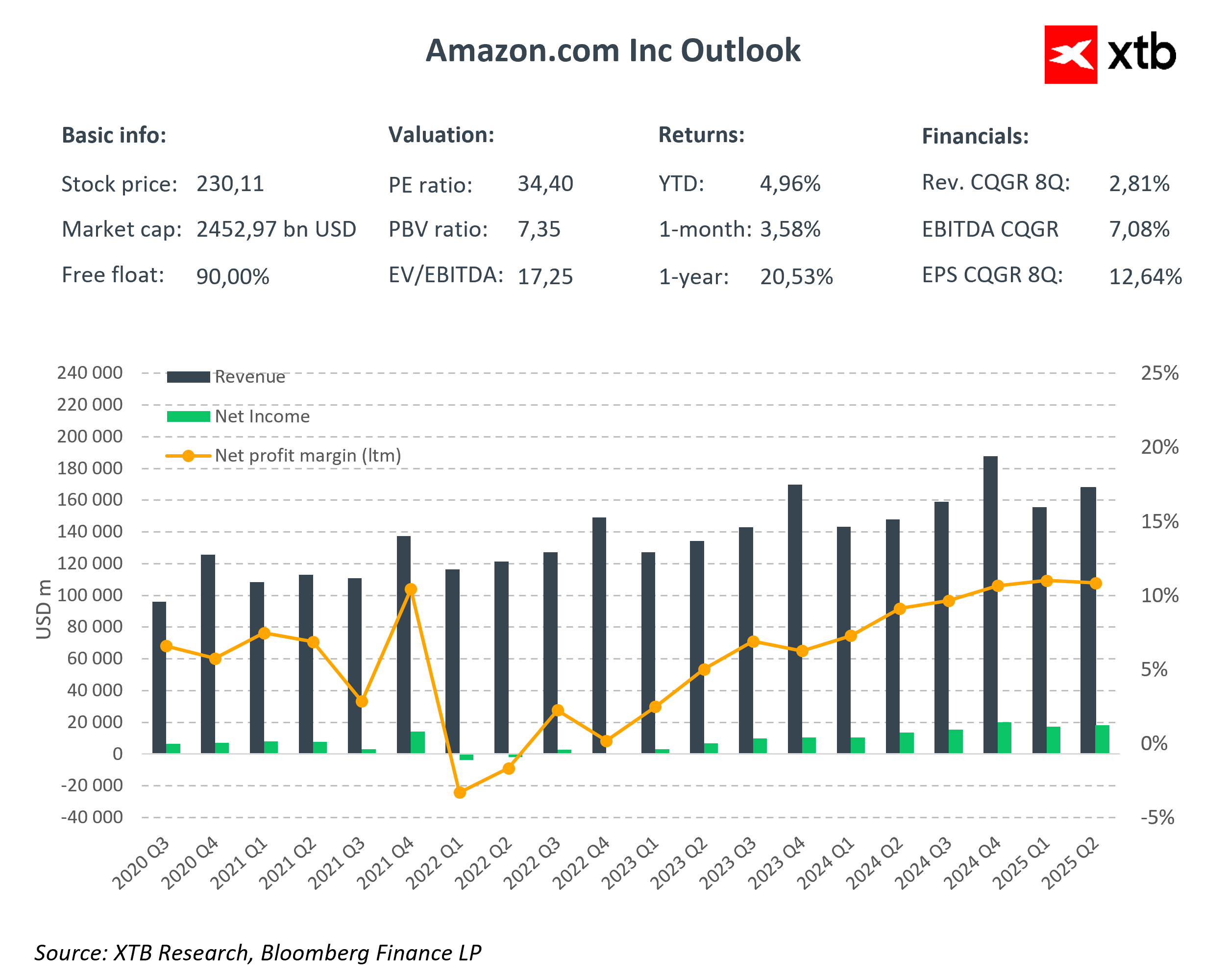

Amazon (AMZN.US) will report its Q3 2025 earnings today after the U.S. market close. Investors expect another solid quarter, though there is uncertainty surrounding the pace of cloud growth and the company’s positioning in AI. Consensus forecasts call for $177.8 billion in revenue and EPS of $1.58, up 12% and 10% y/y, respectively. This represents steady growth, though clearly slower than during the pandemic years.

The main focus will be on AWS, Amazon’s current profit engine. Although it accounts for only about 20% of total revenue, it generates around 40% of operating income. AWS’s operating margin fell last quarter from 36% to 33%, and its market share declined by roughly 2% in favor of Microsoft Azure and Google Cloud. Any sign of margin recovery or changes in AI-related market share will be crucial for sentiment.

Key expectations

- Revenue: $177.8B (+12% y/y)

- AWS revenue: $32.3B (+18% y/y)

- Advertising services: $17.3B (+21% y/y)

- Online store: $66.5B (+8% y/y)

- Third-party seller services: $41.9B (+11% y/y)

- EPS: $1.57–$1.58 (+10% y/y)

- Operating income: $23.7B (+4% y/y)

AI ambitions under scrutiny

Artificial intelligence remains the key growth driver for the entire tech sector. Investors expect management to explain how record-high capital expenditures will translate into future revenue growth. Currently, high CAPEX is weighing on free cash flow. Recent comments from Jeff Bezos emphasize that AI is the company’s “top priority,” spanning everything from logistics and automation to personalized shopping experiences.

Amazon’s stock remains below its all-time highs, unlike other Big Tech peers such as Apple, Microsoft, Alphabet, and Nvidia. Given the strong results from Microsoft and Alphabet yesterday, investors are likely to scrutinize Amazon’s report even more closely.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.