08:50 AM BST, France - PMI Data for December:

- HCOB France Manufacturing PMI: actual 50.7; forecast 50.6; previous 47.8;

08:55 AM BST, Germany - PMI Data for December:

- HCOB Germany Manufacturing PMI: actual 47.0; forecast 47.7; previous 48.2;

09:00 AM BST, Euro Zone - PMI Data for December:

- HCOB Eurozone Manufacturing PMI: actual 48.8; forecast 49.2; previous 49.6;

The euro area PMI weakened stronger than expected as production fell for the first time from Februrary 2025, driven by a sharp deterioration in demand, especially exports. New orders declined faster, prompting deeper cuts to purchasing, inventories and employment. Supply chains tightened and input costs rose, yet firms kept discounting prices. Despite current weakness, business optimism jumped to multi-year highs.

Contrasting changes in France and Germany

France was one of the bright spots of the report, with its PMI rebound driven by a sharp pickup in export demand, helping stabilise output and soften the decline in overall orders. Employment returned to growth, inventories were run down, and purchasing cuts eased. Cost pressures moderated, enabling modest price rises, while domestic demand and political uncertainty capped confidence

Germany’s PMI fell as demand weakened further, led by a sharp acceleration in export order declines. Output slipped after a long expansion, prompting deeper cuts to jobs, purchasing and inventories. Supply bottlenecks and rising input costs added pressure, while intense competition forced further price discounting despite higher costs.

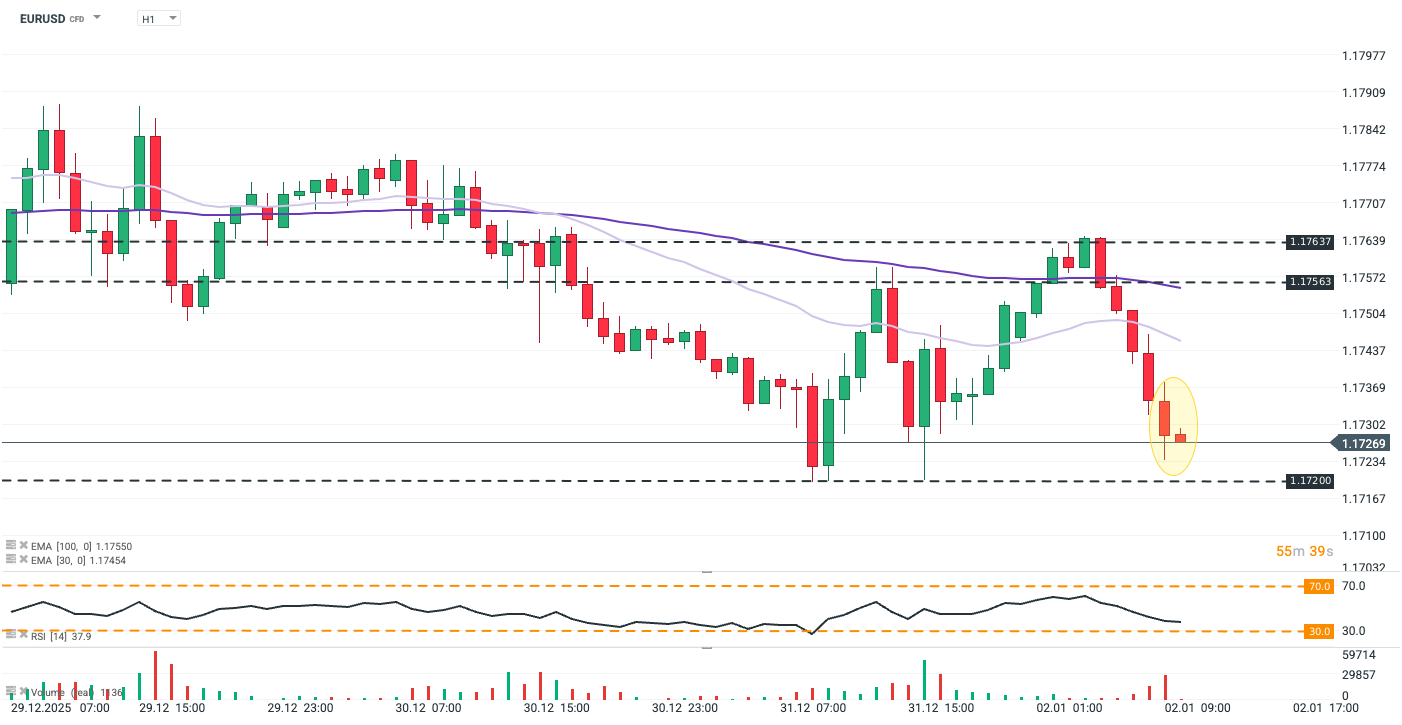

EURUSD (D1)

EURUSD extended its losses following the data release after earlier failing near key resistance around 1.1765. The pair has fallen roughly 0.5% over the past week, reflecting broader dollar strength amid more restrained US rate-cut expectations for Q1 2026. Immediate support sits near 1.1720, while a near-oversold RSI (approaching 30) should spark caution before chasing further downside.

Source: xStation5

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.