Boeing (BA.US) shares gained nearly 3.3% ahead of the opening of the trading session despite the release of worse-than-expected quarterly results. However, the aircraft manufacturer reaffirmed its annual forecast in terms of adjusted free cash flow and operating cash flow figures.

On the other hand, however, the company is lowering its annual target for 737 aircraft deliveries in the face of quality errors. The repair of a critical part of the fuselage turned out to be more complicated than previously expected.

Selected company results along with market expectations. Source: Bloomberg Finance L.P.

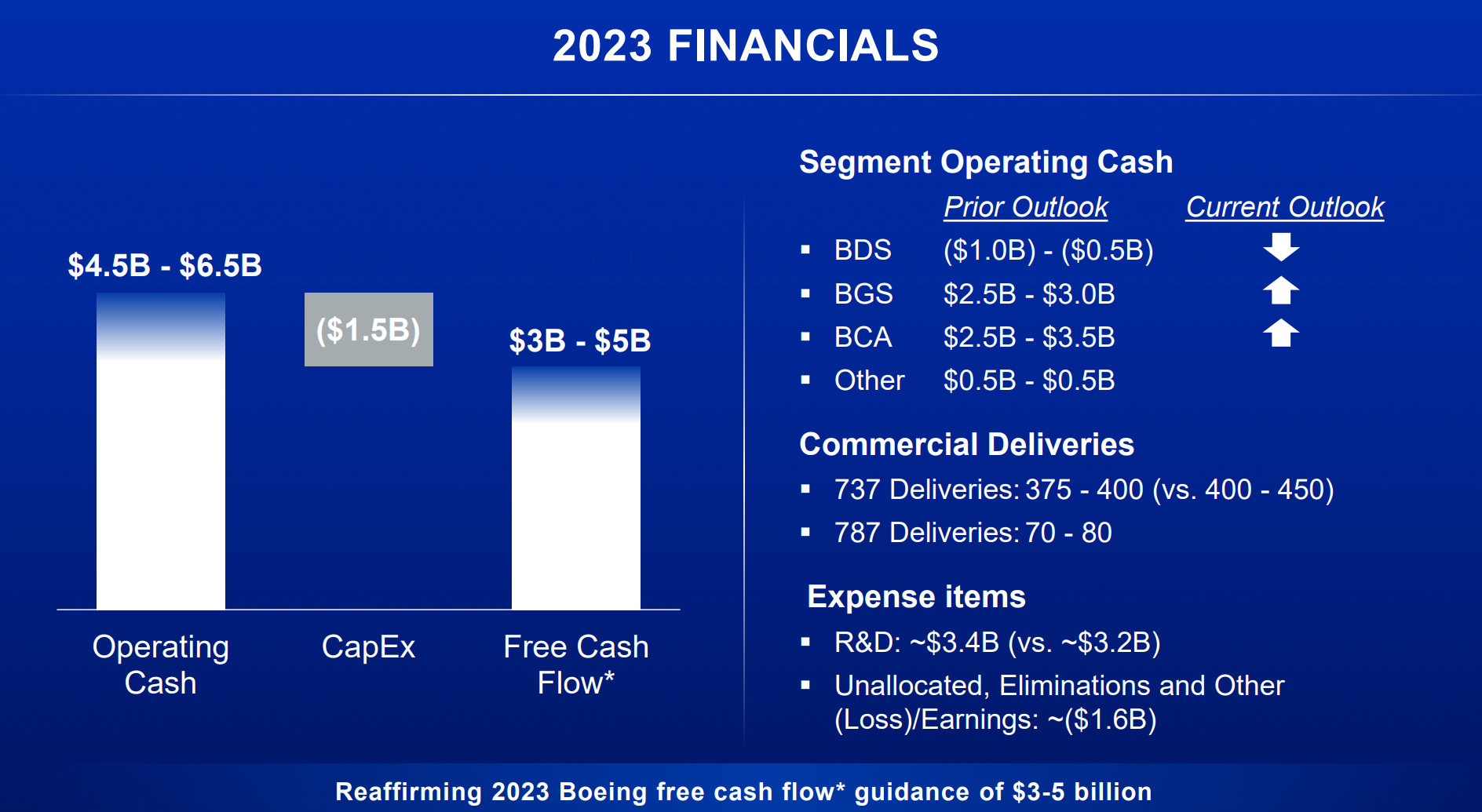

Annual projections:

- Operating cash flow of $4.5 billion to $6.5 billion, estimated $4.85 billion

- Adjusted free cash flow of $3 billion to $5 billion, estimated $3.53 billion

Source: Boeing

Source: Boeing

Looking ahead to the full year (from January 2023), the company is feeling the pressure imposed on net margin. It is worth noting, however, that this goes hand in hand with the increased dynamics of increasing capital expenditures. Source: XTB

The company's current trading before the opening of the session on Wall Street. Source: xStation

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.