Alibaba (BABA.US) shares fell sharply during today's session after Financial Times reported that the Chinese authorities are looking to break up its Alipay associate to reduce its market power and create a separate app for its loans business. Alipay is a highly popular digital payments company owned by Jack Ma’s Ant Group. Alibaba has a one-third stake in Ant Group. Investors are also concerned that Chinese officials are stepping up its ongoing crackdown on big technology companies after regulators have ordered internet companies - including Alibaba and Tencent - to stop blocking links to its competitors' websites on their own websites.

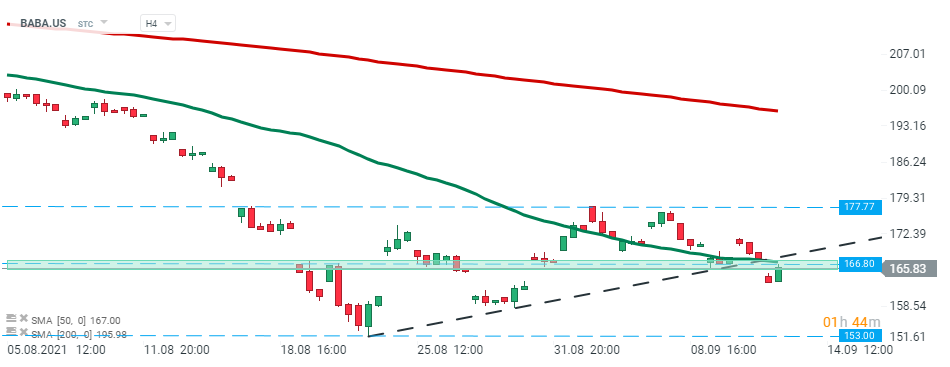

Alibaba (BABA.US) stock broke below the local support at $166.80 which coincides with the upward trendline and 50 SMA (green line) last week. Stock launched today's session lower, however buyers managed to regain control and a retest of the aforementioned $166.80 level may occur today. In case of a break higher, an upward move towards local resistance at $177.77 could be launched. However if current sentiment prevails, then support at $153.00 may be at risk. Source: xStation5

Alibaba (BABA.US) stock broke below the local support at $166.80 which coincides with the upward trendline and 50 SMA (green line) last week. Stock launched today's session lower, however buyers managed to regain control and a retest of the aforementioned $166.80 level may occur today. In case of a break higher, an upward move towards local resistance at $177.77 could be launched. However if current sentiment prevails, then support at $153.00 may be at risk. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.