US NFP report for March was released today at 1:30 pm BST. The report is always closely watched but this time it drew even more attention as it came after a streak of rather downbeat data from the US jobs market, like jobless claims, JOLTS or ADP. Actual data came in more or less in-line with expectations. The only 'real' surprise came from the unemployment rate which dropped from 3.6 to 3.5% (exp. 3.6%). Earnings growth was slightly weaker.

US, NFP report for March

- Non-farm payrolls: 236k vs 240k expected (311k previously)

- Unemployment rate: 3.5% vs 3.6% expected (3.6% previously)

- Average earnings growth: 4.2% YoY vs 4.3% YoY expected (4.6% YoY previously)

- Average earnings growth: 0.3% MoM vs 0.3% MoM expected

Initial market reaction was interesting - neither hawkish, nor dovish as both USD and US equity futures gained. EURUSD dropped below the 1.09 mark in a knee-jerk move while S&P 500 futures (US500) jumped to around 4,135 pts. However, EURUSD recovered much of the drop while US index futures held onto gains.

Market attention now shifts to US CPI reading for March scheduled for Wednesday, 1:30 pm BST next week. Unless inflation drops more than expected, FOMC rate hike in May may be still in play.

EURUSD is making a break back below 1.0910 price zone following a decent NFP reading. Source: xStation5

EURUSD is making a break back below 1.0910 price zone following a decent NFP reading. Source: xStation5

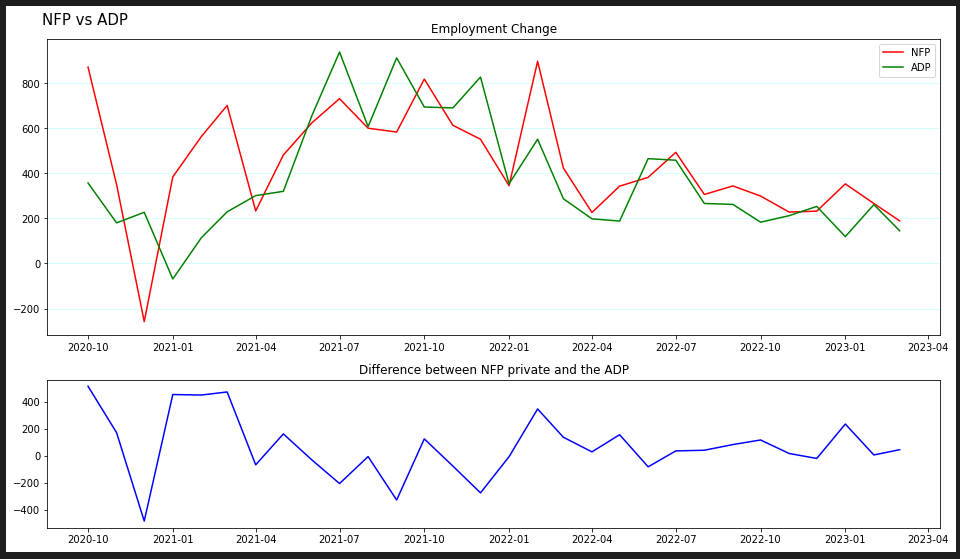

Both ADP and NFP private data showed lower jobs growth in March than in February. Source: Bloomberg, XTB

Both ADP and NFP private data showed lower jobs growth in March than in February. Source: Bloomberg, XTB

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.