- Unexpected knife edge decision

- Inflation rather than labour market is key focus for BOE

- Growth outlook revised higher

- Still plenty of uncertainty, and the BOE would not pre commit to future policy path

- The doves could take charge later this year if expected tax hikes flatten growth

The pound has surged this afternoon, after the Bank voted to cut interest rates, as expected, however, the vote was on a knife edge. The tight vote split, with 5 members voting for a cut, while 4 members voted to remain on hold, is the most noteworthy part of today’s decision. The Governor said that the decision was finely balanced and the hawkish camp at the BOE seems to have gained a new member. Claire Lombardelli, who in the past was in the dovish camp, voted to keep rates on hold.

Hawkish shift at BOE

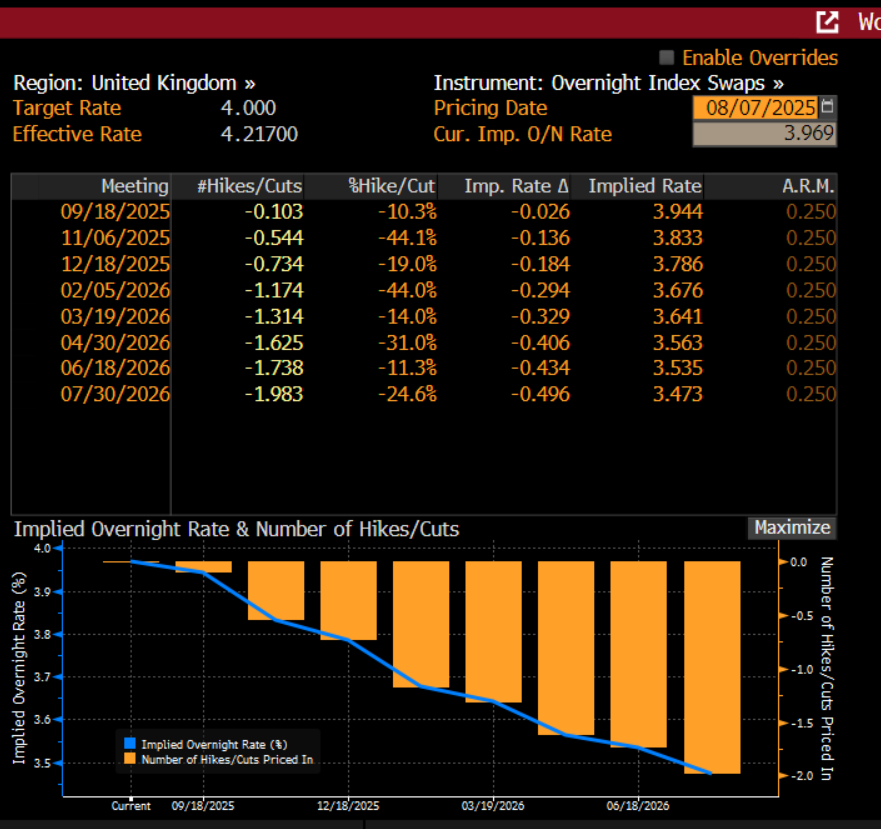

This suggests that far from opening the door to more rate cuts as the economy stalls and the labour market weakens; the power balance has shifted to the hawks. The immediate aftermath of this meeting has seen a repricing of interest rate expectations for the UK. There is now less conviction that a second rate cut will come later this year. Currently there is 21 bps of cuts priced in by year end, which just shy of another cut. Looking ahead, interest rates are expected to be 3.5% in a year’s time, which is slightly higher than before the meeting.

Low and stable inflation needed before BOE cuts rates in meaningful way

Unsurprisingly, the BOE upgraded their inflation forecasts, and inflation is expected to rise to a peak of 4% in September, and to fall back to 2% in 2026. However, the BOE caveated this forecast by saying that higher service prices could keep inflation elevated for longer than expected. The path of interest rates will be determined by inflation, and the BOE’s statement said that that ‘We need to be confident that inflation will remain low and stable in a lasting way’ before they can judge ‘how far and how fast’ they can cut interest rates.

Labour market not a major concern for BOE

This suggests that the BOE is firmly focused on the inflation picture. Ahead of this meeting, there was some expectation that the BOE could start to focus on the cracks that are starting to appear in the labour market. The labour market report for July is released next week, which will give us an update on the UK’s job creation in the aftermath of the rise in employers national insurance payments. The BOE may have upgraded their forecasts for the unemployment rate in the August Monetary Policy report, however, the unemployment rate is expected to peak at 4.9% next year, which is still extremely low by historic standards.

BOE remains careful and gradual

The fact that fewer members voted to cut interest rates today may suggest that MPC members have reason to believe that the unemployment rate will stabilize in the coming months, and that the growth outlook may not be as bad as the mood music would suggest. Both things would support the BOE’s current ‘careful and gradual’ approach to rate cuts. Essentially, the BOE may have eased their foot off the brake today, but growth is not bad enough yet to justify dovish forward guidance.

BOE out of reasons to justify rate cuts

The BOE’s growth outlook was revised higher compared to the May report. 2025 growth is expected to be 1.75% this year, and 2.25% next year. Along with the upgraded inflation outlook, the BOE ran out of reasons that gave them the option to suggest more rate cuts are coming down the line.

Why the government can be blamed for UK’s growth problem

Part of the near-term upgrade to growth is down to a loosening in mortgage market regulation. However, the Monetary Policy report also said that tight fiscal policy will pull down baseline GDP growth over the next year. Thus, for a government that pledged to get the economy growing again, the Bank of England is suggesting that part of the growth problem in the UK is the government’s decisions on tax. Thus, the Chancellor needs to tread carefully in October not to smother growth all together and burden consumers with extra taxes, especially now that the BOE seems unwilling to offer support to the economy through a rapid pace of monetary easing.

Today’s BOE decision has also pushed up UK borrowing costs. UK Gilts are underperforming their peers, and the 2-year yield is higher by 4 bps, the 10-year yield is higher by 2.5bps. After today’s rate cut, the UK’s base rate is lower than the US’s. However, considering the Federal Reserve is expected to cut rates at a rapid pace in the coming months, this may not last long, and UK Gilts could continue to underperform their peers for the foreseeable future.

The market impact

The rise in yields and the recalibration in rate cut expectations has boosted the pound, and GBP/USD is back above $1.34, and EUR/GBP has fallen to the lows of the day. Overall, the pound may not be able to extend gains too much further above this level, as the BOE remains data dependent, and the outlook for interest rates will depend on economic data. If fiscal policy is tightened further in October, then the BOE may have to step in with rate cuts to support growth, and the doves could still get control of the BOE later this year.

Thus, the outcome of today’s meeting was unexpected, with a decision to cut that was on a knife’s edge. This could temper the pound bears for the next few days, but it still leaves big questions over the growth outlook for the UK.

Chart 1: UK interest rate expectations for the next year

Source: XTB and Bloomberg

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.