USA - inflation report for August:

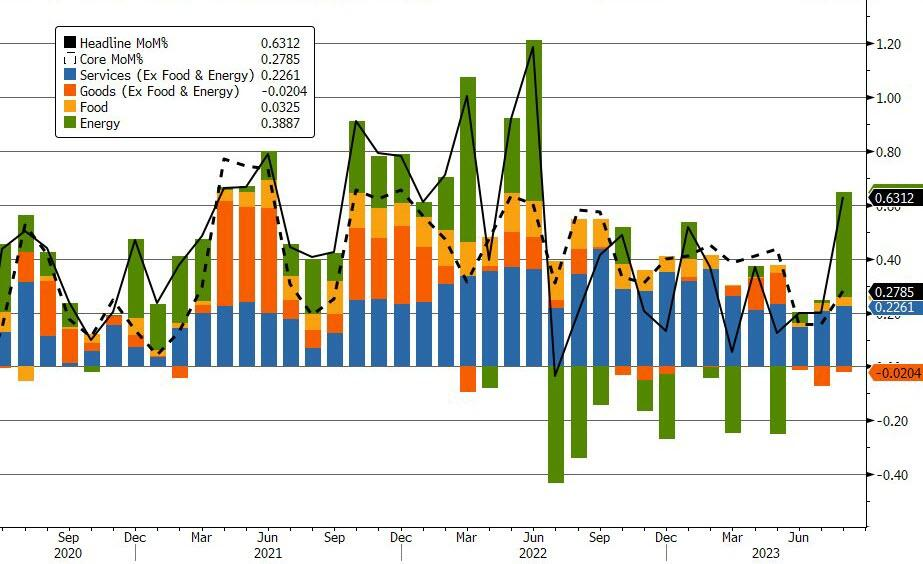

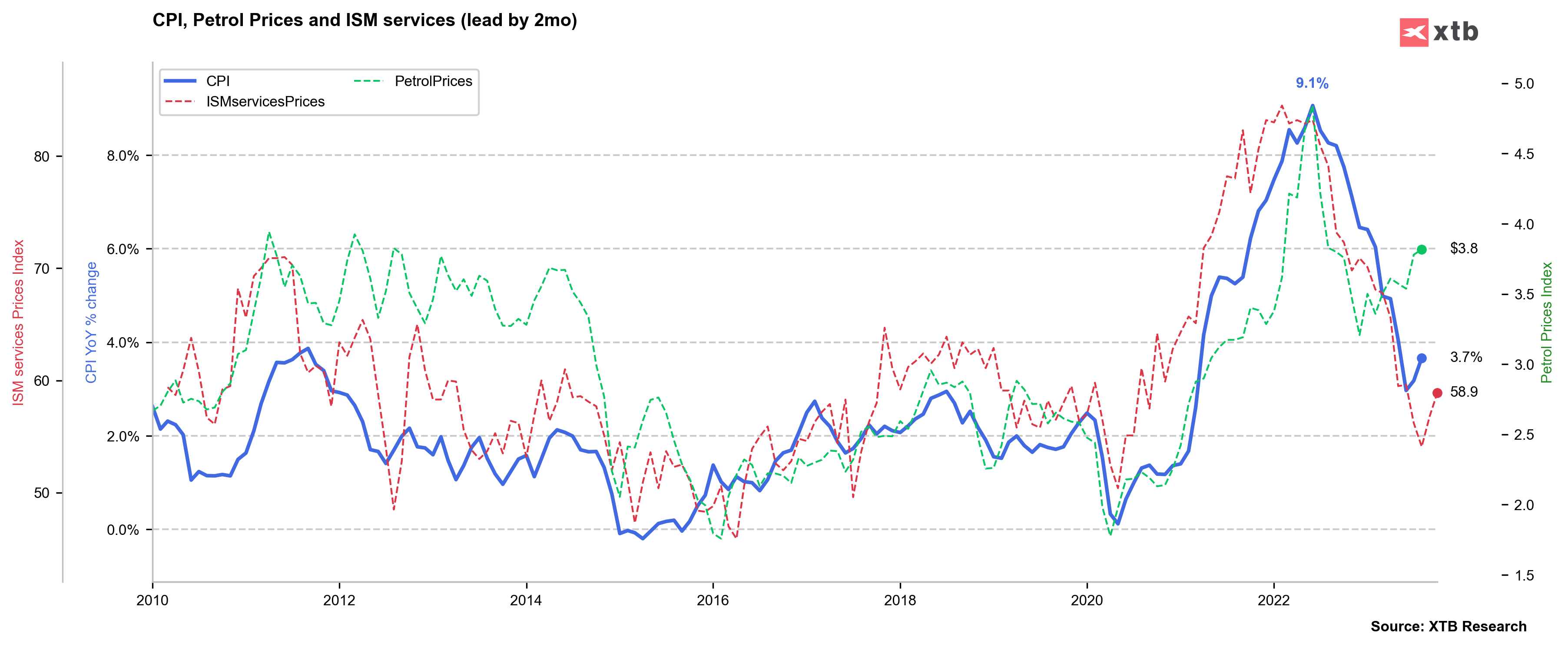

- CPI headline annual: Actual: 3.7% y/y. Expected 3.6% y/y; previously 3.2% y/y

- CPI headline monthly: Actual: 0.6% y/y. Expected 0.6% m/m; previously 0.2% m/m

- Core CPI annual: Actual: 4.3% y/y. Expected 4.3% y/y; previously 4.7% y/y

- Core CPI monthly: Actual: 0.3% y/y. Expected 0.2% m/m; previously 0.2% m/m

Shelter +0.3% versus +0.4% last month. Year on year 7.3% versus 7.7% last month

Services less rent and shelter +0.5% m/m vs +0.2% prior

