portfolios heavily reliant on cyclical sectors or emerging markets could face more headwinds.

The Israel-Iran conflict is yet another reminder of how geopolitics can shape financial markets in ways that are swift, severe, and often unpredictable.

Historically, geopolitical shocks, especially those centered in the Middle East, tend to cause short-term market dislocations rather than long-term systemic crises. However, the degree of disruption depends largely on whether the situation escalates into a broader regional war, disrupts key shipping routes like the Strait of Hormuz, or draws in other powers such as the United States, Saudi Arabia, or Russia.

In the meantime, this is a critical moment to reassess risk exposure. Investors with heavy positions in emerging markets, particularly those reliant on energy imports, may want to reconsider their allocations. Similarly, sectors such as travel, airlines, and consumer discretionary could come under pressure if oil prices remain elevated and consumer confidence weakens.

One of the clearest takeaways so far has been the resurgence of safe-haven assets. Gold has rallied on the back of geopolitical fear and inflation concerns, while U.S. Treasury bonds have seen strong demand. These traditional refuges may continue to perform well if tensions escalate further, particularly if energy price shocks bleed into broader inflationary pressures.

Oil itself has become a focal point of investor strategy. As prices climb, energy companies, especially large integrated producers and oilfield service providers stand to benefit. Some traders are turning to oil ETFs and commodities futures to hedge against further instability. Conversely, high oil prices could weigh heavily on fuel-sensitive industries, putting downward pressure on profitability in sectors like logistics, manufacturing, and airlines.

Maintaining sufficient liquidity not only provides protection during periods of high volatility but also positions investors to take advantage of market corrections. History shows that many geopolitical sell-offs are followed by recoveries, often sudden and sharp, once the immediate crisis passes or diplomatic efforts gain traction.

One wildcard in this environment is central bank policy. With inflation still a lingering concern and monetary policy entering a potential turning point, the conflict’s effect on energy prices could disrupt expectations of near-term interest rate cuts. The Federal Reserve and European Central Bank may be forced to pause or delay easing plans if inflationary pressures resurge due to energy cost spikes. That, in turn, would have implications for bond yields, equity valuations, and the performance of rate-sensitive sectors such as tech and real estate.

Finally, investors should be watching diplomatic developments closely. If talks resume particularly around Iran’s nuclear program or if international mediation gains traction, markets could quickly reverse their risk-off stance. A rapid de-escalation would likely benefit equities and weaken the current rally in safe-haven assets.

In this environment, the key is flexibility. Investors don’t need to overhaul their portfolios, but they do need to stay informed, avoid emotionally driven decisions, and position themselves for both protection and opportunity. The Israel-Iran conflict may yet evolve into a broader geopolitical crisis or it may resolve more quickly than expected.

FAQ

Oil prices may still have room to climb if the conflict between Israel and Iran escalates further. A broader regional war, particularly one that draws in additional players beyond the two nations could significantly disrupt global energy markets. The most severe risk lies in a potential attack on critical oil infrastructure or export routes. If Iran seeks to retaliate by targeting the Strait of Hormuz, a vital chokepoint through which nearly 20% of the world’s oil flows, the implications for supply and pricing could be dramatic.

From a geopolitical standpoint, much hinges on how the United States responds. President Trump has indicated that the U.S. may take direct action against Iran, and the United Kingdom has already pledged to deploy fighter jets to the region.

While the initial market reaction was sharp, analysts are closely watching for longer-term consequences. Chief among them is the potential impact on inflation. Rising oil prices feed directly into higher transportation and energy costs, which could delay expected interest rate cuts from major central banks such as the Federal Reserve and the European Central Bank.

Economists have warned that maintaining oil prices between $90 and $100 for an extended period would significantly drive inflation higher and potentially disrupt the current path of monetary easing. The bank also warned that a sustained conflict could shave as much as 20% off U.S. equity markets from their highs if energy prices remain elevated and geopolitical risks grow.

Moreover, certain sectors are beginning to see rotation. Defense contractors and energy companies are outperforming, while airline, tourism, and consumer discretionary stocks are under pressure. “We’re entering a risk-off environment,” said one portfolio strategist, noting increased demand for liquidity and quality assets.

How to Take Advantage from Falling Prices

The history and future of Natural Gas

What is the dollar index, and how does it work?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.