- Inflation in US below expectations

- Inflation in US below expectations

14:30 - USA CPI (Consumer inflation) for September:

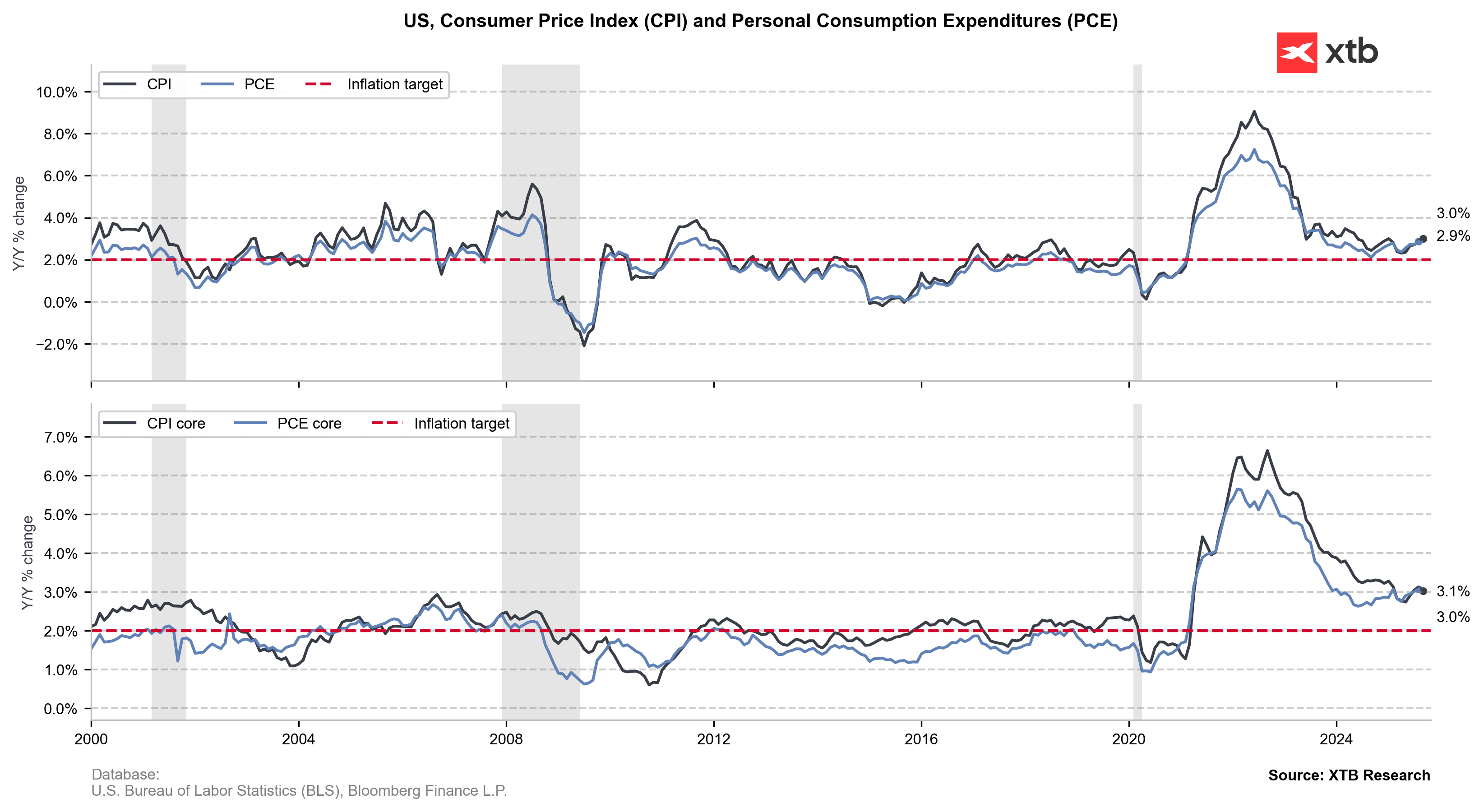

Core CPI YoY: 3% (Expected: 3.1%, Previous 3.1%)

Core CPI MoM: 0.2% (Expected: 0.3%, Previous: 0.3%)

CPI YoY: 3% (Expected: 3.1%, Previous 2.9%)

CPI Mom: 0.3% (Expected: 0.4%, Previous 0.4%)

