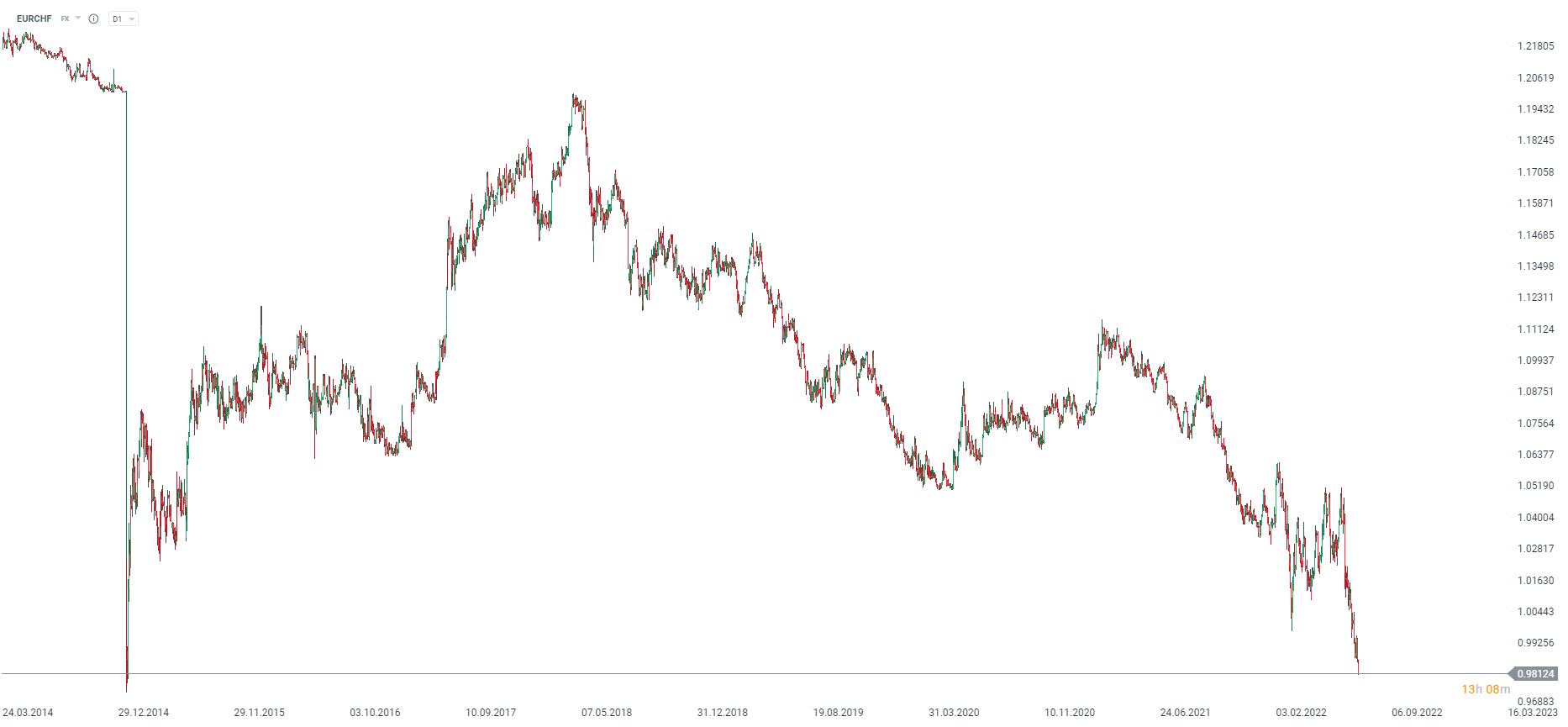

EURUSD may have resisted a drop below parity for now as USD gave back some gains but outlook for euro remains bleak. Common currency is eyeing a break to a new record low against Swiss franc. EURCHF reached 0.9800 level today, which is more or less where the pair settled on January 19, 2015, when Swiss National Bank announced that it will no longer defend 1.20 area. However, current levels are still way above intraday lows from 2015 when EURCHF traded as low as 0.84 on the interbank market. The move was of course exaggerated by liquidity issues and the pair returned above 1.00 shortly after.

While both ECB and SNB are considered very dovish central banks, the Swiss central bank has already begun hiking rates with the intention of exiting a negative rates regime. Meanwhile, the ECB is yet to deliver its first rate hike. Unless the ECB boosts its efforts to normalize policy, EURCHF may be set for a move to fresh record lows.

EURCHF tested 0.9800 level - an area where the pair finished trading on the so-called "Black Thursday" in January 2015. Source: xStation5

EURCHF tested 0.9800 level - an area where the pair finished trading on the so-called "Black Thursday" in January 2015. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.