US, data package for November.

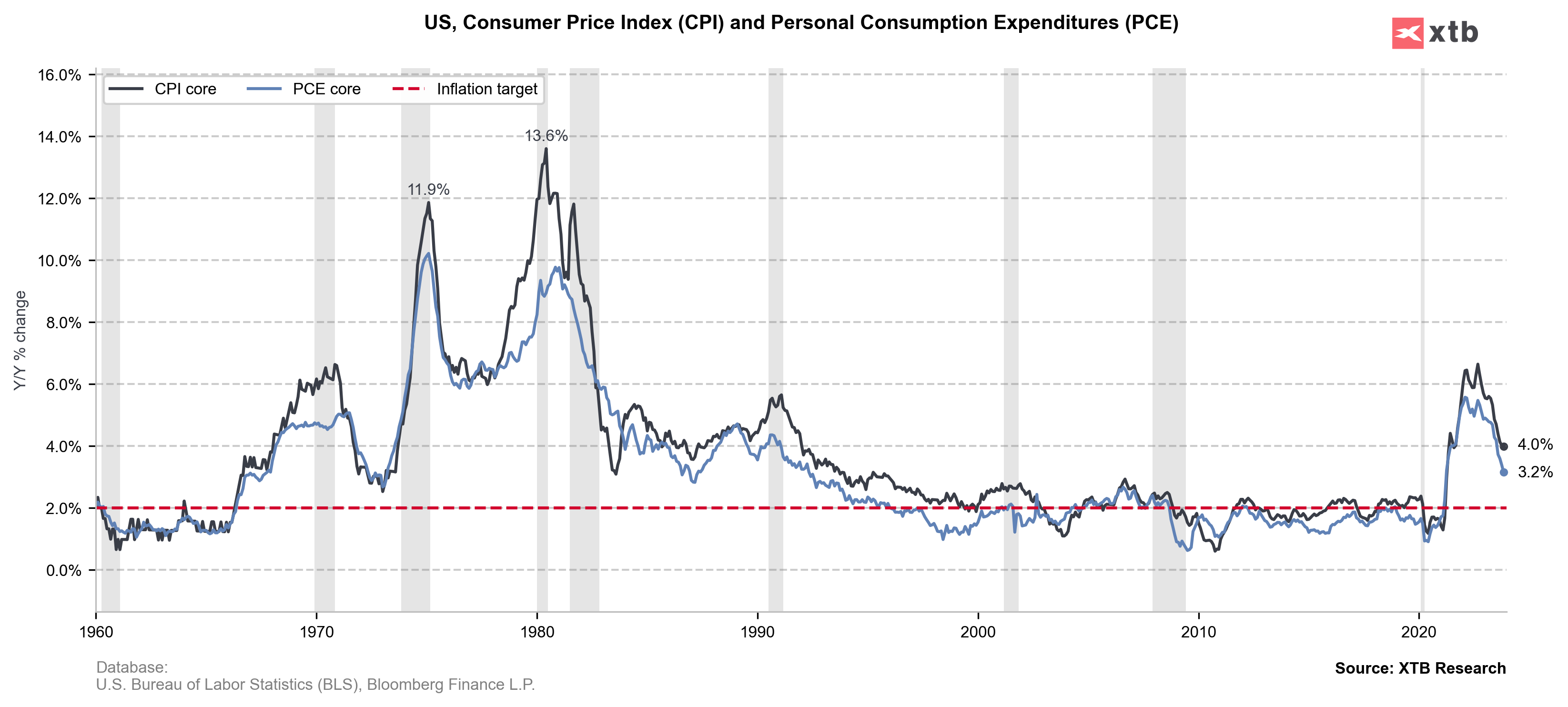

- PCE inflation. Currently: 2.6% y/y. Expected: 2.8% y/y. Previous: 3.0% y/y

- Core PCE inflation. Current: 3.2% y/y. Expected: 3.4% y/y. Previous: 3.5% y/y

- Personal income. Current: 0.4% m/m. Expected: 0.4% m/m. Previous: 0.2% m/m

- Personal spending. Current: 0.3% m/m. Expected: 0.3% m/m. Previous publication: 0.2% m/m

