Record markets, lots of politics and central bank intervention – that’s what we had in 2019. How will 2020 look like? In this analysis we point at 5 stories investors should be familiar with.

Elections in the US

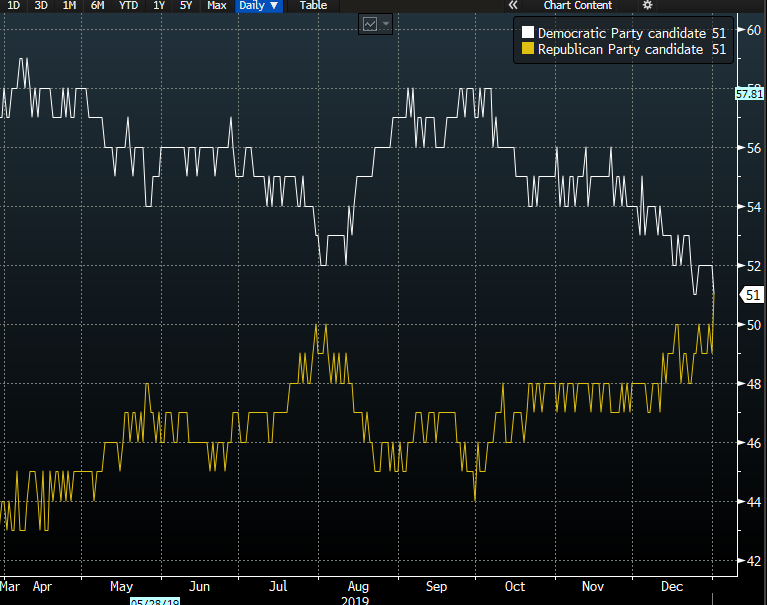

This is probably the single most important story this year. President Trump is often called unpredictable but this one thing is as bright as the sun – he is ready to do whatever it takes to win in November. So far his strategy was to make rifts, negotiate tough and present deals to markets and the public in the United States. Looking at the polls it begins to work as his odds have been on the rise. It seems that his camp will at least try not to rock the boat and maintain good market moods until November. Meanwhile, Democrats will have to pick their horse. Joe Biden seems to be the favourite but his recent resurgence coincided with best polls for Trump in months.

Trump strategy of trade deals and strong markets seems to be working for him. Source: Bloomberg

Trump strategy of trade deals and strong markets seems to be working for him. Source: Bloomberg

Technological revolution and record markets

There’s no denying that technology is changing our lives and it’s happening at the rapid pace. AI, 5G, IoT, 3D printers, autonomous cars – these are not technologies of the future, they already have an impact. The question is – can investors still ride this trend? The 11-year old bull market saw a nearly 800% rally on tech stocks (here US100). Unlike 20 years ago many tech firms reap massive profits but just like then some valuation metrics (especially price to sales) are record high.

The techs are making a big comeback, but will this bull market continue into 2020? Source: xStation5

The techs are making a big comeback, but will this bull market continue into 2020? Source: xStation5

Manufacturing recovery

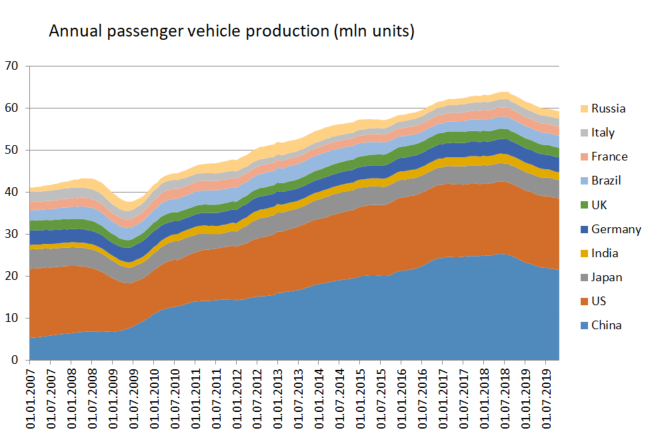

Expectations for a trade truce have lifted markets towards the end of 2019 but a minor tariff rollback could not suffice to revive a struggling manufacturing sector. Investors should track global car output that’s been in downtrend since the mid-2018 as manufacturers have been dealing with saturated markets and environmental restrictions. Manufacturing PMI indices have seen some bottoming out but the sectors is not yet out of the woods.

Global car production has been declining since mid-2018. Source: Macrobond, XTB Research

Global car production has been declining since mid-2018. Source: Macrobond, XTB Research

Brexit negotiations

What Brexit? Some might think that with UK departure from the EU the Brexit story will be over. Wrong! UK will only begin a transition period which is needed for a proper trade deal to be ironed out. Such deals often take years but politically strengthened Boris Johnson pledged to do it in 11 months (ignoring EU warnings). Brexit will remain the main theme for the GBP and one of the major ones on the FX markets.

Central banks and commodities

Central banks went on an easing spree in 2019 to lift global economy and some are warning about a bond bubble being even more dangerous than stock market one (the two rallies have been more and more intertwined). 2019 was a lesson that central banks do not hesitate to use their scarce firepower and they will do it again if the economy weakens again. This has attracted attention to precious metals such as gold, silver or platinum as alternatives to paper currencies.

Despite 2019 gains silver prices remain moderate in historical perspective. Source: xStation5

Despite 2019 gains silver prices remain moderate in historical perspective. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.