When trading options in times of volatility, the directionality of the price ceases to have so much prominence in favour of the magnitude of the movement in the price.

We often find ourselves in situations where, for a specific market or for a specific asset, we can foresee scenarios in which it is relatively easy for us to imagine how much the price is going to move, but nevertheless, it is tremendously difficult for us to try to discover the direction it is going to take. Company results, political decisions, natural events or even technical figures that augur a strong price movement are the ideal times to consider an operation in volatility.

Through volatility operations, the directionality of the price ceases to have so much prominence as to cede it to what will be the cornerstone of the operation, the magnitude of the movement in the price. We went from thinking about "Where to?" to asking ourselves "How much?" Depending on the different scenarios that we imagine can be carried out, we will decide what type of strategy best combines with our portfolio of options or when it will be convenient to sell or buy volatility.

Before getting into the strategies, it is useful to know what volatility is and how it affects us as options traders.

Volatility is determined as the variability of the movement of the underlying asset and is a key factor in option pricing. It refers to the amount of uncertainty, risk and fluctuations that occur on the market and, most often, to the amount of price changes over a given period on the financial markets.

We can determine three types of volatilities:

HISTORICAL: historical volatility is calculated as the standard deviation of the returns of the underlying asset. It is calculable at all times and known in advance.

IMPLIED: implied volatility is the volatility with which the options are trading. It is quite complicated to calculate and it reflects an estimate of the volatility that the underlying asset will have during the life of the option.

FUTURE: future volatility is the one that really ends up having the underlying during the life of the option. It is not calculable until the option expires.

Depending on the maturity with which we are going to square our strategy, we will have to take into account what the historical volatility of the period prior to the option operation has been and with what volatilities these options are currently trading. This way we can determine if an option is trading expensive or cheap volatility.

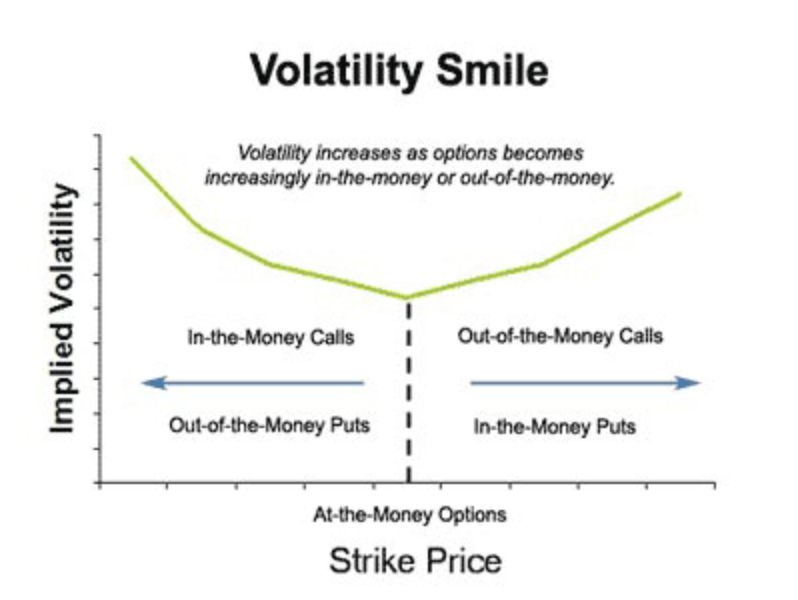

We must also bear in mind that the creator of the options does not apply the same implicit volatility for the different exercise prices, but rather that each price has a different implicit volatility. Therefore, a 3-month CALL on EURUSD with 1.23 as strike will not be valued the same as one with strike at 1.29.

This is done to dilute the prediction errors that are assumed in all option pricing models, since we take as a premise that the returns of the underlying follow a certain distribution when exactly this is not entirely correct. The drawing that the implicit volatility leaves us when plotting it against the strike price is called the volatility smile or volatility smile.

Source: XTB

Source: XTB

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Options Volatility Strategies

Next, we are going to learn about the most basic strategies in volatility trading and how we can determine for which scenario each of them is more convenient.

In general, the entire structure of the strategy is rarely maintained at expiration, but depending on the price evolution, the "legs" of the strategy are usually removed to try to maximise the profitability of the operation.

Cone or Straddle

The cone or straddle is the most aggressive volatility operation. The purchased cone consists of the purchase of a CALL and a PUT with the same strike, and generally In the Money. We will use it in those scenarios in which we foresee an extremely sharp price movement. It has a negative part that is the most expensive operation in volatility, but it has the closest break-even points. On the contrary, we will use the sold cone slope when we do not expect sudden movements in the underlying asset or when we determine that the implied volatility of the option is trading quite expensive.

Cradle or Strangle

The cradle or strangle is an operation similar to that of the cone, but carried out with OTM options, which makes the strategy cheaper but moves away the break-even points. The operator of the cradle-bought strategy will expect the underlying asset to move even with an even greater magnitude than that of the bought cone, since to be profitable it has to cover a large phase of the price movement. In the case of selling a crib, we will enter less premium, but we will be able to better withstand price movements before going negative.

Buy Butterfly

The buy butterfly is, together with the spreads, the most conservative operation in options. For this strategy, four options are combined. On the one hand, a CALL with a strike price lower than the current one is bought (an ITM) and two CALLs are sold at the highest ATM level that we find and on which we think the underlying can end. Finally we buy a CALL with a remote strike, that is, an OTM.

We will use this strategy in those phases of the market in which we expect little volatility in the price movement but on the other hand we do not want to be excessively exposed if the market shoots up in either direction.

Sell Butterfly

Sell butterfly is a strategy designed to try to look for movements of a median in the price, but that nevertheless will not report great gains, but neither excessive losses. It consists of the sale of a CALL ITM, the purchase of two CALL ATMs and the sale of another CALL OTM. The success of this strategy will depend especially on the prices of the premiums collected and paid to the extent that the premiums collected for the sale of the CALLs offset the premiums paid for the purchase of the two central CALL options. The profit is limited and is obtained when the price of the underlying asset is outside the central range at maturity.

Please note that this article is purely educational and this instrument is not a part of XTB’s offer.

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

UK Budget Preview: One month to go

Choosing the Right ISA for You

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.