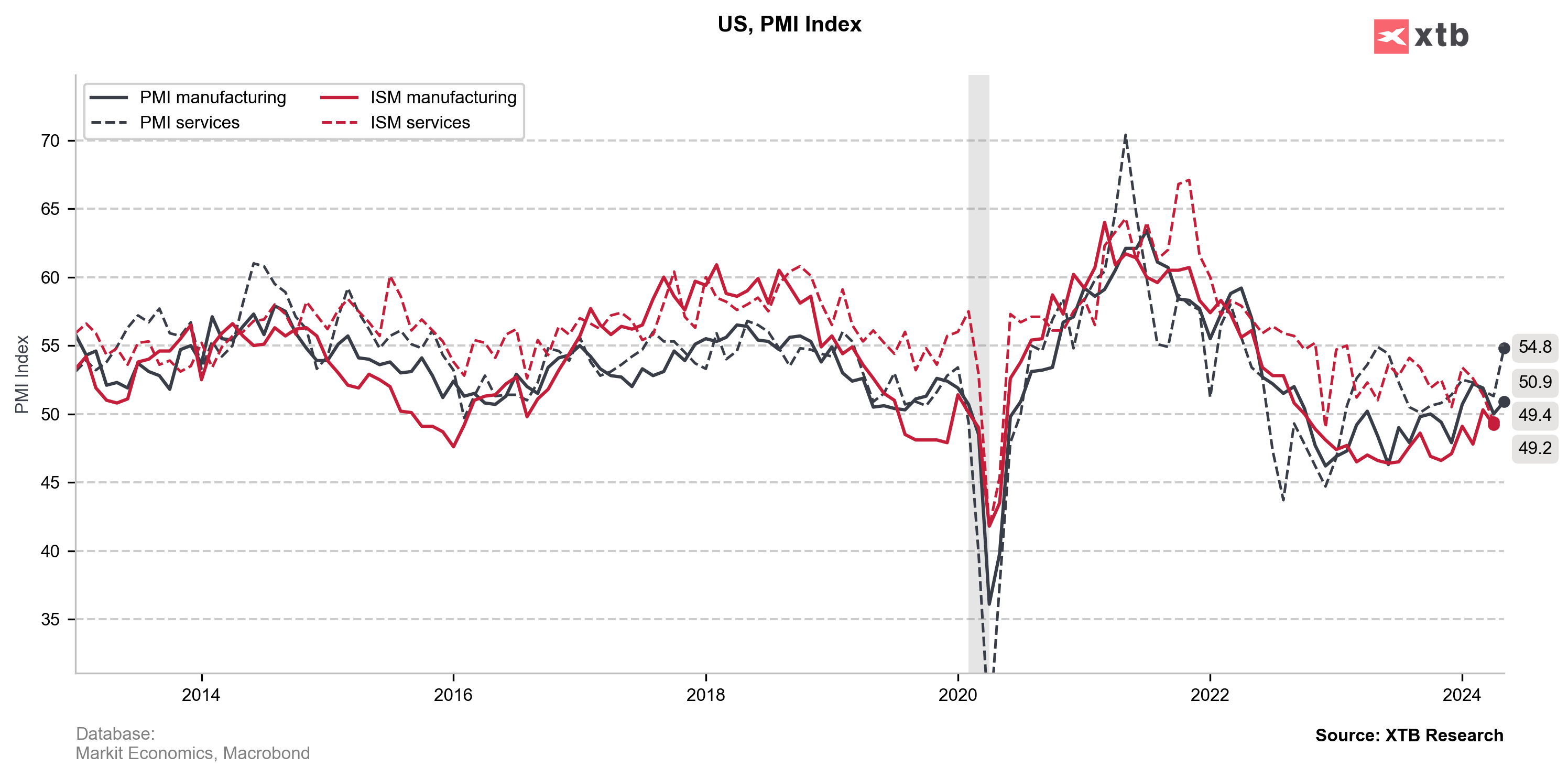

US S&P PMI Services came in 54.8 (the highest since May 2023) vs 51.2 exp. and 51.3 previously

- US S&P PMI Manufacturing PMI came in 50.9 vs 49.9 exp. and 50 previously

- US S&P Composite PMI came in 54.4 vs forecast 51.2 and 51.3 previously

At the same time regional Chicago National Activity Index came in much lower than expected with -0.23 vs 0.125 exp. and 0.15 previously

US dollar gains after the reading, stock market indices erasing some early gains, as investors 'jump in' Nvidia (NVDA.US) shares, selling other stocks. Higher than expected PMI signals that Federal Reserve has still some job that has to be done with 'higher for longer' policy as higher services inflation (justified by higher services PMI data) may be more persistent, than expected.

Source: Macrobondm Markit Economics, XTB Research

Source: Macrobondm Markit Economics, XTB Research

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.