Why Alphabet's Results Are Important

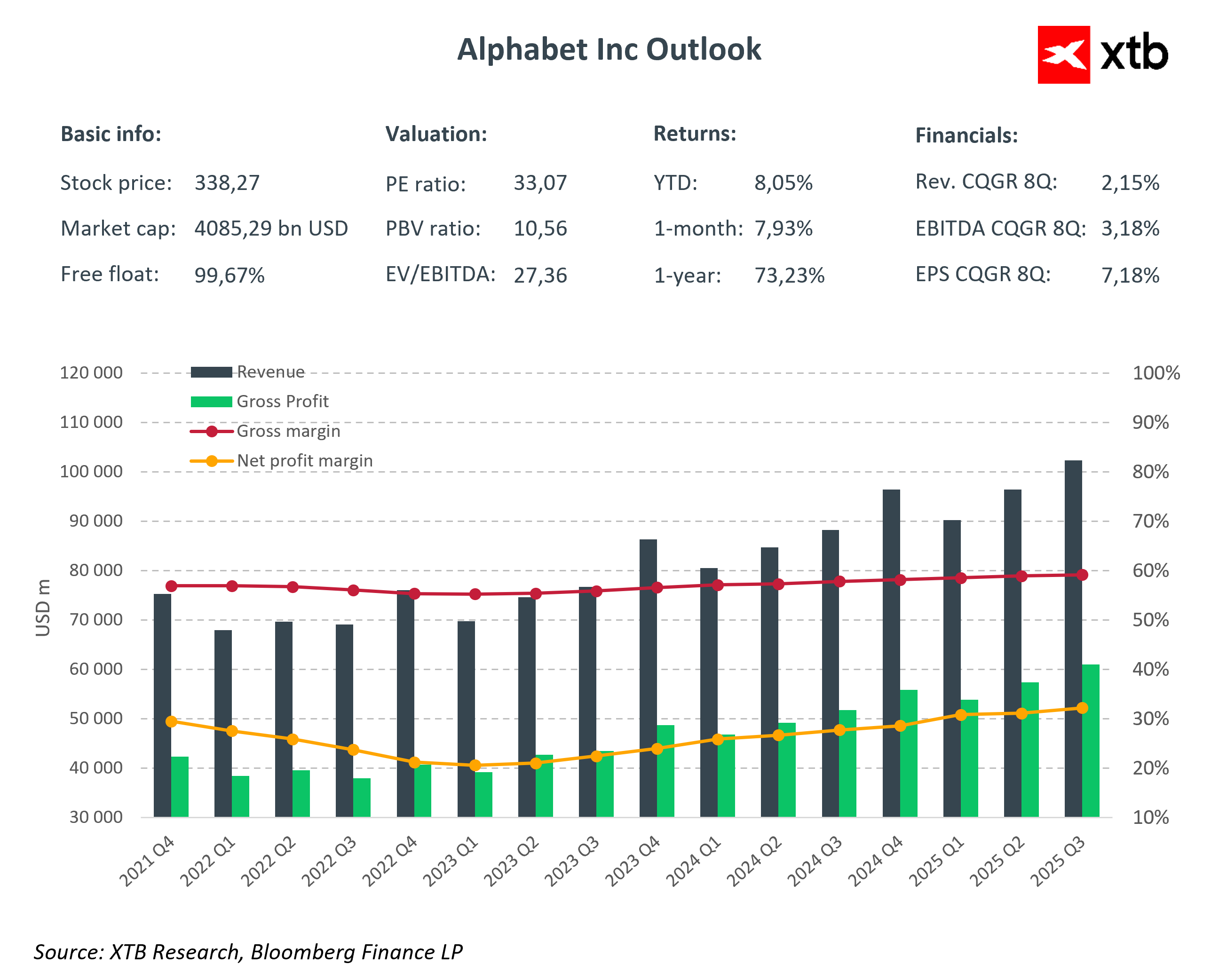

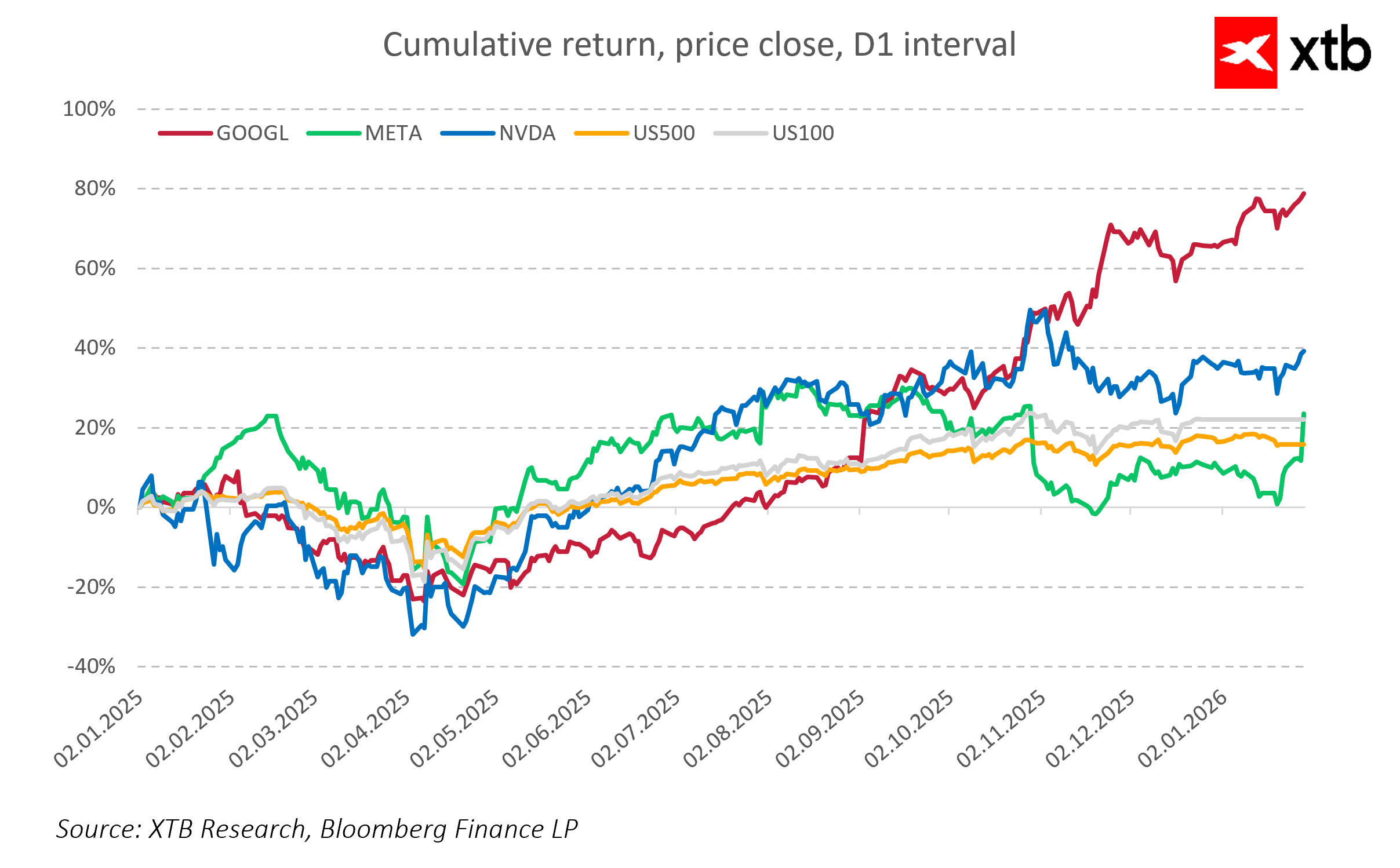

Alphabet enters earnings season as one of the most important and simultaneously one of the most demanding technology companies in the world. After quarters of dynamic expansion in cloud computing, spectacular adoption of artificial intelligence, and strong growth in advertising revenue, the market now expects confirmation that the recent performance was not a one-off result but a durable, structural growth trend.