The CPI reading from the USA presented lower than expected, signaling disinflation in the US economy. Both the annual and monthly indicators fell 0.1% percentage points below consensus. Structure of changes is ambiguous is as follows:

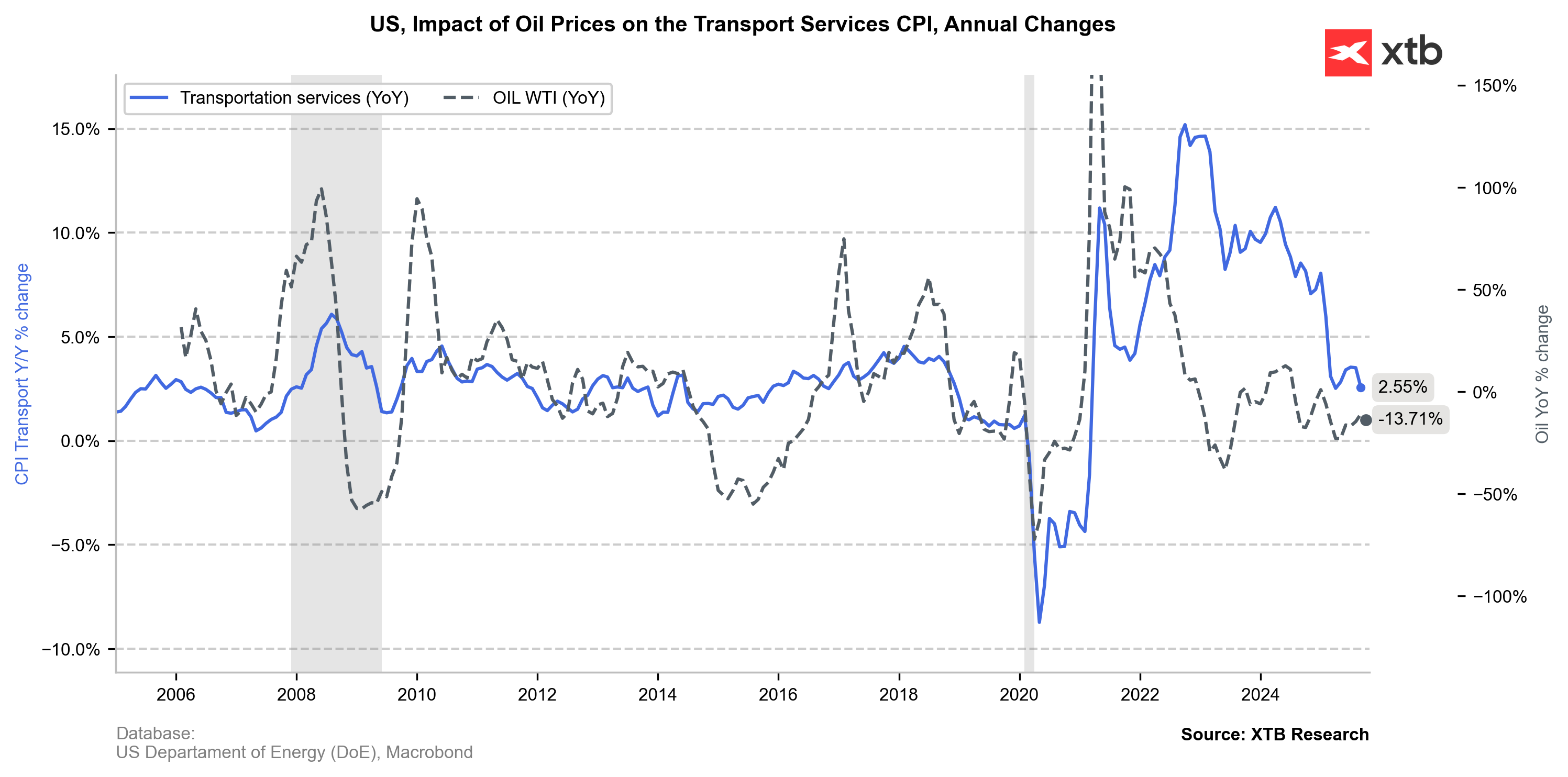

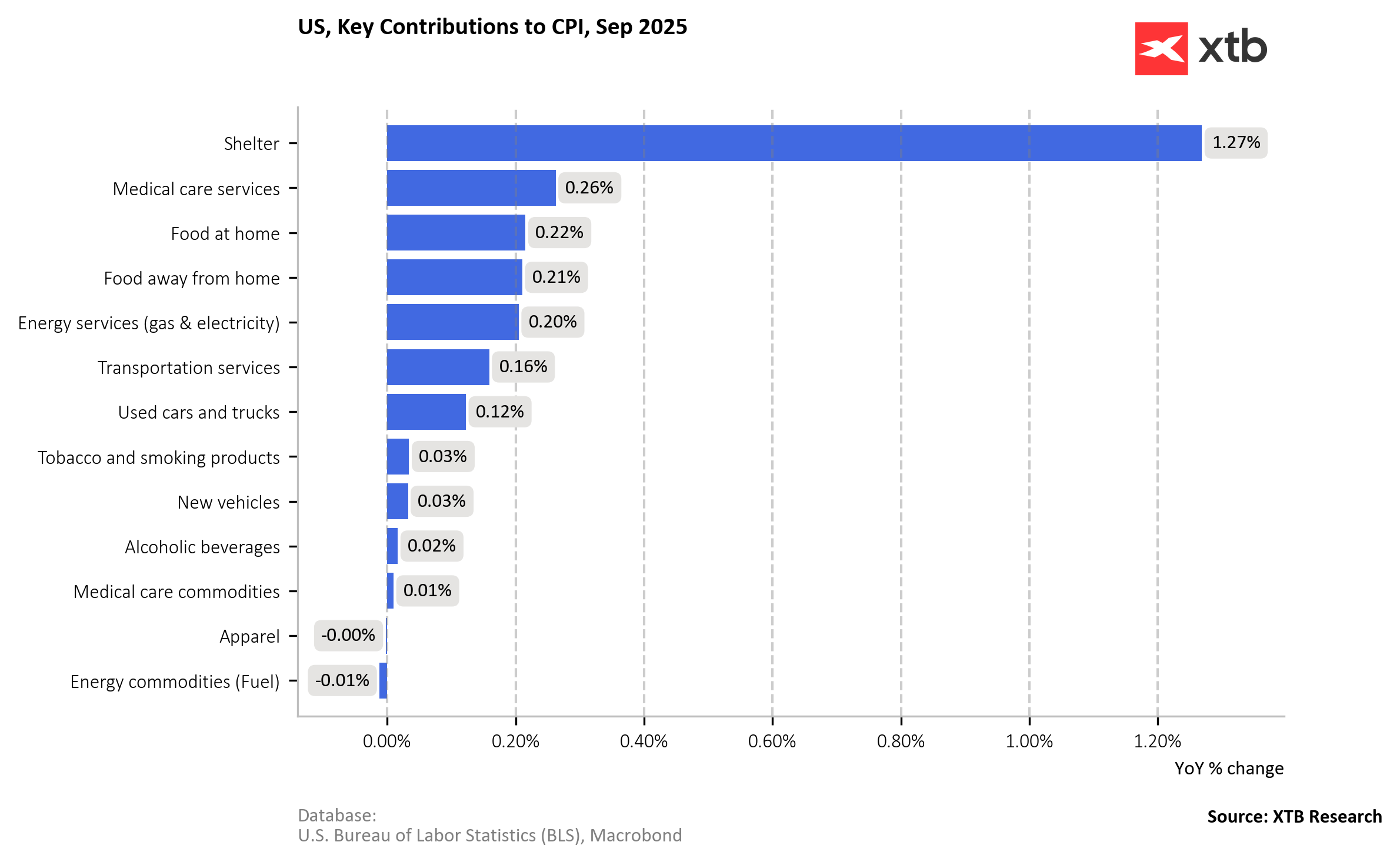

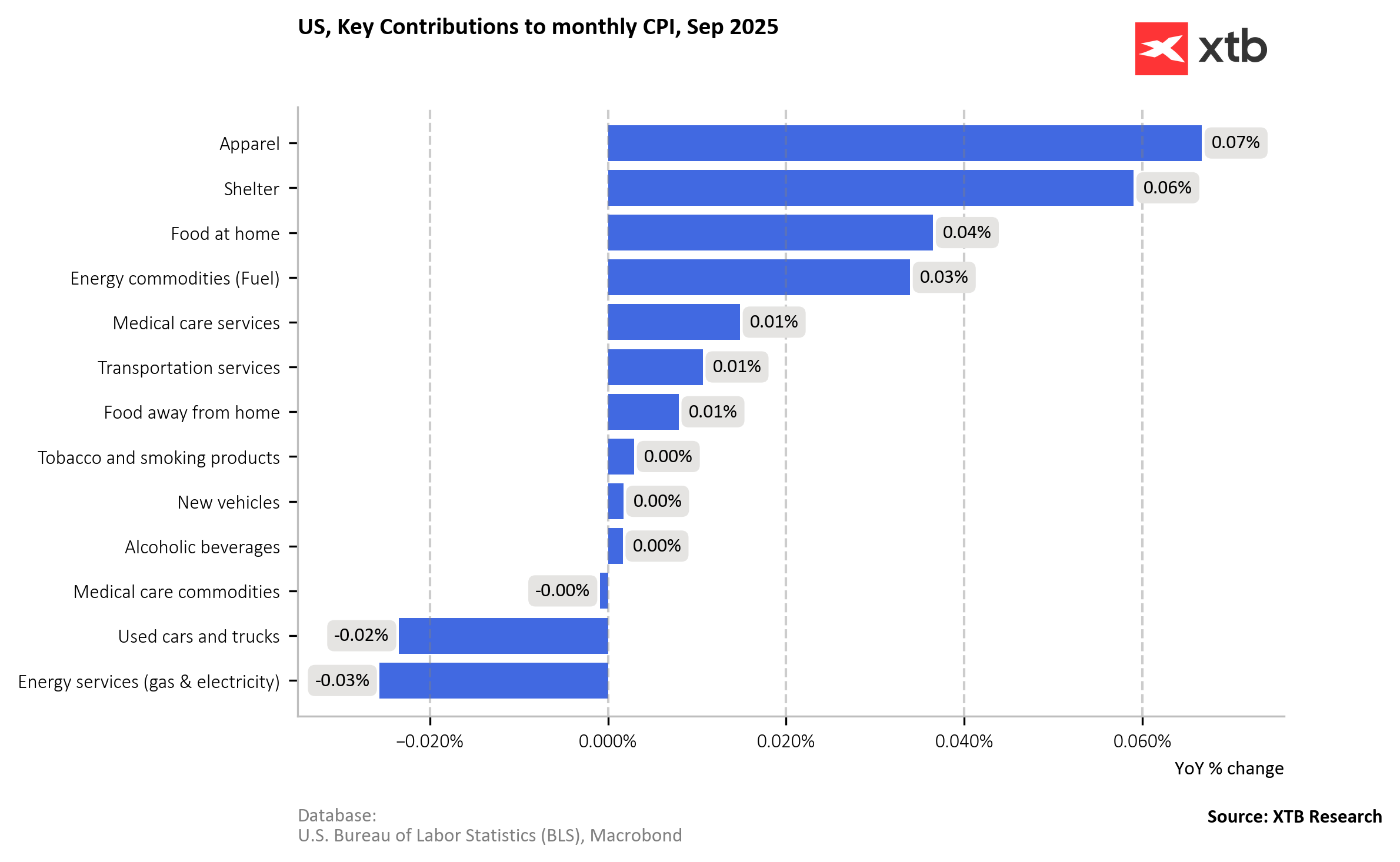

Despite the drop in oil prices, fuels contributed to September's dynamics. This is possibly due to factors such as refinery margins and seasonally higher prices at stations.

At the same time, the apparel category came out surprisingly high.

On the other hand, electricity decreased month-on-month and acted in a disinflationary manner. This is interesting in the context of ongoing debate in the US related to the electricity prices rising due to high usage by data centers.

Finally, housing, or "shelter" inflation, remains the largest and most persistent contributor to CPI, although the growth rate in this category is gradually slowing.

This mix suggests further flattening of price pressure in most goods, while inertia persists in housing related services. The power market, fuel and tariffs may still react with a delay, but for now, CPI shows relief subcomponent in this regard.

This has far-reaching implications for monetary policy. Lower than expected means increased expectations that FED will resume QE policy sooner than expected. Pricing in further rate cuts and repurchase of the debt by the Fed is crucial for the current market.

Even more so now due to "heightened concerns about shutdown" pressure on the economy.

Markets reacted swiftly, Euro appreciated to the dollar after the CPI reading by approximately 0.3%, although market quickly corrected substantial part of this gain.

Source: xStation5

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.