The Bank of England announced its monetary policy decision at 12:00 pm GMT. Market expected a 75 basis point rate hike and BoE delivered onto those expectations. Rates increased by 75 bp with main rate climbing to 3.00%. The decision was unanimous with all 9 members voting in favor of a hike (1 voted for 25 bp rate hike and 1 voted for a 50 bp rate hike). However, BoE warned that a 2-year recession may occur if rates follow path set by the market curve. According to BoE, GDP may fall by 2.9% over the next 8 quarters if the market curve is followed. BoE also said that peak policy rate is likely to be lower than predicted by the market (currently at 5.25%). Inflation is expected to peak at around 11% in Q4 2022. GBP moved lower on the news with GBPUSD testing 1.1200 mark.

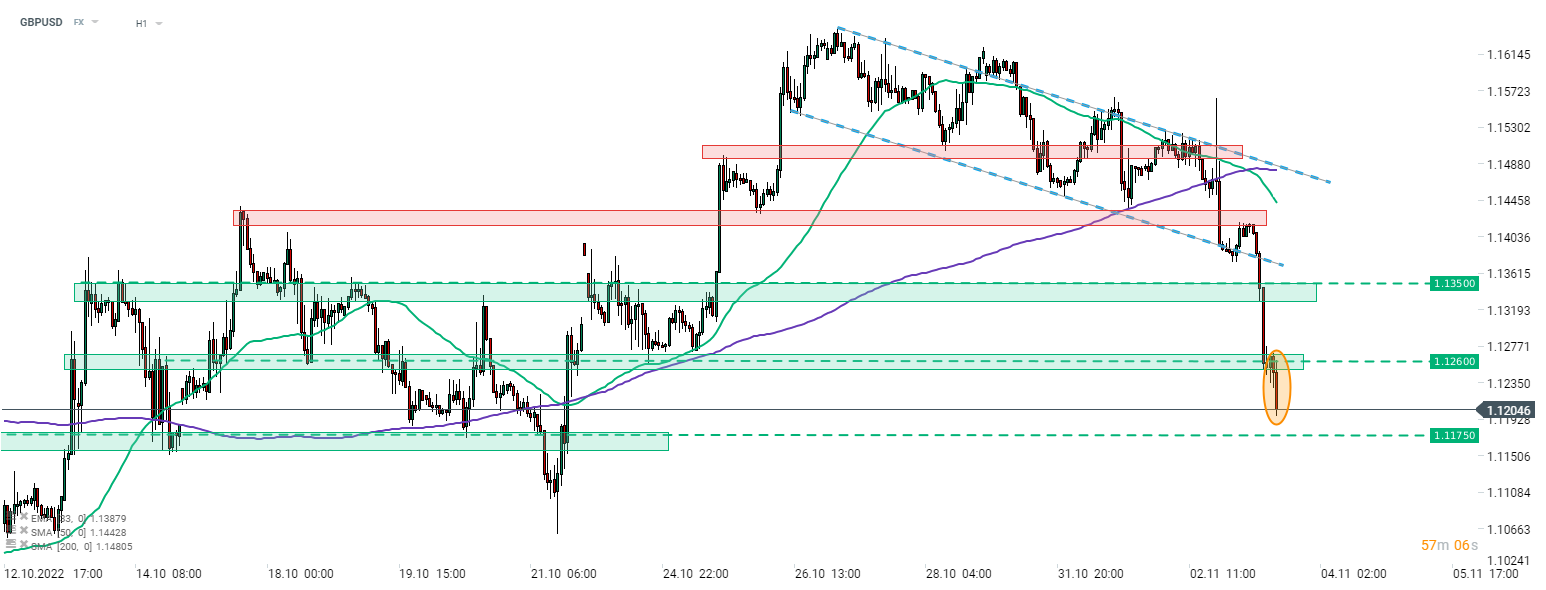

GBPUSD painted another leg lower in today's downward move following an in-line rate hike from BoE. Bank of England warned that should policy rates follow market path, a 2-year recession may occur. Source: xStation5

GBPUSD painted another leg lower in today's downward move following an in-line rate hike from BoE. Bank of England warned that should policy rates follow market path, a 2-year recession may occur. Source: xStation5

BREAKING: US100 with mixed reaction to the JOLTS/PMI/Orders prints 🏛️

BREAKING: Eurozone inflation slightly below estimates 🇪🇺 EURUSD ticks up

Economic calendar: US labour market set for a rebound❓🇺🇸 (07.01.2026)

BREAKING: DE40 rebounds despite unexpected drop in German retail sales 🇩🇪

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.