Today’s results will be a test of the quality of the company’s strategy. Investors will look not only at the numbers but will focus primarily on whether Alphabet can effectively monetize Gemini and other AI products, maintain accelerated growth in Google Cloud and YouTube, and control rising infrastructure and energy costs.

Q4 2025 Consensus

- EPS: $2.65

- Total Revenue: $111.4 billion

- Google Services: $94.9 billion

- Google Ads: $80.89 billion

- Google Search & Other: $61.37 billion

- YouTube Ads: $11.78 billion

- Google Cloud: $16.2 billion (+30–35% YoY)

- Operating Income: $36.95 billion

- Operating Margin: 33.1%

- CapEx: $28.17 billion

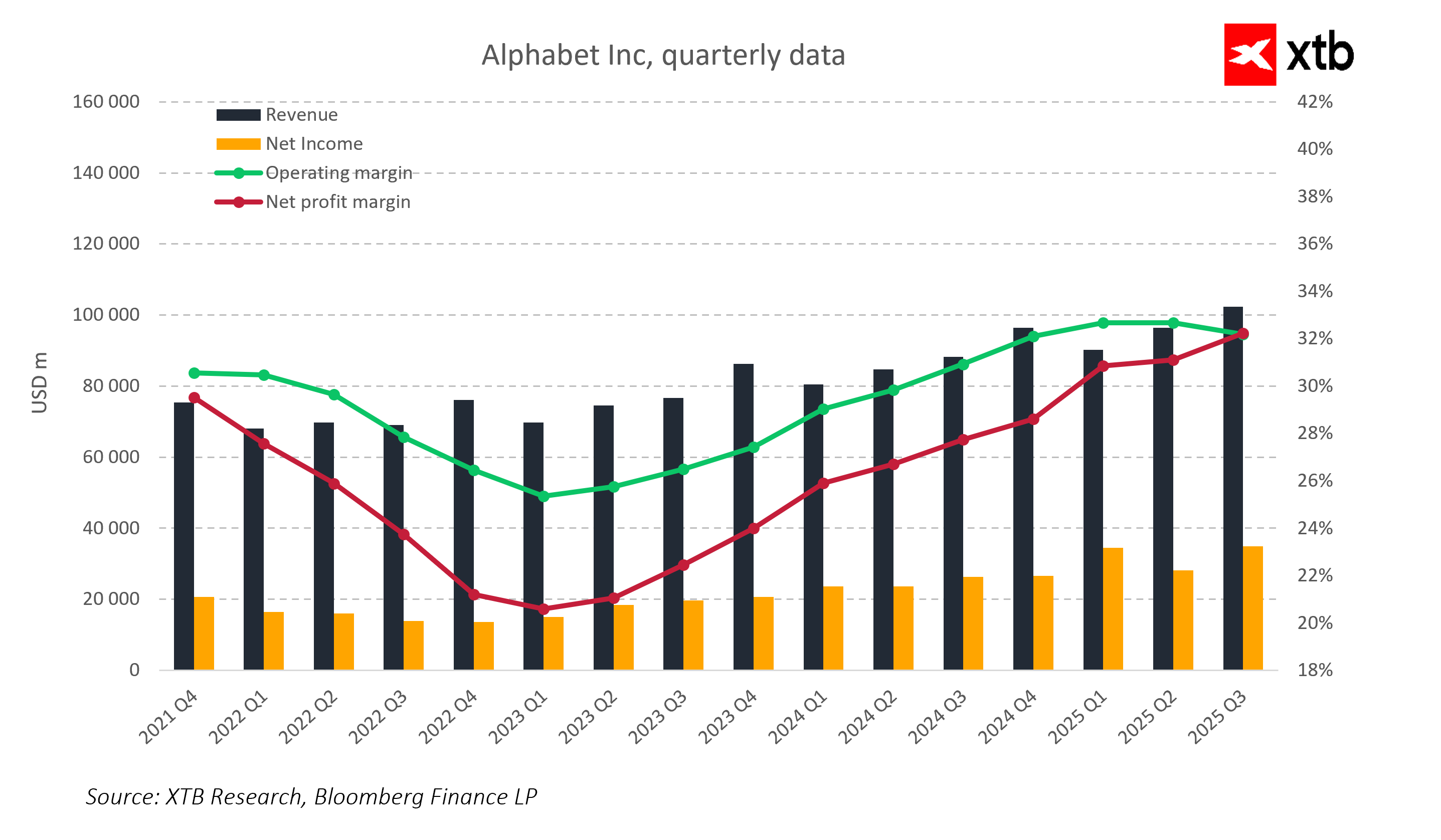

For the market, the key is not only whether consensus is met, but also the revenue structure and the growth pace of individual segments. Critical questions include whether AI and Google Cloud revenues maintain a high growth rate that would indicate sustainable monetization of generative AI technology. It is also important to understand the contribution of YouTube and Search advertising to revenue growth, especially in the context of rising competition and regulatory changes. Markets will also watch whether investment in data centers, GPUs, and energy grows in line with AI revenues or whether cost pressures could affect margins.

AI Implementation and Cloud Expansion as Growth Drivers

Gemini and its integration across Google products have become a key indicator of future revenue. Rapid AI adoption in Search, Chrome, and Workspace demonstrates that Alphabet is not only developing technology but also effectively monetizing it, generating real AI revenue.

Google Cloud remains the primary growth engine outside of advertising, with revenue growing significantly faster than the overall IT market. Cloud and AI growth dynamics will be interpreted by the market as a signal of Alphabet’s sustainable competitive advantage.

YouTube continues to generate a significant advertising revenue stream and is becoming an increasingly important part of the ecosystem, particularly as AI is implemented in recommendations and ad targeting.

Investment and Margins as Measures of Strategic Effectiveness

Alphabet is investing heavily in AI and data centers. High spending exerts pressure on operating margins despite solid revenue growth.

Markets will closely analyze management commentary on CapEx allocation, operational cost control, and the return on AI and Cloud investments. Today’s results will show whether Alphabet can scale AI and Cloud profitably while remaining competitive with AWS and Microsoft and protecting advertising margins.

