Japanese yen is one of the worst performing G10 currencies today after erasing earlier gains. JPY gained during the Asian session on some risk-off flows but has given back those gains since, which is somewhat puzzling. Why? There are 2 reasons.

Firstly, it was announced that minimum hourly wage in Japan will be hiked by around 4.2% in fiscal 2023/2024 - the biggest increase in years. This is important because Japan has struggled to achieve its inflation target and even as CPI is above BoJ's target right now, such a situation is not expected to last. Bigger increase to minimum wage growth has a chance to boost price growth in the economy.

Secondly, Kyodo reported that Japan's Ministry of Finance increased the assumed long-term interest rate for fiscal year 2024/2025 from 1.10% to 1.50%. It is said that the upward revision to the forecast is driven by BoJ decision to tweak policy and allow for greater deviation from target yield. While it does not mean that the Bank of Japan will embark on policy tightening and rate hikes soon, it is a hawkish development.

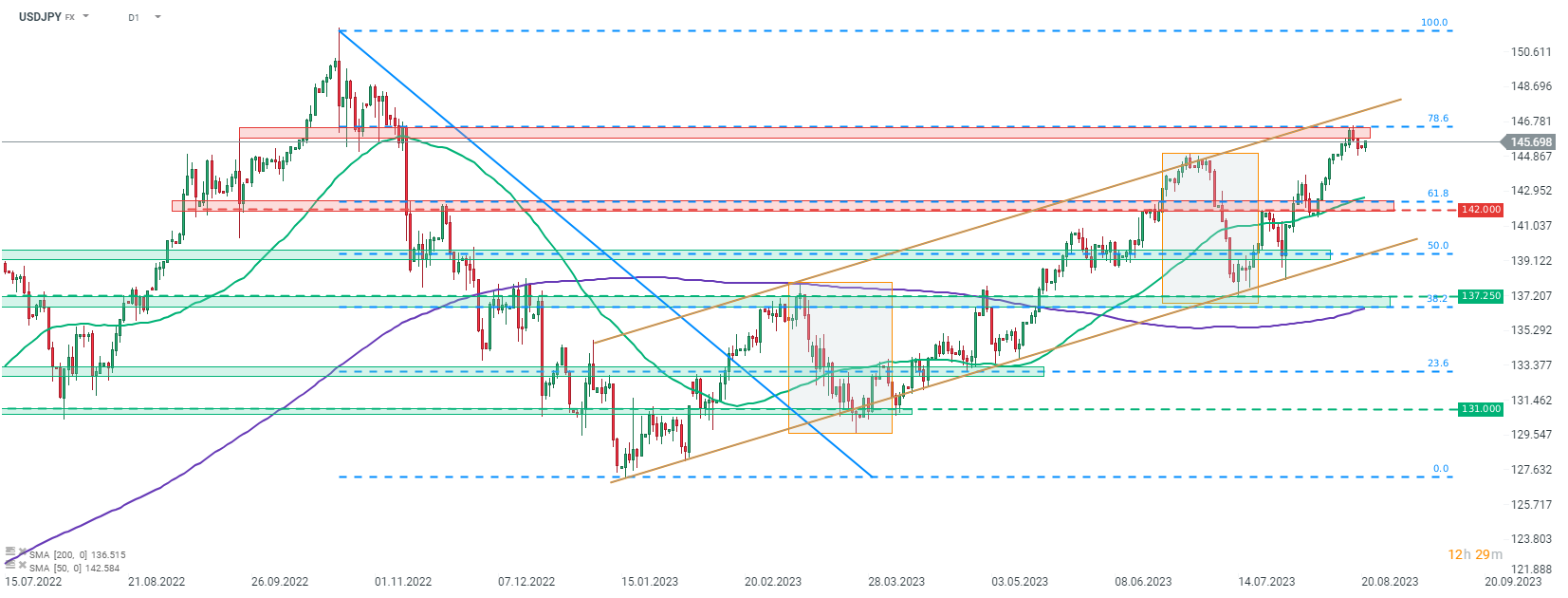

Having said that, today's weakening of Japanese yen is somewhat strange. Taking a look at USDJPY chart at D1 interval, we can see that the pair trading higher today, erasing almost all of the losses made on Friday. Another test of the resistance zone ranging below 78.6% retracement of the downward impulse launched in October 2022 cannot be ruled out. However, the upper limit of the bullish channel runs slightly above this resistance therefore bulls may struggle to extend gains even if they manage to break above the aforementioned 78.6% retracement.

Source: xStation5

Source: xStation5

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.