Summary:

-

US indices trade not far from last night’s closing level

-

US30 rallies above Tuesday’s high on Boeing lift

-

Boeing called to open near 4% higher after earnings beat

Yesterday’s recovery for US indices was all the more impressive considering an early swoon lower following the opening bell, which took out recent lows for the S&P500 (US500 on xStation) and the DJIA (US30 on xStation), and while the markets still ended in the red, the majority of the declines were recouped. In the past couple of hours the US30 has moved higher and taken out Tuesday’s high of 25296, boosted by a strong move higher in Boeing during the pre-market trade.

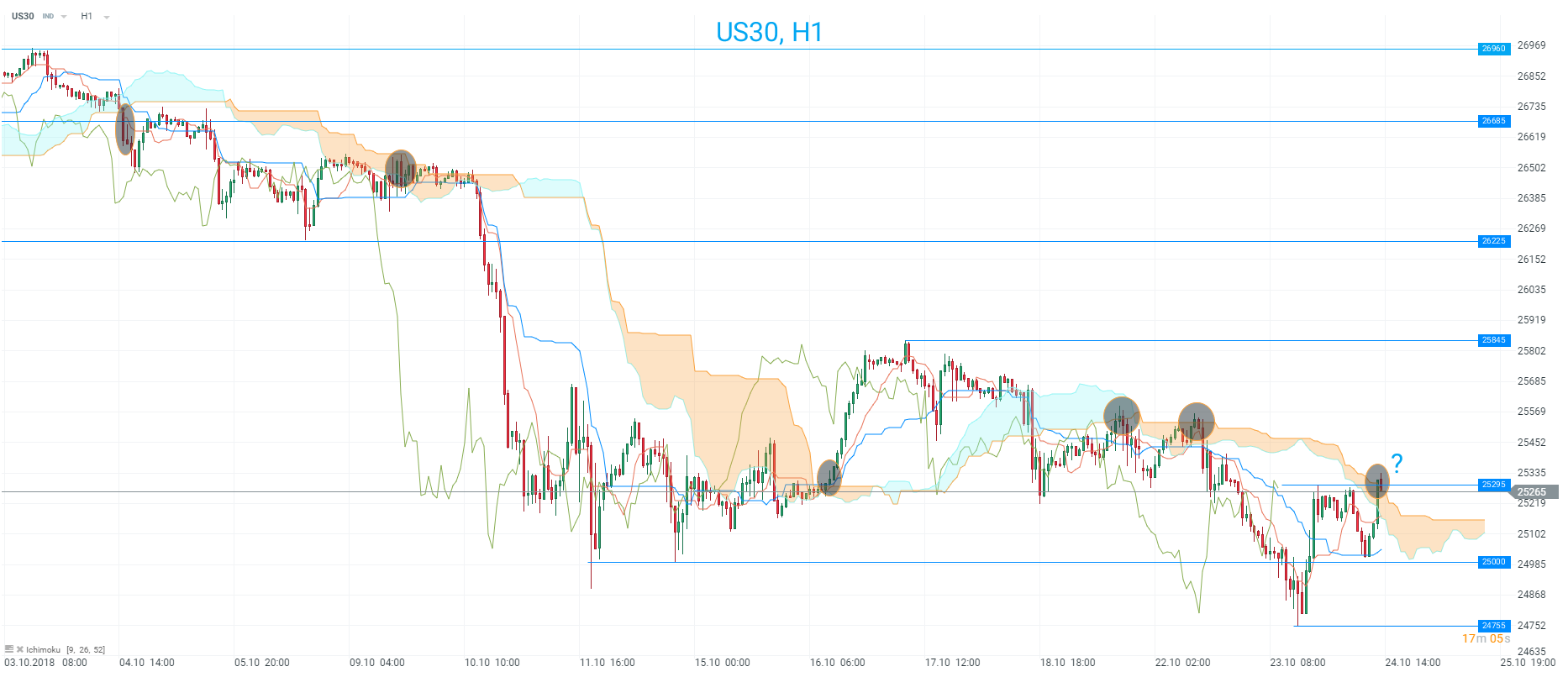

Given the strong bounce, the obvious question to ask is whether Tuesday marked a turnaround for the US markets or whether it was simply a pop higher in the prevailing downtrend. On this front for the US30 the coming couple of hours may well prove pivotal with price threatening to break above the H1 Ichimoku cloud. This indicator has proven a turning point on several occasion previously and two advances in the past week has run into the cloud before reversing lower. As you’d expect the market has been below the ecloud for the vast majority of this month as price has been in a shorter term downtrend although there was one clear move higher which occurred after price broke above the cloud. A clean break above the cloud now would be a positive signal and while it may not represent a turning point in the longer term trend it could easily lead to a rally of 5-600 points - similar to what we saw last week.

US30 is back near the top of the H1 cloud and how price acts in the next couple of hours could well determine the path for the next move. Source: xStation

A gain of more than 4% in the premarket trade for Boeing has boosted the US30 with the rally adding approximately 100 points to the Dow. Boeing delivered core earnings per share of $3.58 on revenues of $25.1B for the 3rd quarter - well above the $3.47 and $23.91B expected. Perhaps even more positive than the results themselves was the fact that the aerospace manufacturer raised its full-year forecast for EPS to $14.90-$15.10 from $14.30-$14.50 previously. Revenue is also now expected to be higher by $1B to between $98-100B. The upwards revision continue a pleasing trend for Boeing, with the firm raising their guidance in each of their 3 reports so far this year.

Shares in Boeing are called to open higher by around 4% after a strong earnings release. The market held a rising trendline yesterday to close back above the 200 day SMA (purple line). Given its large weighting of almost 10% on the DJIA, the gains have boosted the broader market. Source: xStation

Shares in Boeing are called to open higher by around 4% after a strong earnings release. The market held a rising trendline yesterday to close back above the 200 day SMA (purple line). Given its large weighting of almost 10% on the DJIA, the gains have boosted the broader market. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.