Stability of Core Segments and Revenue Diversification

Outside of Cloud and AI, Alphabet has a strong advertising segment that provides a recurring cash flow. Google Search, YouTube, and network advertising remain the financial foundation that cushions short-term investment risks and cyclical spending in Cloud and AI.

Other Bets and new initiatives continue to generate limited revenue but represent a potential long-term option. The company has room for aggressive AI and Cloud expansion while minimizing the risk of destabilizing financial results.

Risks Shaping Alphabet’s Performance

Alphabet faces several important challenges. Regulatory and antitrust pressures in the US could affect revenue structure and market conditions. Competition in AI and cloud from Microsoft and AWS continues to intensify. High infrastructure and energy costs could constrain margins. Market expectations are high, and tolerance for disappointment in results and margins is limited. The ongoing antitrust appeal could influence agreements with partners, including Apple, potentially affecting Search and Chrome.

Can Alphabet Translate Strategy into Financial Results?

Today’s results will test whether Alphabet can convert investments in AI and Cloud into tangible financial outcomes. Sustained revenue growth in Cloud, continued AI momentum, efficient CapEx management, and margin maintenance will be key indicators of strategic quality.

Alphabet stands at a point where its strategy is clear, demand is real, and competitive advantages are significant. The market will assess not only the numbers but also the company’s ability to maintain technological leadership in AI and Cloud, which will determine its future value.

Key Takeaways

Alphabet must demonstrate that AI and Cloud revenue growth was not accidental but structural. Google Cloud and AI are at the heart of the strategy and the main growth drivers outside advertising. High CapEx investments test the company’s ability to scale AI and Cloud profitably. Stable advertising segments and YouTube mitigate short-term risks, providing space for aggressive expansion. Regulation and competition remain important risk factors that could influence results in upcoming quarters.

Q4 2025 results could be the moment the market verifies whether Alphabet is truly entering an era of sustained AI growth or

Daily summary: The beginning of the end of disinflation?

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop

UK Spring Statement Preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.