EURUSD ended after 6 hours rather lower in the latest minutes releases, although on average EURUSD gained, but this is the result of reactions from October, November and January.

Source: Bloomberg Financial LP

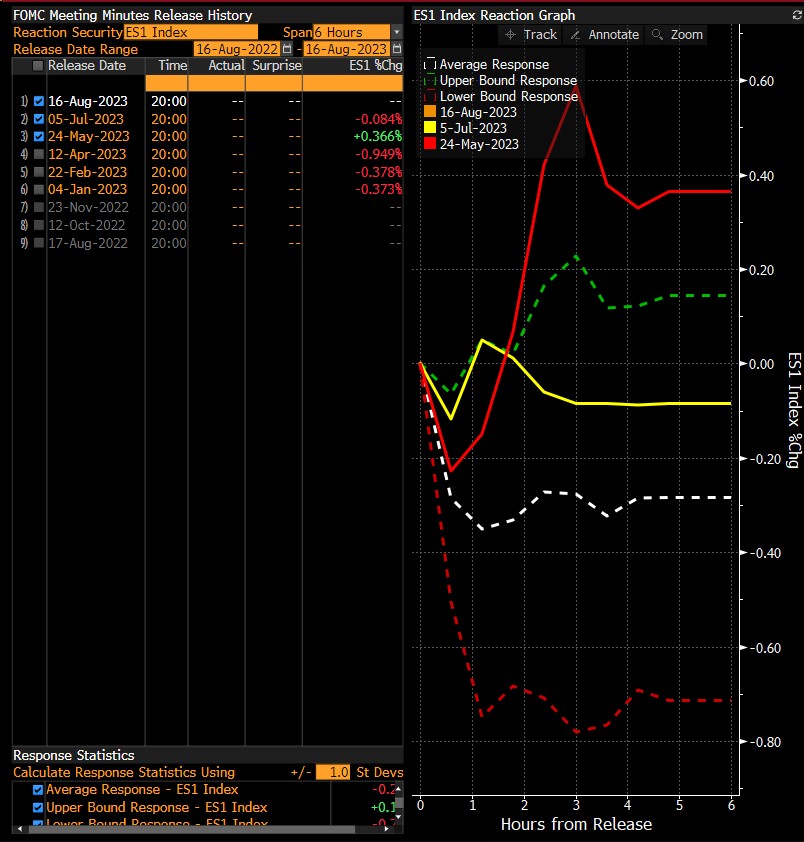

The July minutes following the June decision did not bring volatility to the US500. In contrast, we saw a sizable increase in May, but for the most part the US500 lost during the minutes, including during the first minutes after the publication.  Source: Bloomberg Financial LP

Source: Bloomberg Financial LP

It is worth remember that we have heavily oversold markets today: the EURUSD and the US500, so there is potential for profit-taking if the minutes are dovish. However, if they point to the need for more hikes, these markets could fall into a further downtrend this week.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.