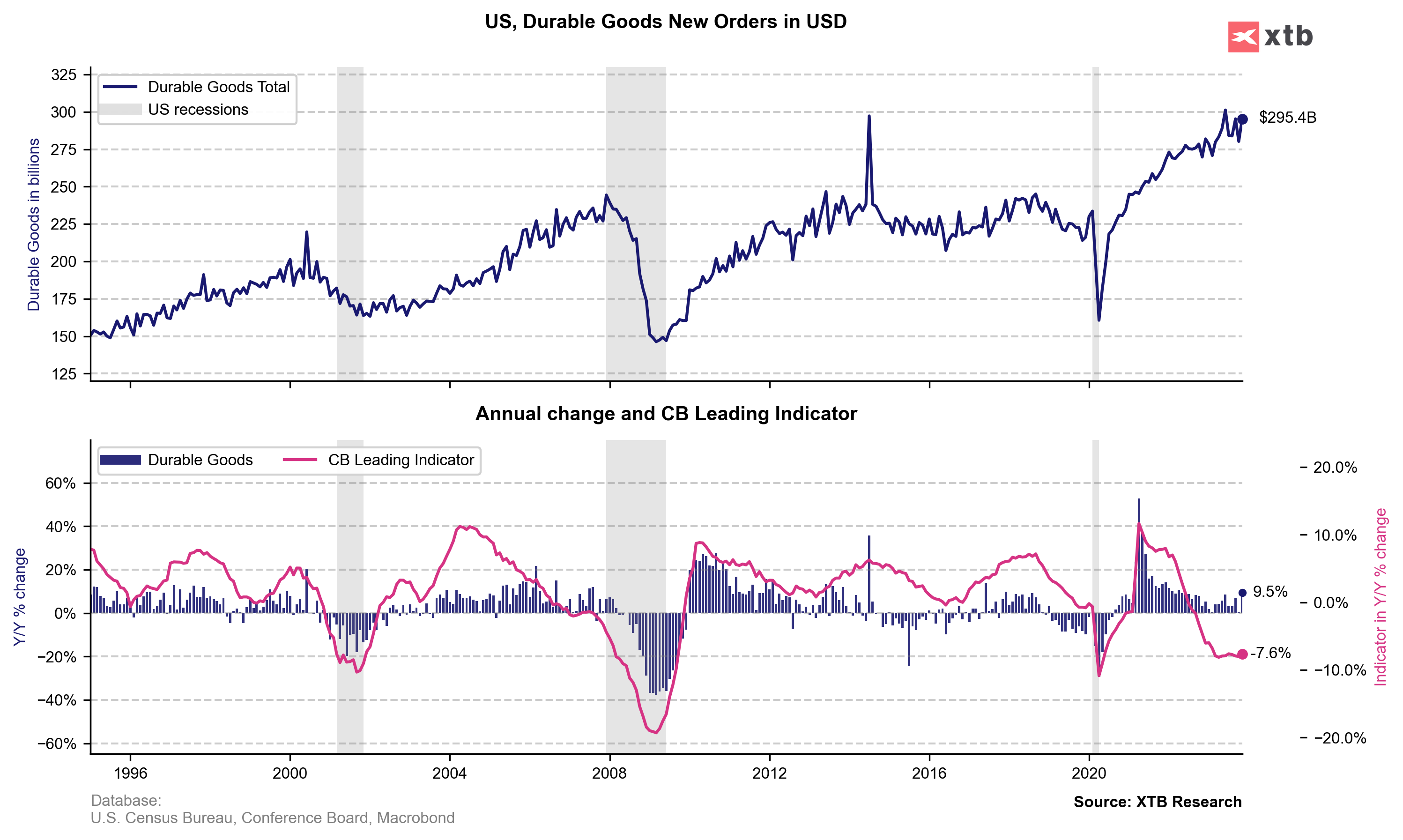

US, durable goods orders for November.

- Main. Currently: 5.4% m/m. Expectations: 2.3% m/m. Previous: -5.4% m/m

- Excluding transportation. Current: 0.5% m/m . Expectations: 0.2% m/m. Previous: 0.0% m/m

In response to the data, the dollar index strengthened dynamically. The move, however, was temporary, and after a few minutes USDIDX returned to the vicinity of pre-release levels.

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.