American Express (AXP.US), a US financial services company specializing in payments cards and a Dow Jones member, reported earnings for Q1 2023 ahead of the Wall Street session open today. Headline results from the company turned out to be mixed - EPS missed median estimate while revenue came in above expectations. Quick summary of American Express' Q1 earnings:

Q1 2023 earnings highlights

- Revenue: $14.30 billion vs $14.03 billion expected (+22% YoY)

- EPS: $2.40 vs $2.68 expected (-12% YoY)

- Net Income: $1.82 billion (-13% YoY)

- Provision for Credit Losses: +$1.06 billion vs +$0.89 billion expected (-$0.03 billion in Q1 2022)

- Total Network Volume growth: +16% YoY vs +32% YoY in Q1 2022

- 3.4 million new cards acquired during Q1 2023

2023 full-year forecasts (unchanged)

- Revenue growth: 15-17%

- EPS: $11.00-11.40

As one can see there are some positives and some negatives in the release. On one hand, the company managed to boost its revenue by over 20% compared to a year ago and report a 16% YoY increase in total network volume (TNV). However, this marks quite a significant slowdown from a 32% YoY growth in TNV in Q1 2022. Also, American Express is once again making provisions for credit losses after a period of releasing them. Provision for credit losses increased by $1.06 billion in Q1 2023 as the company is experiencing higher net write-offs.

Company added 3.4 million new cards in the January-March 2023 period and said that this growth is driven by Millenial and Gen Z consumers. American Express noted that spending on Travel & Entertainment was especially robust in the quarter and increased 39% YoY. However, it should be noted that as the world was still emerging from Covid pandemic a year ago, the base effect likely played a role. Nevertheless, the company claims that consumers have been resilient so far amid deteriorating macroeconomic picture with elevated inflation and rising interest rates. As such, American Express decided to maintain its full-year forecasts issued in January and still expects 15-17% growth in revenue this year as well as EPS reaching $11.00-11.40.

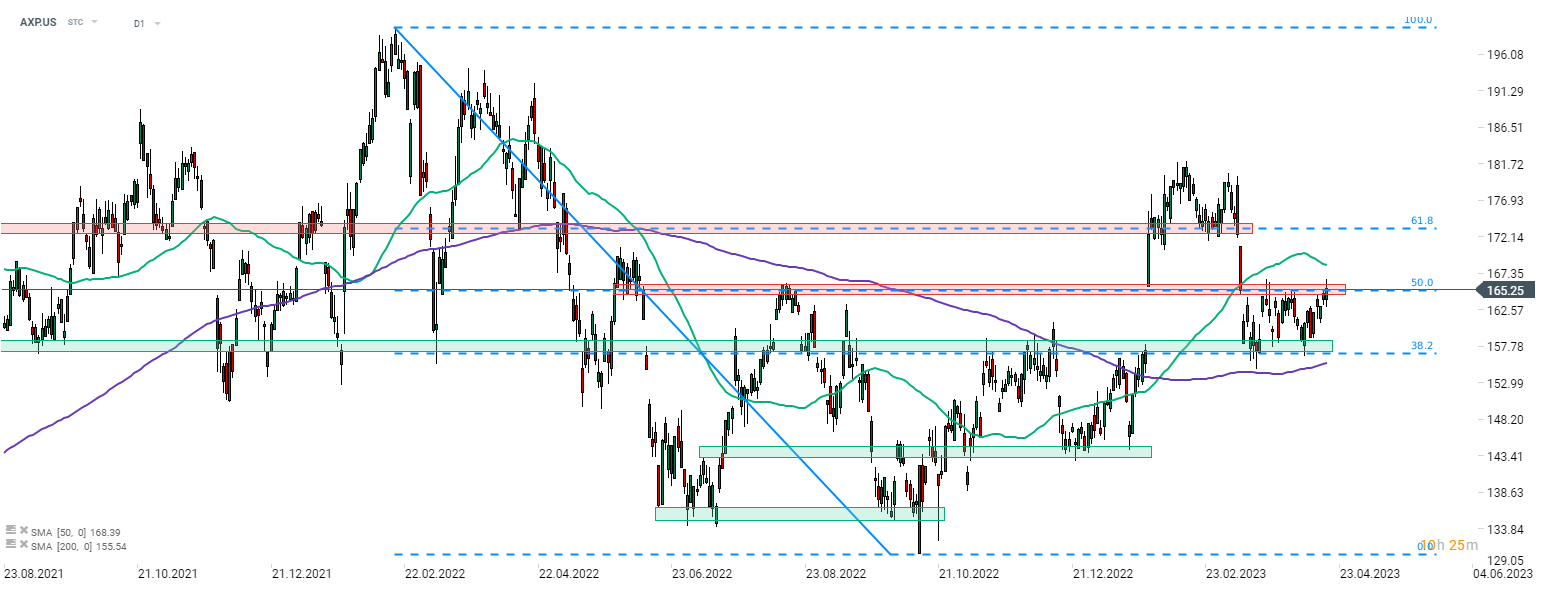

Share price of American Express (AXP.US) tested resistance zone marked with 50% retracement of the February-October 2022 downward move yesterday but failed to break above. Current premarket quote points to stock launching today's cash session slightly lower (around 1%). This would mean that the recent short-term trading range marked with 38.2 to 50% retracement may be upheld and the stock may continue to move sideways.

American Express (AXP.US) at D1 interval. Source: xStation5

American Express (AXP.US) at D1 interval. Source: xStation5

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Navigating Middle East uncertainty and tariff risks

Market wrap: European and US stocks try to rebound rebound 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.