Gasoline contributed to more than 50% gain in the US CPI in August

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

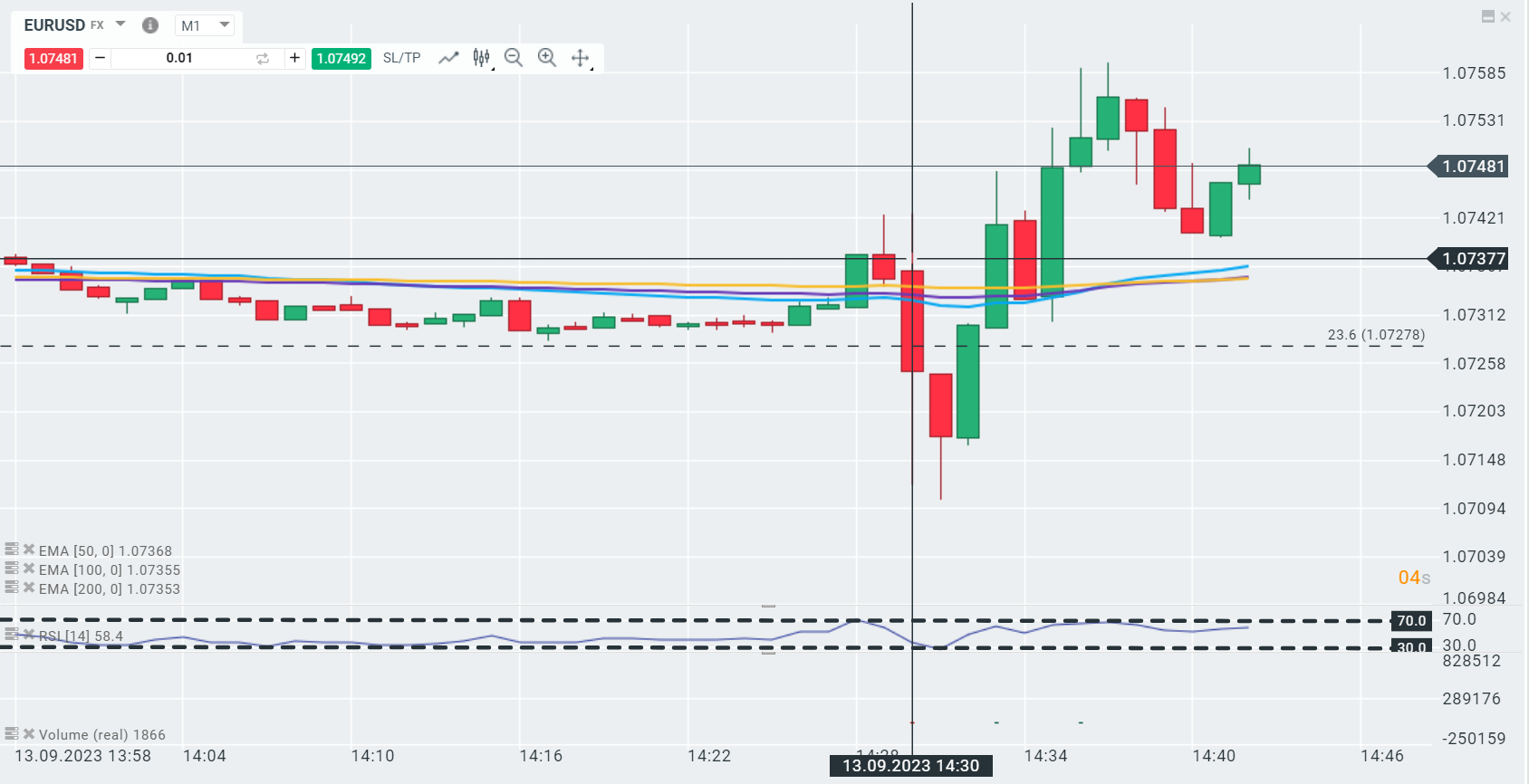

In general, initial moves in the dollar, stocks and yields have erased. That confirms the view that most participants had been positioned for a hot reading. The implied rate for November shows exactly the same number as before the latest CPI numbers hit (implying a roughly ~38% chance of a 25 bps hike).

ii

EURUSD erases early downward reaction to data. Source: xStation 5

EURUSD erases early downward reaction to data. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.